Model Salary Lease For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

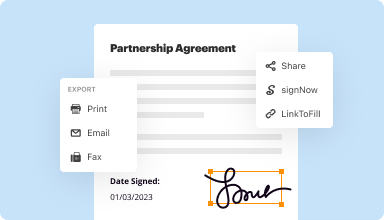

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

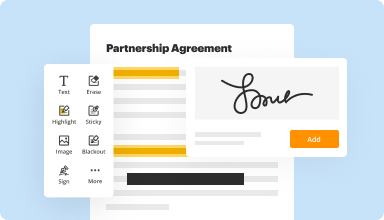

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

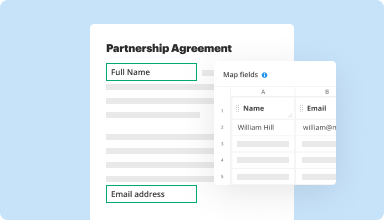

Fill out & sign PDF forms

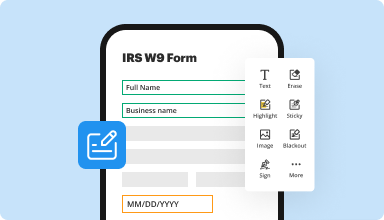

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

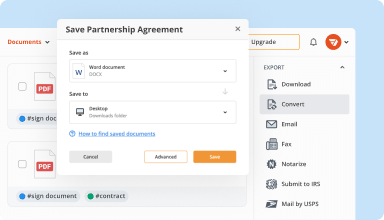

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

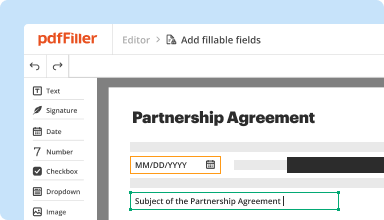

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

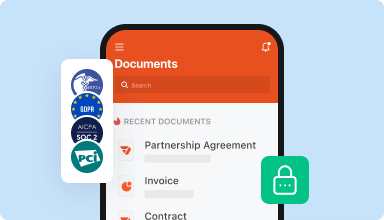

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Much easier/more intuitive than past editing systems I've used! Don't love that I found out only after editing an intensive document that I had to pay though :/

2016-06-19

PDF Filler customer service is like it used to be when businesses actually cared if you did business with them, their 24 hour support guys are incredible, unfortunately I am always in such a hurry when I talk to them I X out the opportunity to give them a 5 star Kudos..."Thank you for hiring an amazing group of people which do a great job representing the integrity of your program, you have earned a customer for life", that's what I would say if I could slow down for a few minutes!

2018-01-12

I find it so much easier to edit documents, and save for later. Being able to share and easily find them. As well as changing page lay outs for presentations too.

2018-09-09

Its OK

Easy to use on desktop, but on the mobile it was OK like C+ overall, but good idea

It does what it should, but its a simple to use. If I had more time to use it, maybe give 120 day trial? I loved the signature and email process of the paperwork. Thats was easy.

I wish we can do more in the free trial. So I can dig in more. Make the mobile experience more easier

2019-09-17

It really makes billing a lot easier. The program is really user friendly and it saves all your work

It makes it so much easier to print of my cms 1500 forms for insurance billing.

I like that this software saves your previous work so you can reprint if you make a typo or need to add something to submit again.

2017-11-22

This was my first experience with completing a 1099-NEC. It took me a while to figure out what to do. I really enjoyed it. I hope I haven't duplicated

2024-05-23

Had a technical issue where I couldn’t…

Had a technical issue where I couldn’t find my document. Somehow it disappeared. Contacted support via the chat and they were able to resolve the issue within minutes! Thank you so much for your help and for fixing the issue so quickly!

2024-03-07

What do you like best?

Ease of use and can access anywhere I can get internet access

What do you dislike?

I have not had any dislikes at this point

Recommendations to others considering the product:

Cost is low and works perfectly.

What problems are you solving with the product? What benefits have you realized?

Billing and printing issues

2021-10-11

I mislead them on my intentions for the service level that I required. Once I brought it to their attention, I answered 3 questions; and the matter was immediately resolved. Outstanding customer service comms. !!!

2020-08-27

Model Salary Lease Feature Overview

Introducing the Model Salary Lease feature, designed to help you manage salary details effectively while leasing valuable assets. This tool simplifies the process of budgeting and planning for long-term financial commitments.

Key Features

Streamlined salary calculations for easier budgeting

Customizable lease terms to suit your financial needs

Integrated reporting tools for real-time insights

User-friendly interface for quick navigation

Secure data storage to protect your sensitive information

Potential Use Cases and Benefits

Individuals can plan their finances more effectively when leasing a car or property

Businesses can optimize their cash flow with precise salary budgeting

Financial advisors can access detailed reports for better client support

HR teams can manage employee compensation packages with transparency

Users can make informed decisions about asset leasing options

This feature addresses common financial planning challenges. By providing clear salary insights, it enables precise budgeting and contributes to smarter leasing decisions. You can confidently navigate your financial landscape and ensure that your expenses align with your income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you calculate a lease payment?

In broad terms, you calculate a lease by determining and adding the depreciation fee, plus a monthly sales tax and a financing fee. If you're looking to calculate your payment manually, here is the formula: Start with the sticker price (MSRP) of the car. Take the MSRP and multiply it by the residual percentage.

What is the lease payment on a $30000 car?

A $30,000 vehicle with a 65 percent residual would have a base monthly payment of $292 before taxes, interest and fees. Choosing the vehicle with the higher residual percentage would net a savings of more than $200 per month for a vehicle with the same selling price.

What is the lease payment on a 25000 car?

For example, if the MSRP is $25,000, the residual value is around 50 percent (this number can be obtained from the car finance expert). If you negotiate the lease value for $24,000, the car value is $11,500 ($25,000 / 50 percent — $1,000 = $11,500). Take the car value and divide it by the term of the lease.

How do you calculate a lease payment on a car?

Identify the number of the monthly payments on the lease. Then subtract the residual value from the net capitalized cost. Divide the resulting number by the number of payments. The result is the depreciation portion of the lease payment. For example, you lease a new car for three years.

How much is a lease on a 30000 car?

It will be worth $30,000 at the end of the lease, so your lease cost, before interest, taxes, and fees, will be $15,000 divided into equal monthly payments. If you put $2,000 down, the amount you make payments on drops to $13,000.

How are finance charges calculated on a leased vehicle?

The money factor is applied to the sum of the net cap cost and the residual value of the car to find the monthly finance charge. Continuing with the example above, use the money factor 0.00333. Multiply this by the sum of the net cap cost and residual as follows: $40,000 × 0.00333 = $133.2.

How do you calculate interest rate on a lease?

The formula is: Interest Rate = Money Factor x 2400 But neither the money factor nor your interest rate is likely to be present on your contract. You'll have to ask your dealer.

What is a typical rent charge on a lease?

Rent charges are similar to the concept of interest charges on a car purchase. For instance, a $500 car payment may comprise $450 of principal and $50 of interest. The same thing is true for your lease payment. A certain percentage is the cost of the car and a certain amount is the rent charge.

#1 usability according to G2

Try the PDF solution that respects your time.