Regulate Sum Settlement For Free

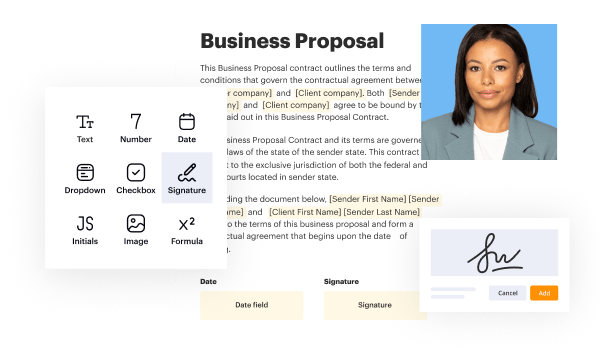

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

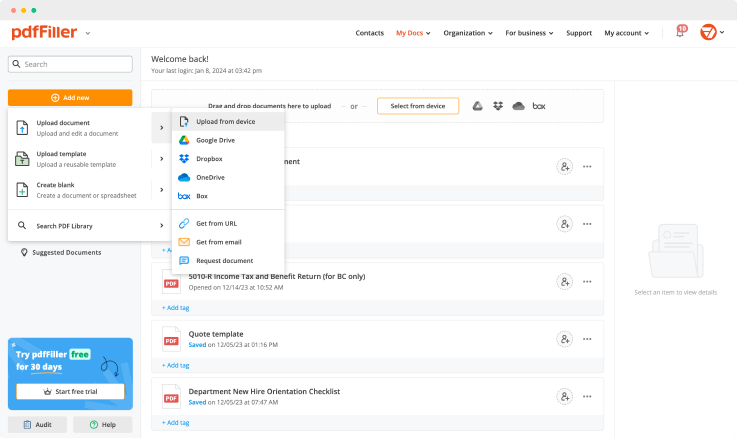

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

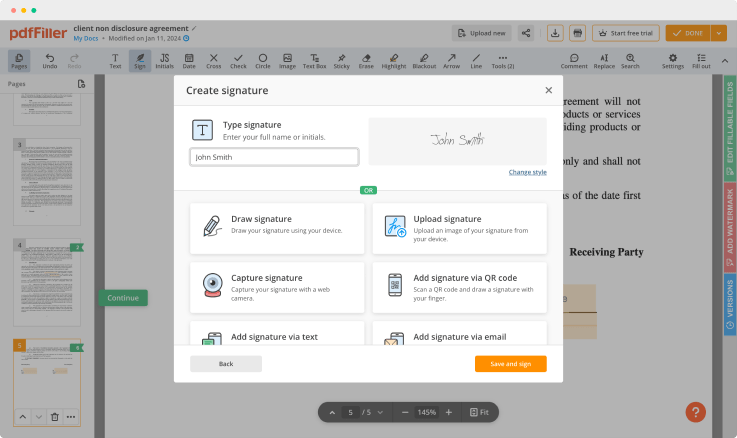

Generate your customized signature

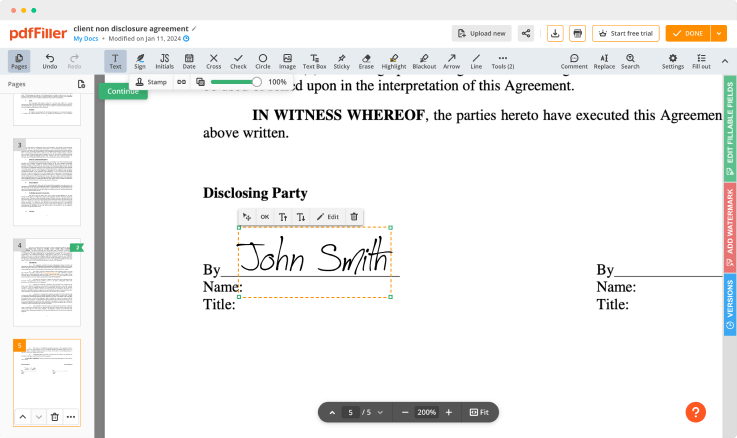

Adjust the size and placement of your signature

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

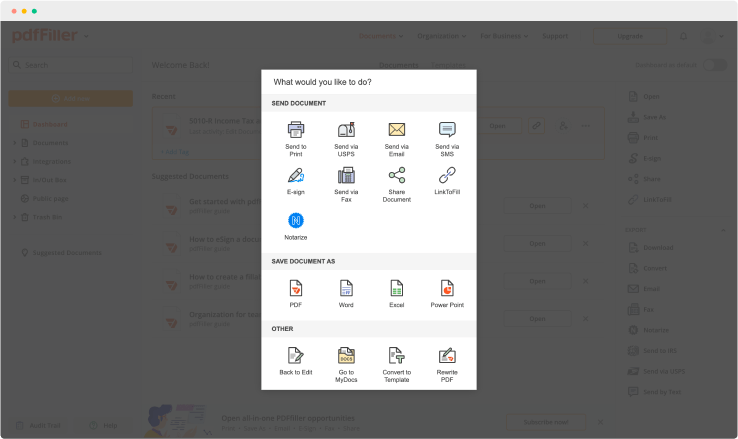

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Regulate Sum Settlement Feature

Introducing the Regulate Sum Settlement feature, designed to simplify your financial management. This feature helps you maintain balance and accuracy in your transactions, making your workflow smoother and more efficient.

Key Features

Automated transaction calculations

Real-time settlement updates

Customizable settlement thresholds

User-friendly interface

Comprehensive reporting tools

Potential Use Cases and Benefits

Businesses needing quick transaction reconciliations

Individuals managing personal budgets effectively

Financial institutions streamlining their settlement processes

Accounting teams searching for accurate financial reporting

With the Regulate Sum Settlement feature, you can resolve common financial challenges, such as inaccurate transaction records and slow reconciliation times. It empowers you to maintain control over your finances, ensuring you make informed decisions without stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you negotiate a lump sum settlement?

Go over your income and expenses with a fine-tooth comb, figure out what you can afford, and only agree to pay a realistic amount. Generally, you can negotiate the best settlement on a debt if you can come up with a lump sum amount to resolve the debt. If you agree to a payment plan, you will likely pay more over time.

What percentage should I offer to settle debt?

Offer a Lump Sum Settlement Some want 75%80% of what you owe. Others will take 50%. Those that have given up on you may settle for one-third or less. Before you make an offer, however, decide your top amount and stick to it.

