Report Day Document For Free

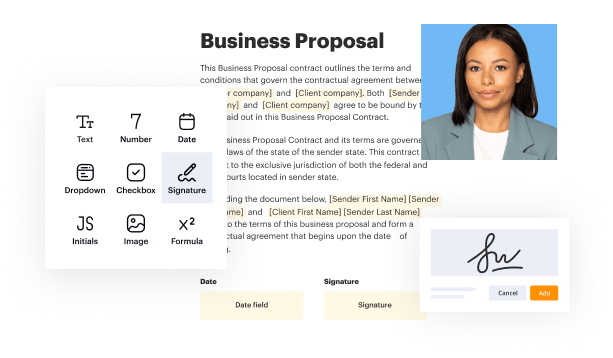

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

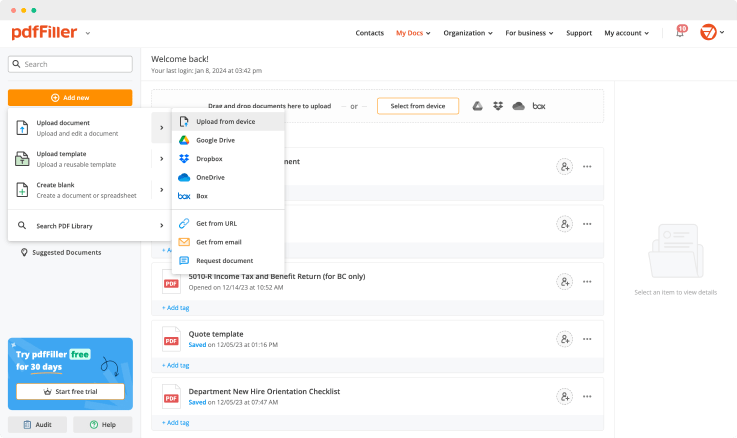

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

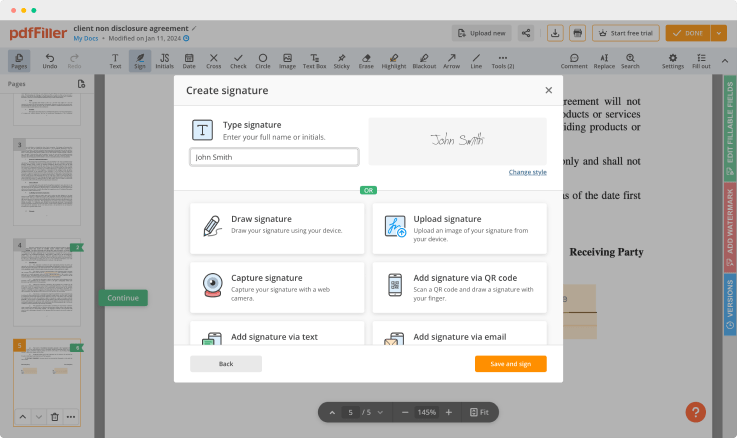

Generate your customized signature

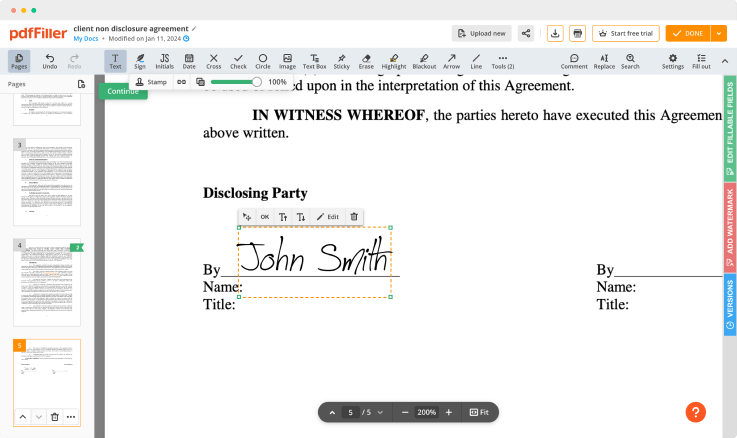

Adjust the size and placement of your signature

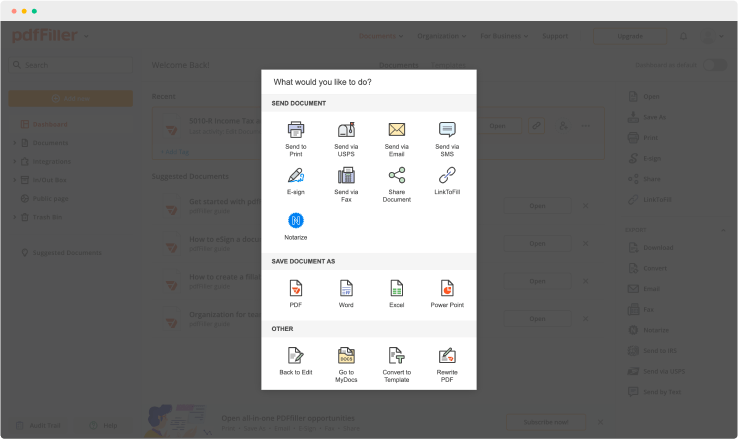

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Report Day Document Feature

The Report Day Document feature helps you streamline your reporting process. You can easily generate detailed reports that present your data clearly and effectively. This feature is designed for users who want to simplify report creation without sacrificing quality.

Key Features

Automated report generation saves time

Customizable templates for a professional look

Collaboration tools for team input

Export options to various formats

Real-time data integration for accuracy

Potential Use Cases and Benefits

Create monthly performance reports for stakeholders

Generate sales reports for team meetings

Compile data analysis for project reviews

Prepare compliance documentation quickly

Share visual reports with clients effortlessly

With the Report Day Document feature, you can overcome challenges in report creation. Instead of spending hours gathering data and formatting documents, you can focus on analysis and decision-making. This feature empowers you to deliver meaningful insights efficiently, ensuring your reports reflect the performance and progress that matters most.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you report investments on taxes?

First, take a look at investors who have the easiest reporting route. If your ordinary and interest income is less than $1,500 in each category, you don't have to file Schedule B with your Form 1040 or Form 1040A. You simply list your interest and dividend income directly on line 8a of your 1040 or 1040A.

How do I report investment income on my tax return?

