How to sign a document online?

Why sign documents with pdfFiller?

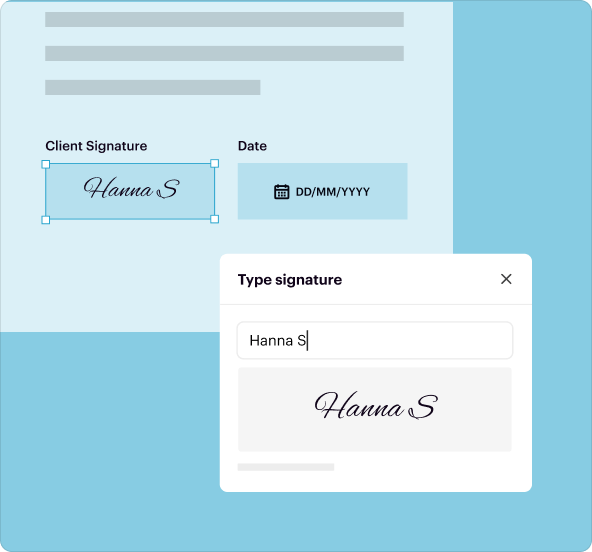

Ease of use

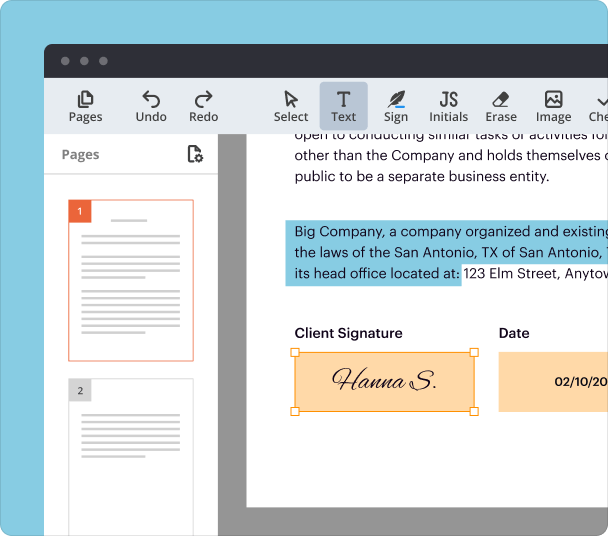

More than eSignature

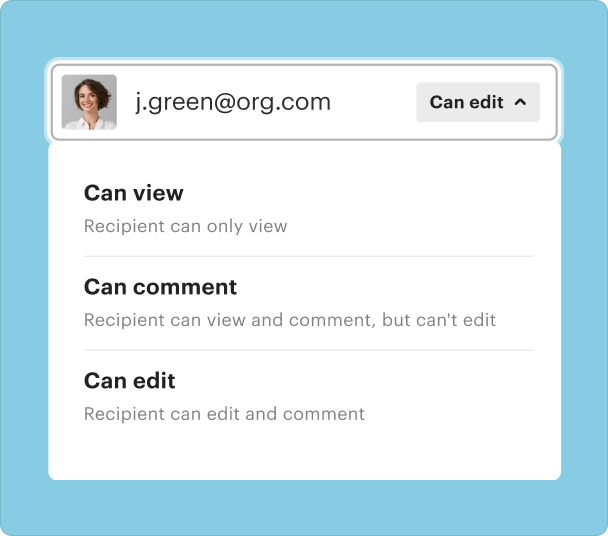

For individuals and teams

pdfFiller scores top ratings on review platforms

Watch pdfFiller eSignatures in action

Print signature profit sharing plan

Understanding print signature profit sharing plan

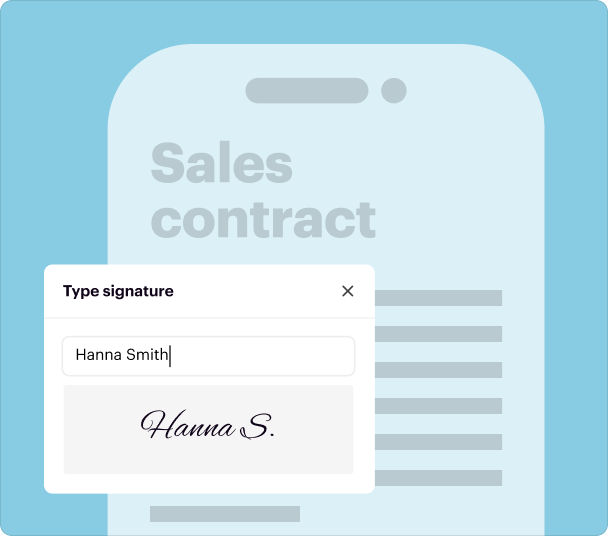

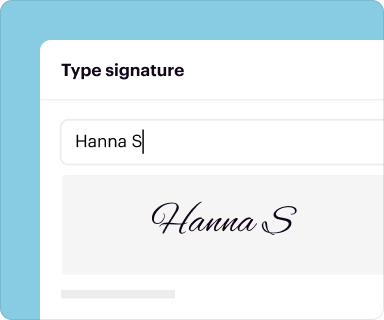

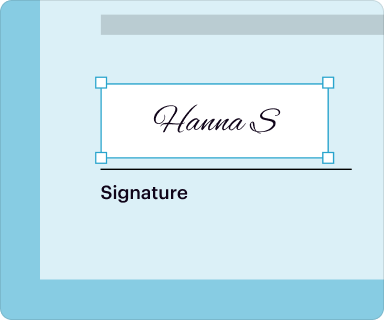

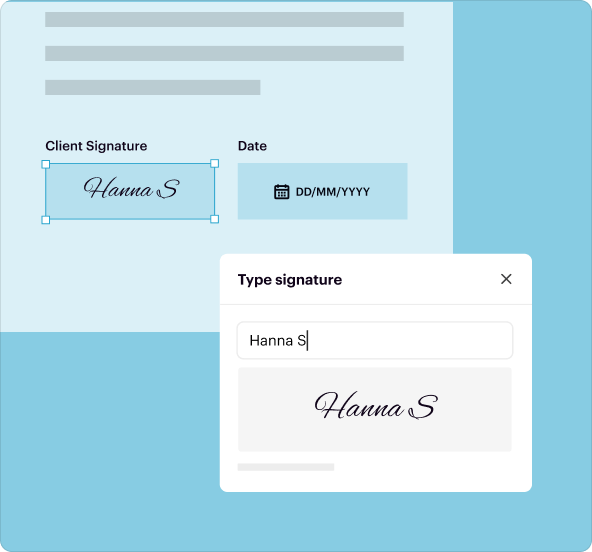

The concept of a Print Signature Profit Sharing Plan allows businesses to manage profit-sharing electronically, streamlining the process significantly. With pdfFiller’s eSignature feature, users can not only create these plans but also ensure that all parties involved can eSign with ease. The digital nature of these documents fosters transparency and access for team members.

Utilizing pdfFiller eliminates the delays associated with manual signatures and boosts overall efficiency. The eSignature feature allows for quick turnaround on important profit-sharing agreements, ensuring that everyone involved is on the same page without the hassle of physical paperwork.

Benefits of using a print signature profit sharing plan

-

1.Enhanced efficiency in document management

-

2.Reduced turnaround time for signing agreements

-

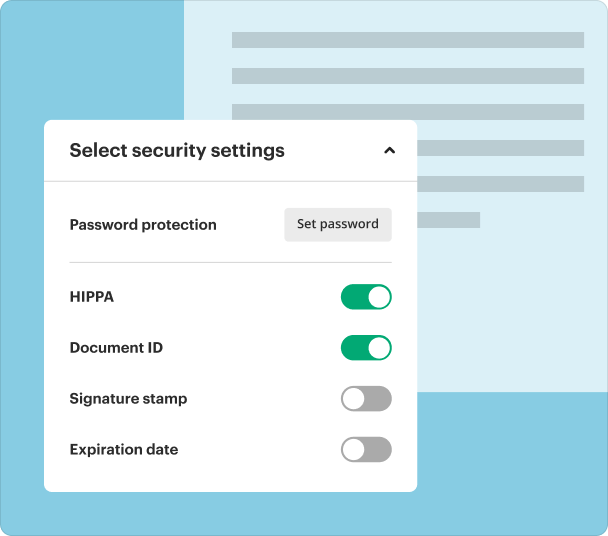

