Redline Church Donation Receipt For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Redline Church Donation Receipt Feature

The Redline Church Donation Receipt feature streamlines the donation process for your church, making it easier for you to manage contributions and for your donors to track their generosity. This feature provides automatic generation of receipts that fulfill tax requirements and enhance donor engagement.

Key Features

Potential Use Cases and Benefits

With the Redline Church Donation Receipt feature, you can resolve the common challenge of managing donations effectively. By simplifying the receipt process, you provide your donors with a seamless experience while ensuring your records are accurate and up to date. This functionality not only helps you maintain organization but also fosters trust and loyalty among your congregation.

Redline Church Donation Receipt with the swift ease

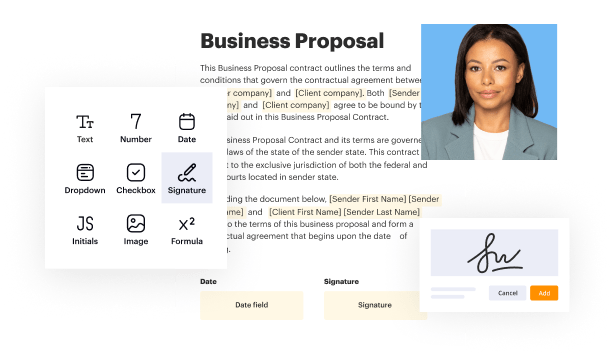

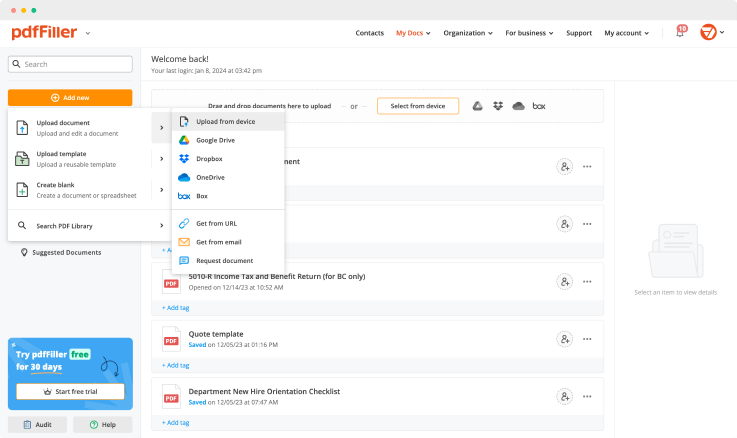

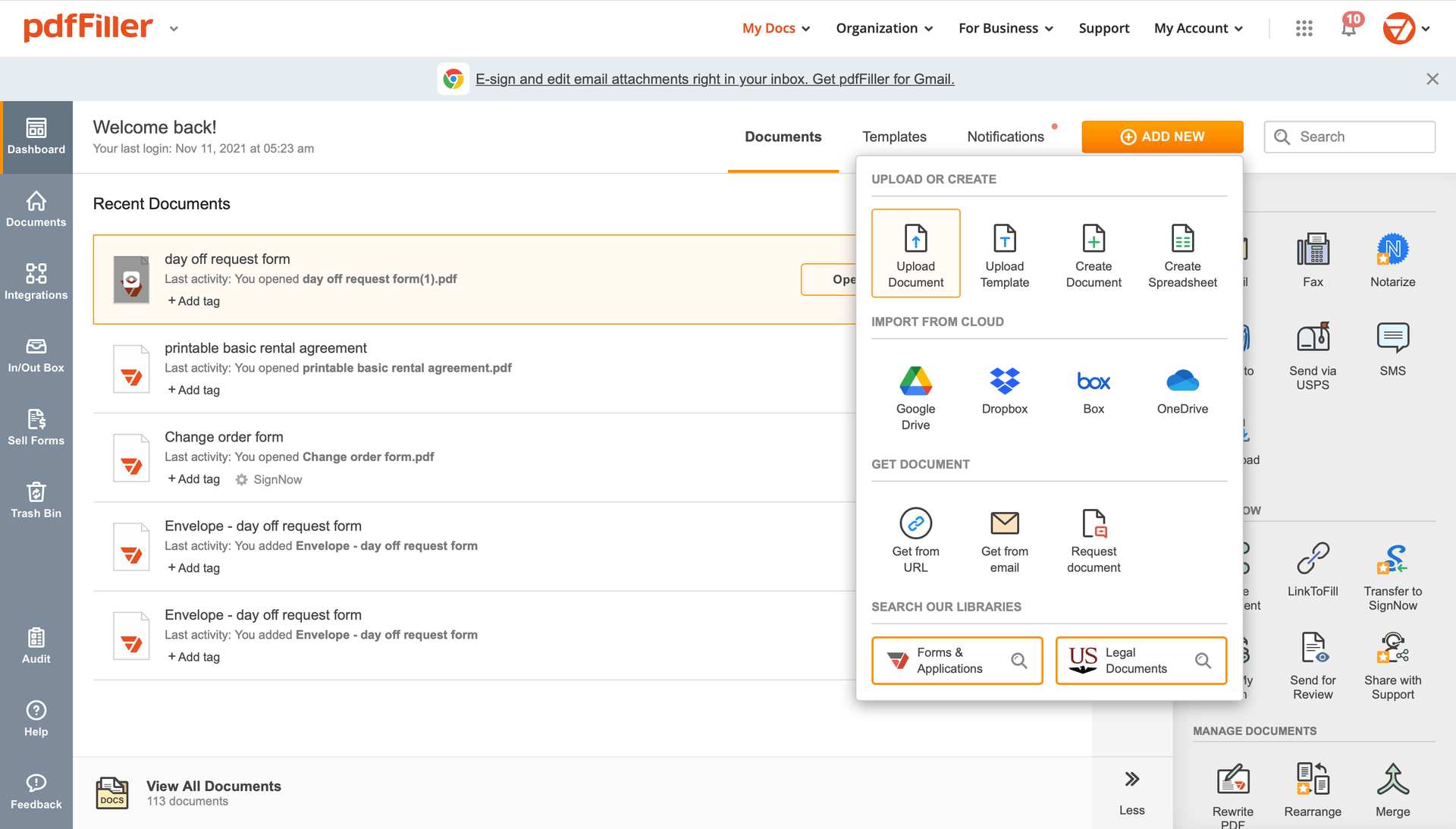

pdfFiller enables you to Redline Church Donation Receipt quickly. The editor's convenient drag and drop interface allows for quick and intuitive document execution on any operaring system.

Ceritfying PDFs electronically is a fast and secure method to validate paperwork anytime and anywhere, even while on the go.

