Regulate Payment Transcript For Free

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Regulate Payment Transcript Feature

The Regulate Payment Transcript feature offers a streamlined approach to managing transaction records. This tool helps you maintain accurate payment documentation, ensuring compliance and transparency in your financial dealings.

Key Features

Potential Use Cases and Benefits

This feature addresses your financial documentation challenges effectively. By automating payment records, it reduces the risk of human errors, ensuring you remain compliant with regulations. Additionally, your team can quickly retrieve necessary transcripts, allowing you to focus on strategic tasks instead of administrative hurdles.

Instructions and Help about Regulate Payment Transcript For Free

Regulate Payment Transcript: simplify online document editing with pdfFiller

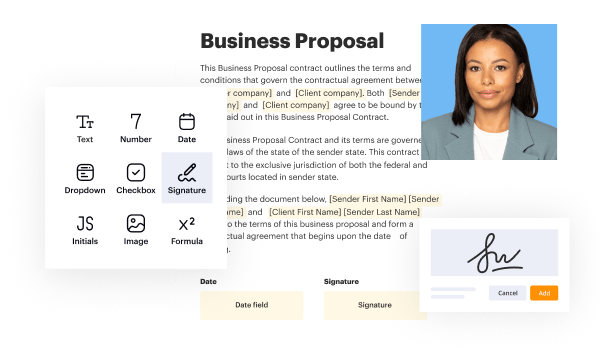

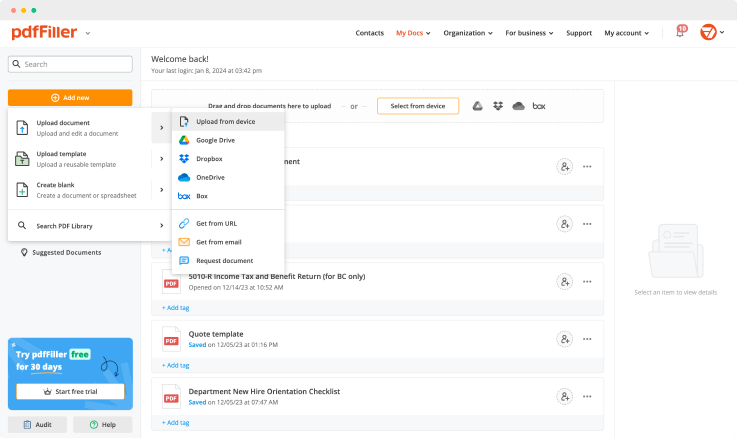

Filing PDF documents online is the most convenient way to get any type of paperwork done fast. An application form, affidavit or any other document — you're just several clicks away from completion. Thanks to PDF editing tools, you'll be sure that information in the document is 100% accurate. Having access to a PDF editor gives you the opportunity to edit text, add images and photos, complete forms and convert PDF files to other file formats.

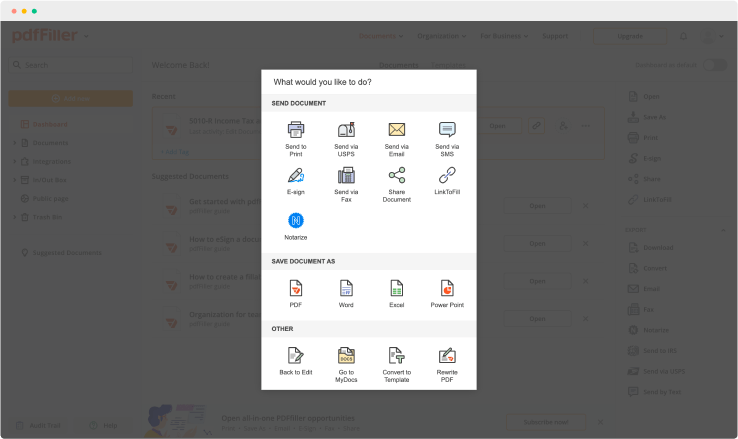

With pdfFiller, you can create new fillable document from scratch, or upload an existing one to change text, add spreadsheets, images and checkmarks. Save documents as PDF files easily and forward them both inside and outside your company, using the integration's features. With pdfFiller, any PDF document can be converted into Doc, PPT, Excel, JPG, or simple text file.

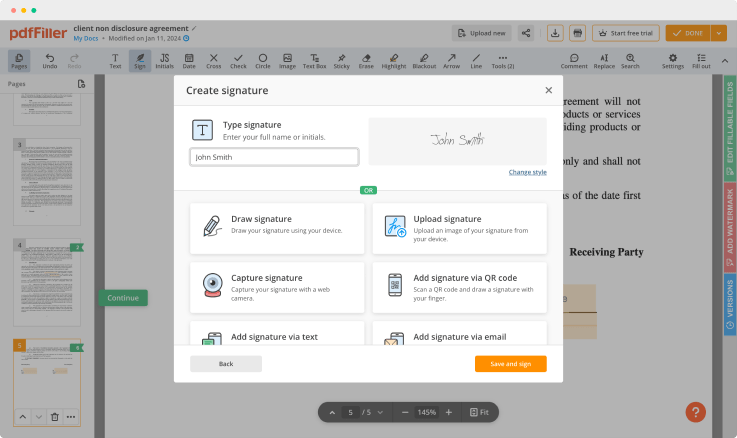

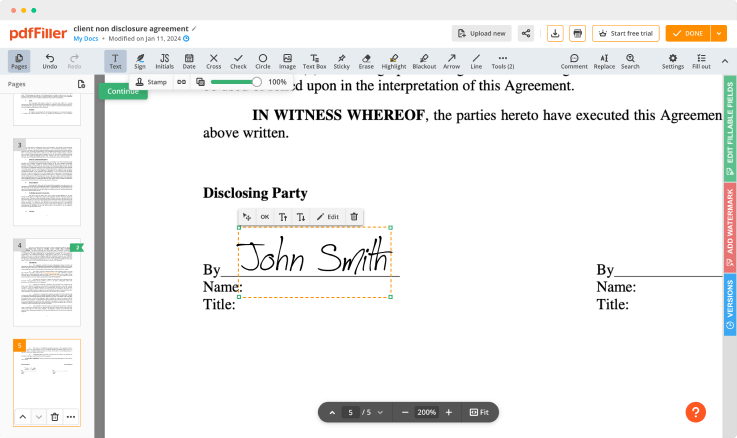

Sign documents digitally using e-signature, which you can create with your mouse or touchpad, or upload from a photograph. You'll get access to this from all your desktop and mobile devices and your signature will be verified all across the United States, under the DESIGN Act of 2000.

Discover the numerous features to edit and annotate PDF files efficiently. Cloud storage is available on any device and includes world-class security.

Create documents from scratch. Add as many fillable fields as you want. Add and erase text.

Fill out forms. Discover the range of ready-made forms and choose the one you are looking for

Edit. Change the content or mix it up with images, apply watermarks or add checkboxes

Change the format. Convert PDF files to any document format including Word, Excel, Google Docs, Pages and more

Provide safety. Prevent third parties from accessing your data without a permission

For pdfFiller’s FAQs

Ready to try pdfFiller's? Regulate Payment Transcript