Regulate Needed Field Settlement For Free

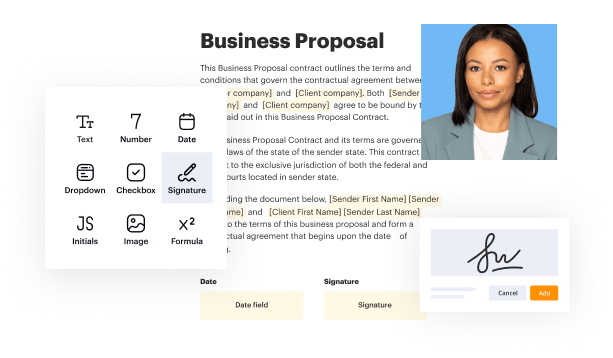

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

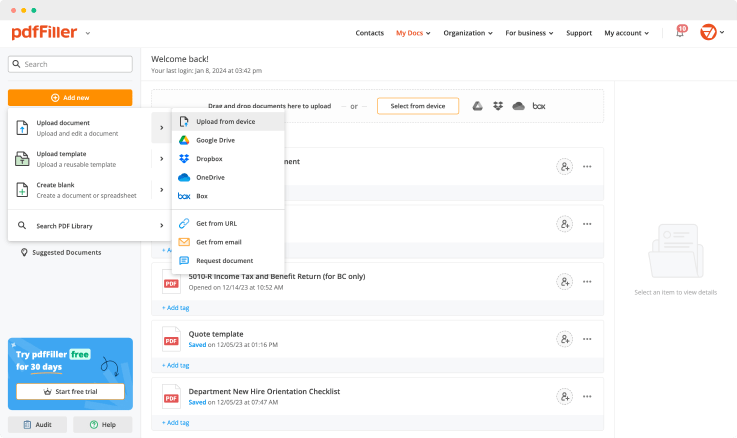

Upload a document

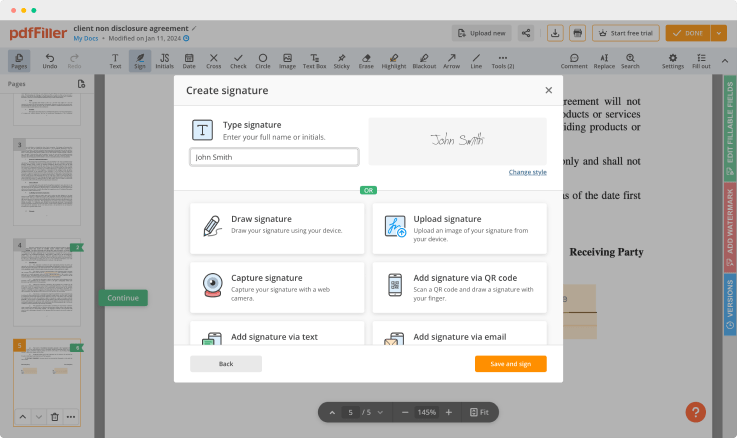

Generate your customized signature

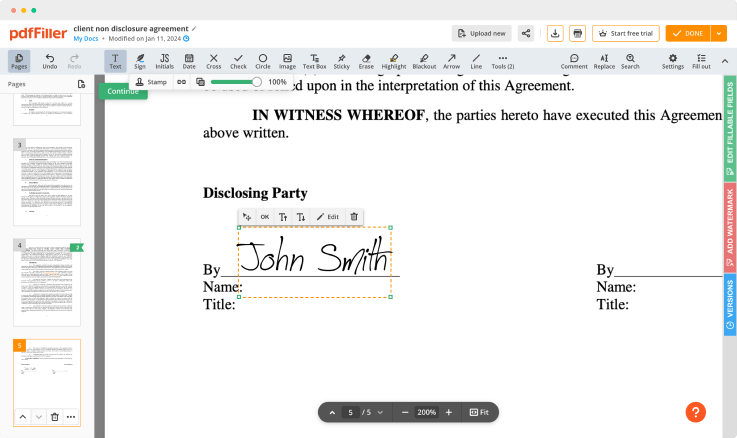

Adjust the size and placement of your signature

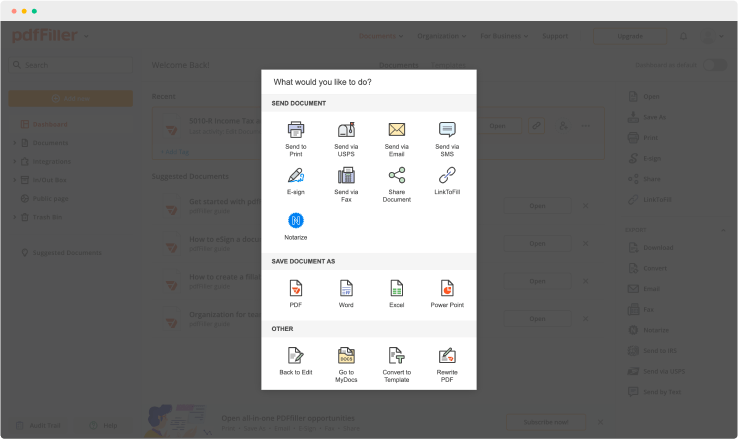

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Regulate Needed Field Settlement Feature

The Regulate Needed Field Settlement feature simplifies the process of managing and settling field data. It helps you keep your projects organized and ensures timely action on critical information.

Key Features

Automates field data regulation

Enhances data accuracy and consistency

Integrates seamlessly with existing workflows

Provides real-time updates and alerts

Offers customizable settings for different projects

Potential Use Cases and Benefits

Streamline data processing in large projects

Improve decision-making with accurate information

Reduce time spent on manual data entry

Enhance collaboration among team members

Minimize errors that can lead to costly setbacks

By using the Regulate Needed Field Settlement feature, you can address challenges related to data management. It enables you to act on data promptly, which reduces the risk of missing critical information. This feature empowers you to maintain control over your projects, ensuring greater efficiency and success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is prohibited by resp?

Section 8 of RESP prohibits a person from giving or accepting anything of value for referrals of settlement service business related to a federally related mortgage loan. It also prohibits a person from giving or accepting any part of a charge for services that are not performed.

What does resp not apply to?

Commercial or Business Loans Normally, loans secured by real estate for a business or agricultural purpose are not covered by RESP. However, if the loan is made to an individual entity to purchase or improve a rental property of 1 to 4 residential units, then it is regulated by RESP.