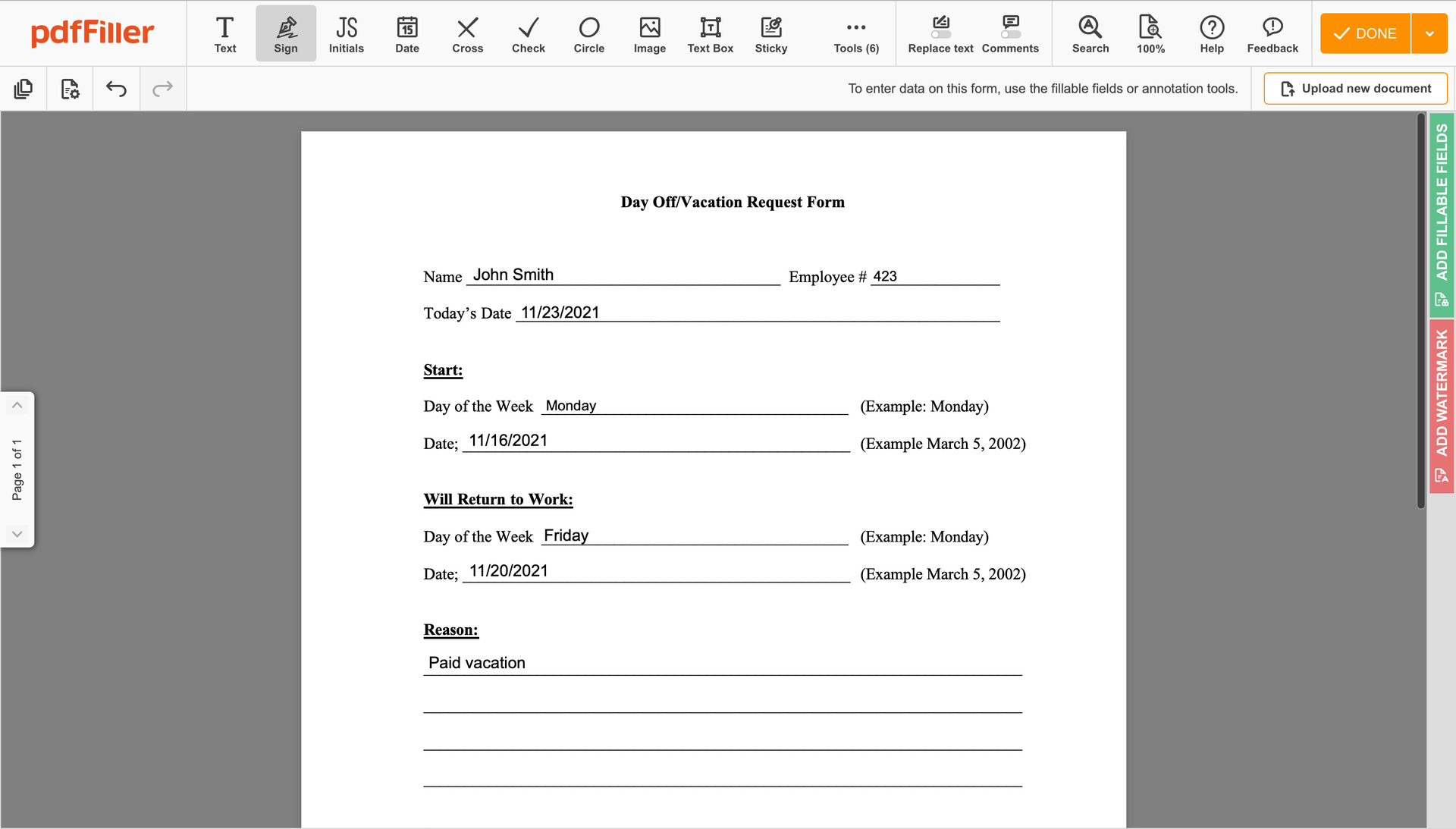

See the detailed guide on how to Redline Church Donation Receipt electronically with pdfFiller:

Add the document you need to sign to pdfFiller from your device or cloud storage.