First, take a look at investors who have the easiest reporting route. If your ordinary and interest income is less than $1,500 in each category, you don't have to file Schedule B with your Form 1040 or Form 1040A. You simply list your interest and dividend income directly on line 8a of your 1040 or 1040A.

Do I have to report investment income on my taxes?

Yes, in that the IRS requires all investment income to be reported when your income tax return is filed. And no, because if you have multiple transactions to report, you are allowed to send in the sum total of those transactions with the return.

How do you avoid tax on investment income?

Capital Gains Should Be Long-Term. Keep Your Portfolio in Tax Sheltered Accounts. Invest in Municipal Bonds. Consider Real Estate Investments. Try Index Funds.

What is considered investment income for tax purposes?

In general, investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities and businesses that are passive activities to the taxpayer (within the meaning of

Are investment accounts taxable?

An individual taxable account is an investment account offered by a brokerage. With a taxable account, you can invest in assets like stocks, bonds and mutual funds. As your fund grows in value based on the stock market's performance, you'll owe taxes each year on your investment income.

Does invest affect tax return?

Capital Gains That profit is called a capital gain. And yes, you have to pay taxes on it. If you bought an investment like mutual fund shares, stocks or bonds and sold them less than a year later, that means they qualify as a short-term capital gain, and your profit will be taxed at a normal rate of up to 35%.

Do I have to report investments on my taxes?

Yes, in that the IRS requires all investment income to be reported when your income tax return is filed. And no, because if you have multiple transactions to report, you are allowed to send in the sum total of those transactions with the return.

Ready to try pdfFiller's? Report Day Document

Upload a document and create your digital autograph now.