3.Secure and legally binding electronic signatures

-

4.Easy access for all stakeholders involved

-

5.Elimination of paper-based processes

Implementing a Print Signature Profit Sharing Plan via pdfFiller’s eSignature can significantly streamline operations. The collaborative features provide a platform for transparent teamwork, making it easier to manage changes and obtain necessary approvals swiftly.

Real-world examples of print signature profit sharing plan utilization

Businesses can leverage a print signature profit sharing plan to facilitate smoother transactions in various scenarios, including employee profit-sharing agreements, partnership profit distributions, and investment returns. By employing pdfFiller’s feature, these processes become simpler, allowing for quicker resolutions and documented agreements.

Ultimately, integrating such plans into your business operations supports a more organized and efficient workflow.

Editing a PDF document with pdfFiller

Steps for editing your document

-

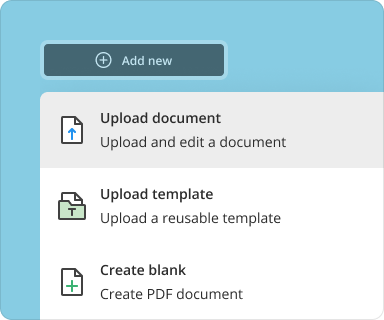

Download your form into pdfFiller

-

Select the Print Signature Profit Sharing Plan option from the menu

-

Make necessary modifications to the document

-

Click the orange 'Done' button located in the top right corner

-

Rename the form if needed

-

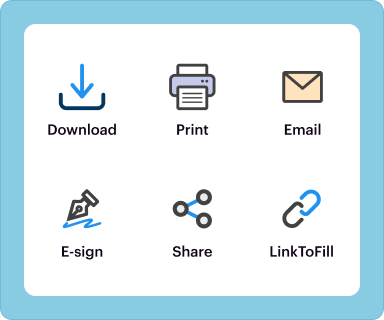

Print it, email, or save the template to your computer

Utilize pdfFiller for quick and effective PDF editing.