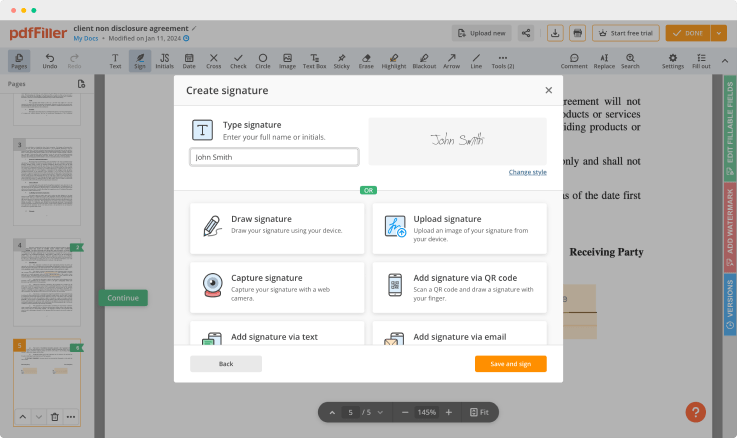

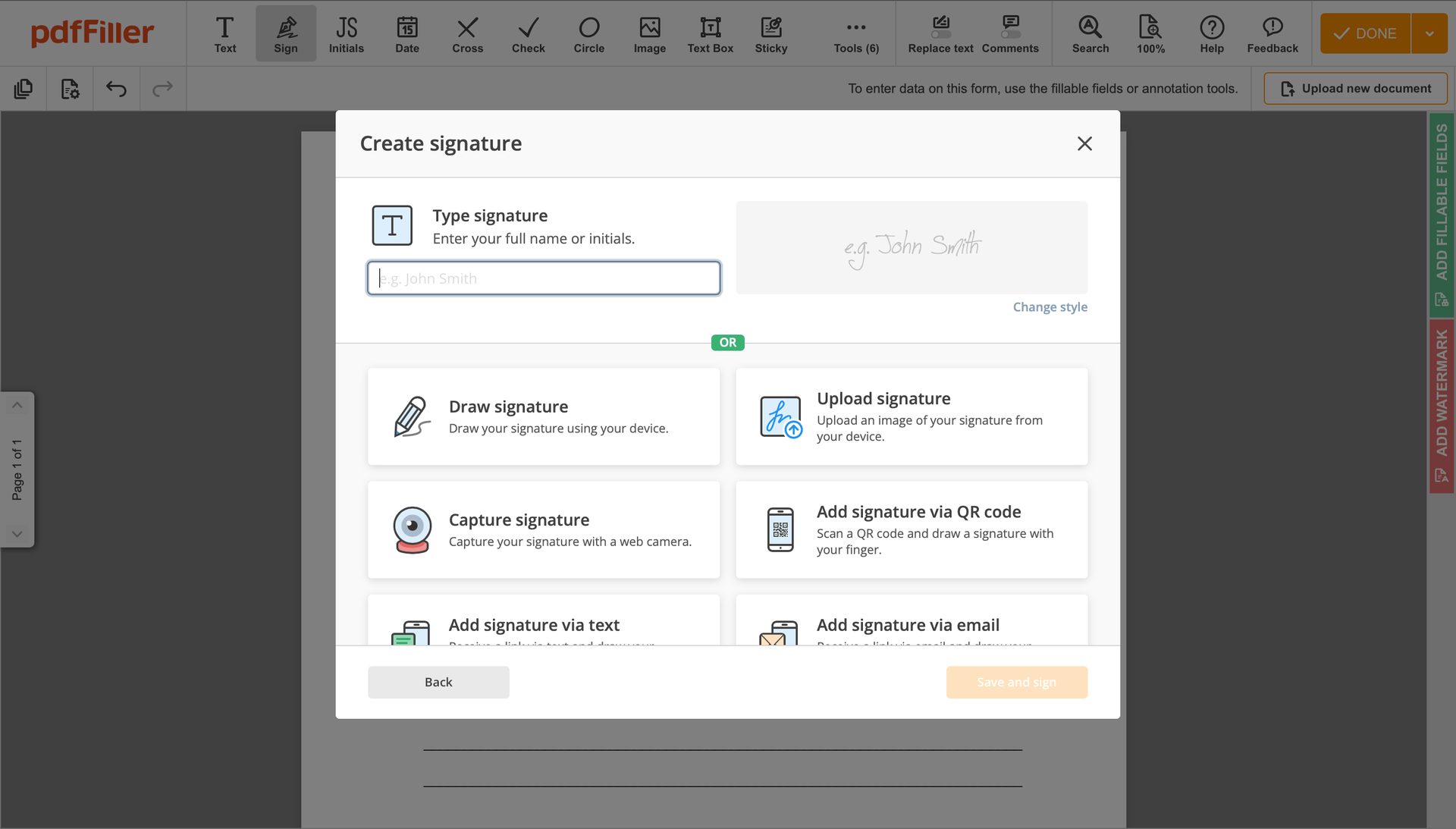

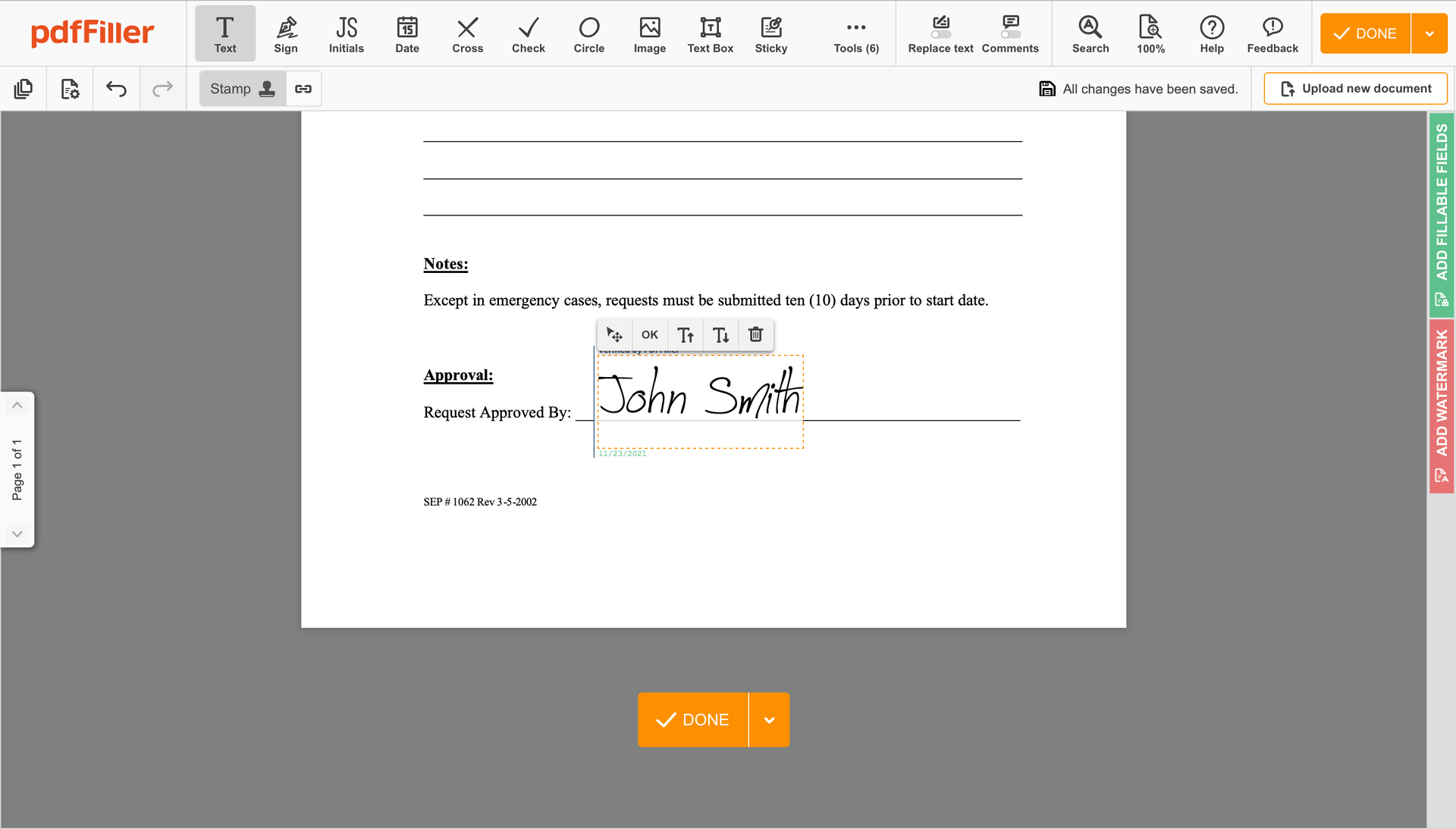

Once the file opens in the editor, click Sign in the top toolbar.

Generate your electronic signature by typing, drawing, or importing your handwritten