What percentage of a debt is typically accepted in a settlement?

Average Debt Settled by Debt Settlement Companies Then there are the fees to the debt settlement company, which are typically 15%. Sometimes that is 15% of the amount you originally owed. Sometimes that is 15% of the amount you paid.

How much should I offer creditors to full settlement?

Depending on the creditor and how much you owe, you may be able to settle for anywhere from 30% to 70% of the outstanding balance of your debt. Typically, a creditor will only consider a settlement when an account is delinquent, but you should keep in mind that they're not required to accept your offer.

How much can you negotiate with debt collectors?

A debt collector may settle for around 50 percent of the bill, and Loftsgordon recommends starting negotiations low to allow the debt collector to counter. If you are offering a lump sum or any alternative repayment arrangements, make sure you can meet those new repayment parameters.

Should I take a debt settlement offer?

”If you're happy with their offer, and you should be because it's less than what you actually owe them, then you should at least consider it,” he says. The alternative, according to Alzheimer, is the creditor either outsourcing the debt to a collector or even suing you.

How do you negotiate a charge off settlement?

Stick to Your Story. The person on the other end of the phone doesn't want to hear all the details about why you're not able to pay your bills. Avoid Drama. Ask Questions. Take Notes. Read (& Save) Your Mail.

Can you negotiate a charge off?

”You can try to negotiate a 'pay for delete' arrangement, which means your repayment is contingent on the removal of the charge-off from your credit report, but that happens very infrequently,” says Alzheimer. Any negotiation should be confirmed in writing.

Ready to try pdfFiller's? Regulate Sum Settlement

Upload a document and create your digital autograph now.