Lock Up Text Contract For Free

Join the world’s largest companies

Video Review on How to Lock Up Text Contract

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Lock Up Text Contract Feature

The Lock Up Text Contract feature is designed to enhance your document management experience. By securing your text contracts, you gain full control over your agreements and ensure that important information remains protected.

Key Features

Potential Use Cases and Benefits

This feature effectively addresses your challenges by minimizing the risk of unauthorized changes and protecting sensitive information. By locking your contracts, you gain peace of mind knowing that your agreements are secure, allowing you to focus on your core activities without worrying about document integrity.

Instructions and Help about Lock Up Text Contract For Free

Lock Up Text Contract: easy document editing

Document editing become a routine task for the people familiar to business paperwork. It is possible to modify a Word or PDF file efficiently, thanks to different software solutions to adjust documents in one way or another. The common option is to try desktop software, but they take up a lot of space on a computer and affect its performance drastically. Processing PDFs online helps keeping your computer running at optimal performance.

Now you have the option of avoiding those problems by working with your documents online.

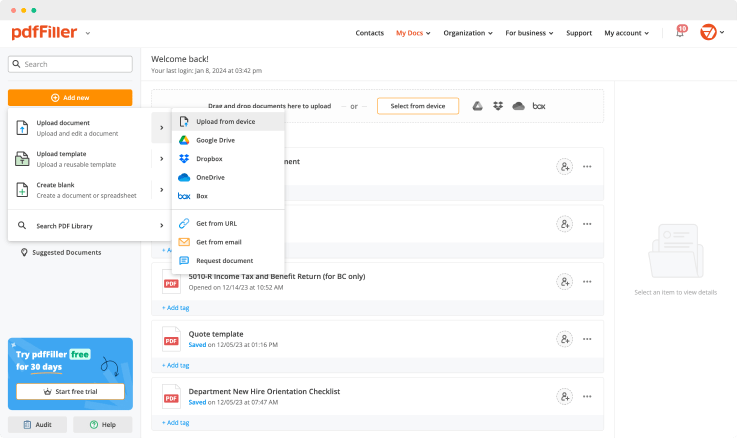

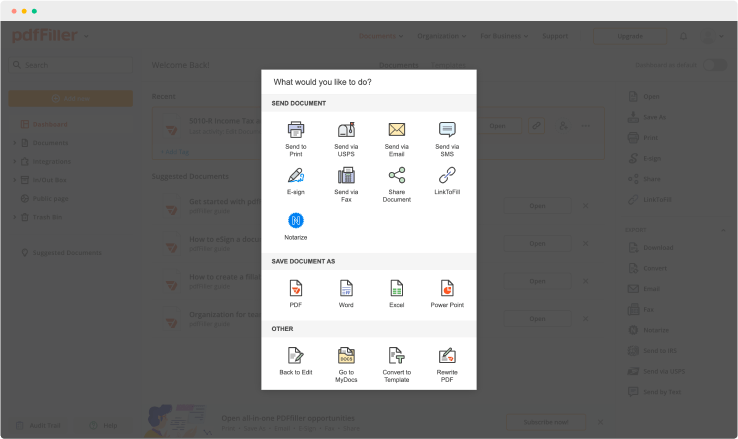

Using pdfFiller, it is possible to store, change, produce, send and sign PDF documents efficiently, without leaving a browser tab. Apart from PDFs, it is possible to save and edit other primary formats, such as Word, PowerPoint, images, text files and much more. Using pdfFiller's document creation platform, create a fillable document from scratch, or upload an existing one to modify. All you need to start working with pdfFiller is an internet-connected computer, tablet or smartphone, and a pdfFiller subscription.

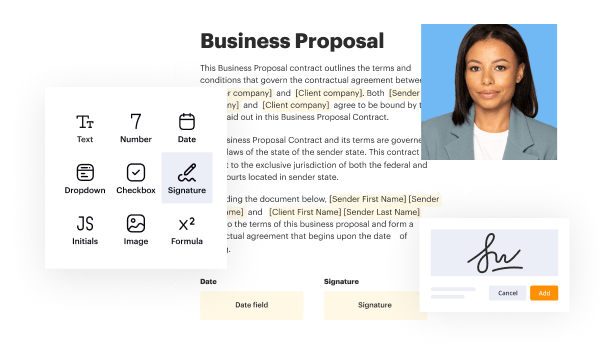

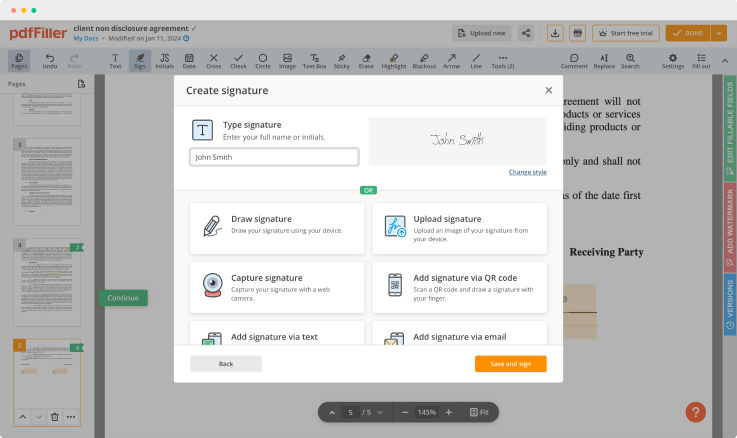

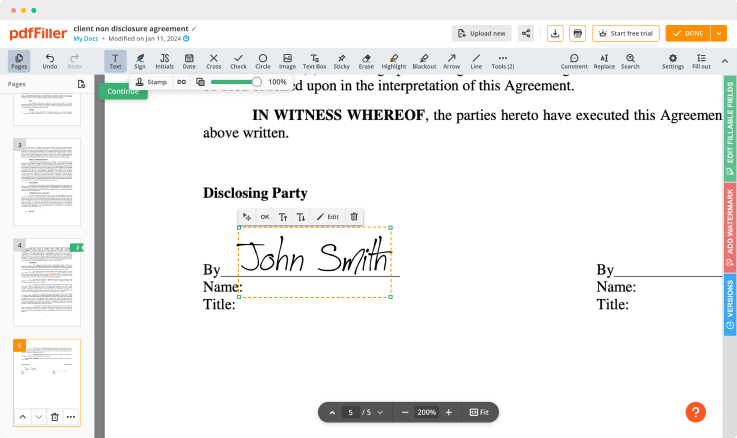

pdfFiller provides a multi-purpose online text editing tool, so you can rewrite the content of your document. It includes a range of tools you can use to modify your document's layout and make it look professional. Using pdfFiller, you can edit pages on the go, place fillable fields anywhere on the form, add images, text formatting and attach digital signatures.

To edit PDF form you need to:

Get access to every form you worked on just by browsing to your My Docs folder. All your docs are securely stored on a remote server and protected with world-class encryption. Your information is accessible across all your devices immediately, and you are in control of who are able to access your documents. Save time by managing documents online directly in your web browser.

For pdfFiller’s FAQs

Ready to try pdfFiller's? Lock Up Text Contract