signature's photo from your laptop. Then, click Save and sign.

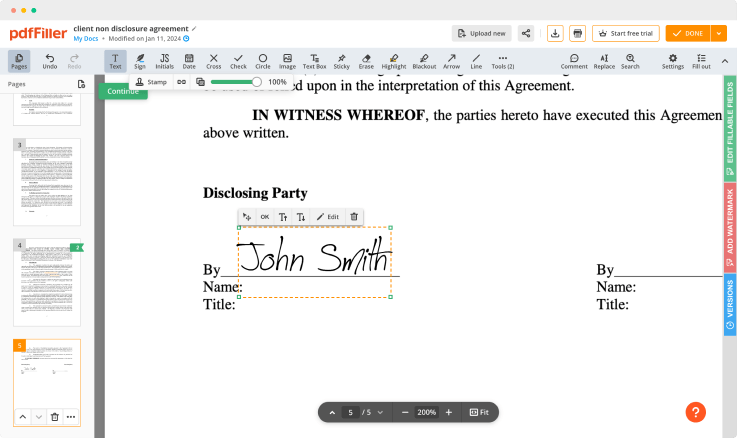

Click anywhere on a document to Redline Church Donation Receipt. You can move it around or resize it utilizing the controls in the hovering panel. To use your signature, hit OK.