What type of loans does resp apply to?

The types of loans covered by RESP include the majority of purchase loans, assumptions, refinances, property improvement loans, and equity lines of credit. RESP requires lenders, mortgage brokers, or services of home loans to disclose to borrowers any information about the real estate transaction.

What are the resp requirements?

The Act requires lenders, mortgage brokers, or services of home loans to provide borrowers with pertinent and timely disclosures regarding the nature and costs of the real estate settlement process. The Act also prohibits specific practices, such as kickbacks, and places limitations upon the use of escrow accounts.

What is the main purpose of resp?

RESP has two main purposes: (1) to mandate certain disclosures in connection with the real estate settlement process, so home purchasers can make informed decisions regarding their real estate transactions. And (2) to prohibit certain unlawful practices by real estate settlement providers, such as kickbacks and

What are resp rules?

The Real Estate Settlement Procedures Act, or RESP, was enacted by Congress to provide homebuyers and sellers with complete settlement cost disclosures. The Act was also introduced to eliminate abusive practices in the real estate settlement process, to prohibit kickbacks, and to limit the use of escrow accounts.

What types of fees and conditions are prohibited under resp?

What types of fees and conditions are prohibited under RESP? Title Insurance Placement, Kickbacks and Referral Fees. For what items may a lender require escrow accounts from a borrower? Property taxes, hazard insurance and mortgage default insurance premiums.

What is a violation of resp?

A RESP violation occurs when a title company has a financial interest (or ownership) in a real estate transaction where a buyer's loan is federally insured. RESP is a consumer protection law created to make sure that buyers of residential properties of one to four family units are informed in detailed writing

Ready to try pdfFiller's? Regulate Needed Field Settlement

Upload a document and create your digital autograph now.