Regulate Title For Free

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Instructions and Help about Regulate Title For Free

Regulate Title: easy document editing

You can use digital solutions to manage all your documents online and don't spend any more time on repetitive steps. Most of them offer all the essential features but take up a lot of storage space on your desktop computer and require installation. When a simple online PDF editor is not enough and more flexible solution is required, you can save time and work with your PDF files efficiently with pdfFiller.

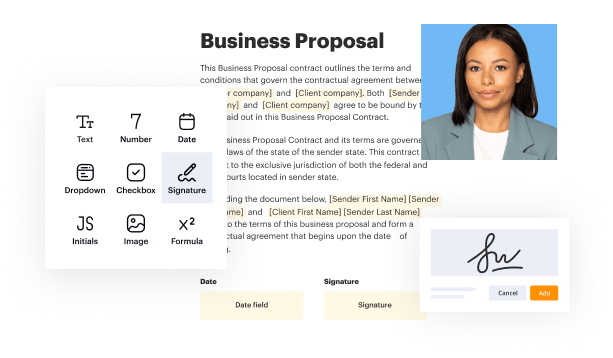

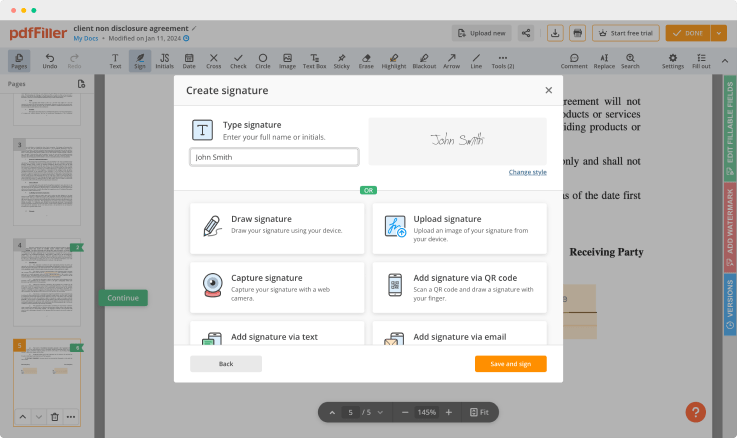

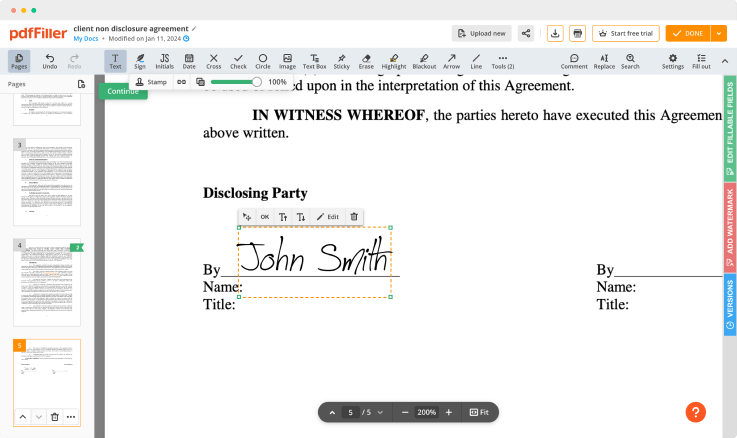

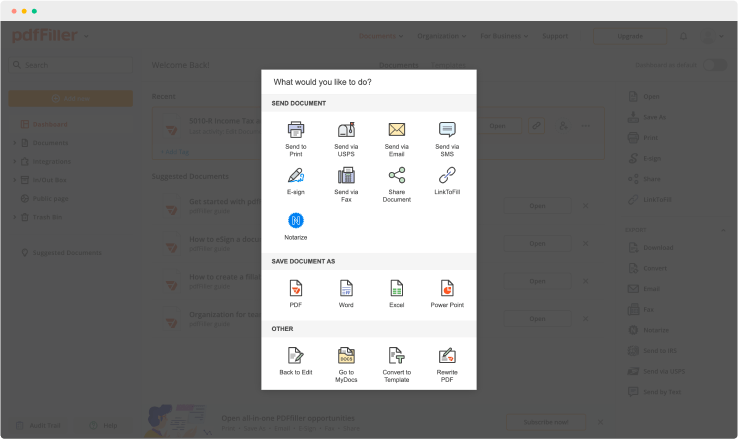

pdfFiller is a robust, online document management platform with an array of tools for modifying PDF files. In case you've ever had to edit a document in PDF, sign a PNG scan of a contract, or fill out a form in Word, you will find this tool useful. Make every document fillable, submit applications, complete forms, sign contracts, and more.

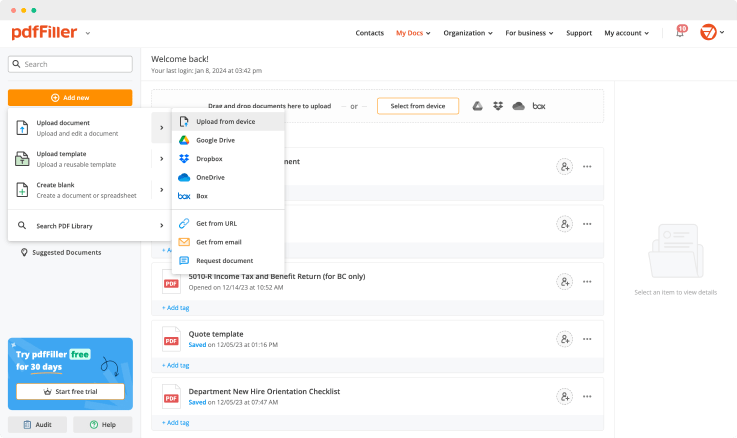

Just run the pdfFiller app and log in using your email credentials to start. Browse your device for a needed document to upload and change, or simply create a new one yourself. You'll

you will be able to simply access any editing tool you need in just one click.

Use powerful editing tools such as typing text, annotating, blacking out and highlighting. Add images to your PDF and edit its appearance. Change a page order. Add fillable fields and send documents for signing. Ask other users to fill out the document. Once a document is completed, download it to your device or save it to cloud storage.

Use one of the methods below to upload your document and start editing:

Discover pdfFiller to make document processing simple, and ditch all the repetitive actions. Streamline your workflow and fill out important documents online.

For pdfFiller’s FAQs

Ready to try pdfFiller's? Regulate Title