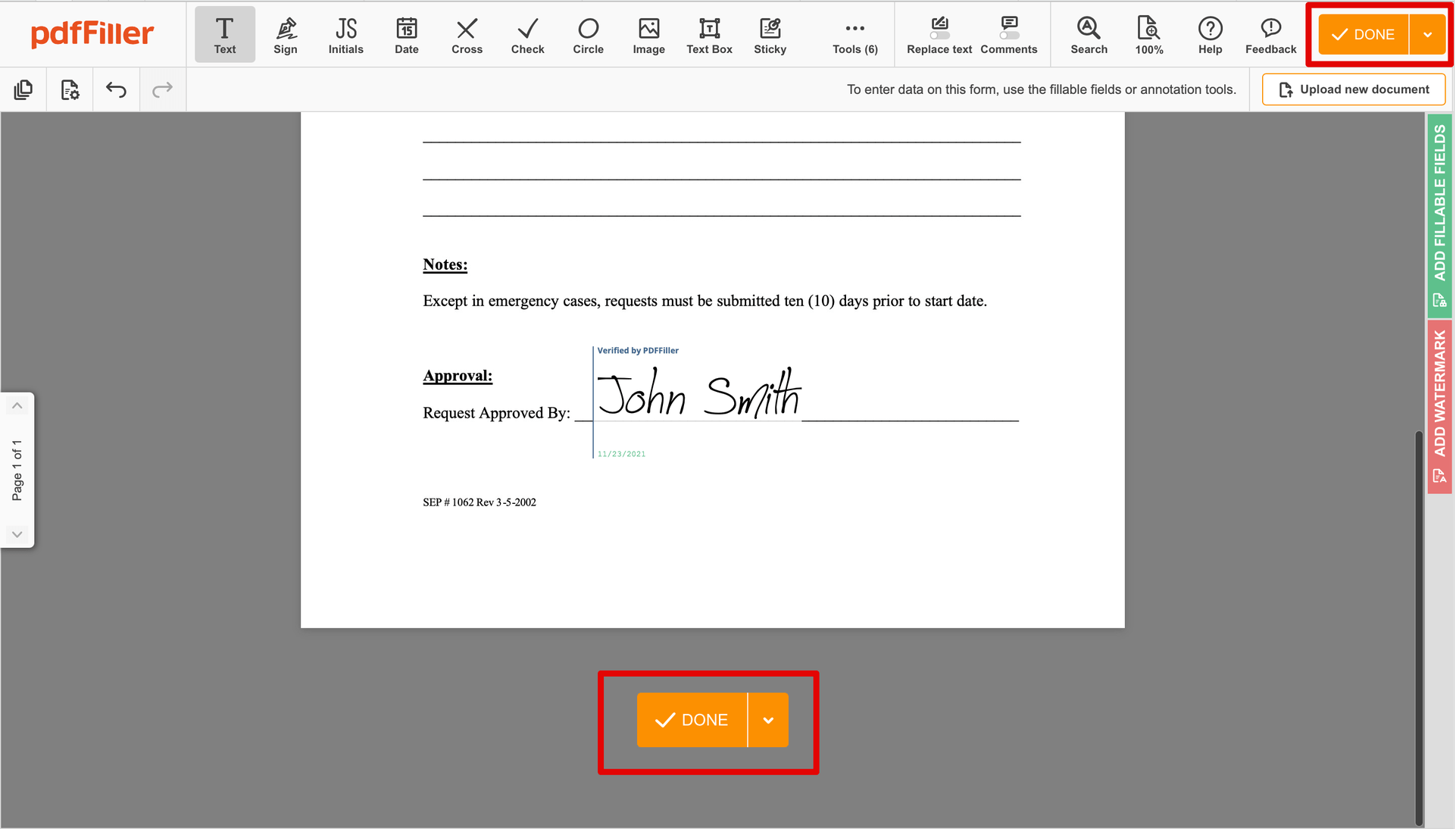

Complete the signing process by clicking DONE below your form or in the top right corner.

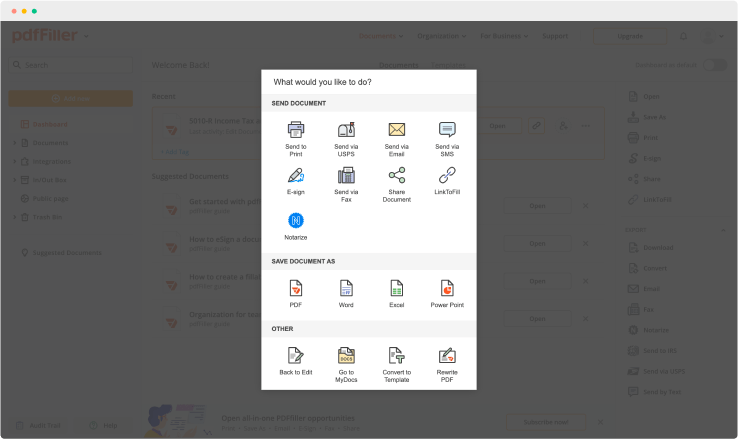

Next, you'll go back to the pdfFiller dashboard. From there, you can download a signed copy, print the document, or send it to other people for review or validation.

Still using multiple programs to manage and sign your documents? Try our all-in-one solution instead. Use our tool to make the process fast and simple. Create document templates on your own, edit existing forms, integrate cloud services and utilize even more useful features without leaving your account. You can use Redline Church Donation Receipt with ease; all of our features, like orders signing, reminders, requests, are available instantly to all users. Get a major advantage over those using any other free or paid tools.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Redline Church Donation Receipt