Report Fax Contract For Free

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Report Fax Contract Feature

The Report Fax Contract feature simplifies tracking and managing your fax communications. It provides you with a precise overview of all fax transactions related to your contracts, helping you maintain organized records and enhance your workflow.

Key Features

Potential Use Cases and Benefits

This feature addresses your need for reliable documentation of faxed contracts. By implementing the Report Fax Contract feature, you can solve problems related to lost faxes, incomplete records, and miscommunication. You can trust it to enhance your operational efficiency and provide peace of mind.

Instructions and Help about Report Fax Contract For Free

Report Fax Contract: edit PDFs from anywhere

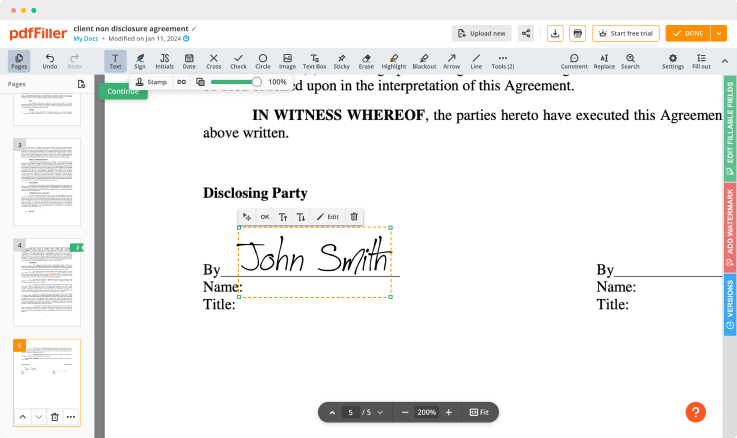

The Portable Document Format or PDF is a common file format used for business records because you can access them from any device. You can open it on any computer or phone running any OS — it will appear same.

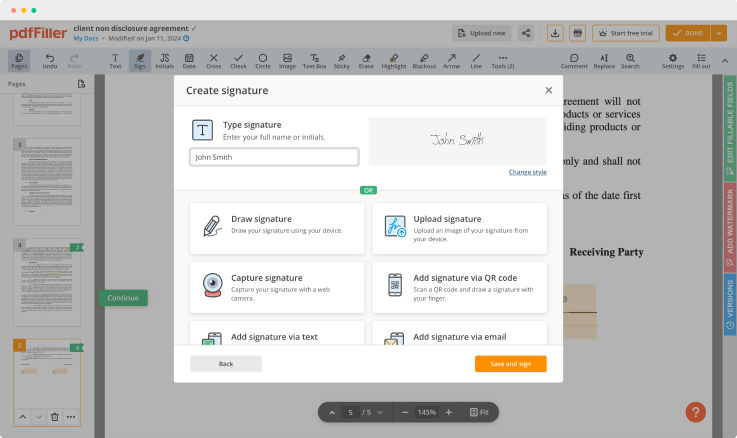

The next point is data safety: PDF files are easy to encrypt, so it's safe to share any confidential data in them. Apart from password protection, particular platforms offer opening history to track down people who read or filled out the document without your notice.

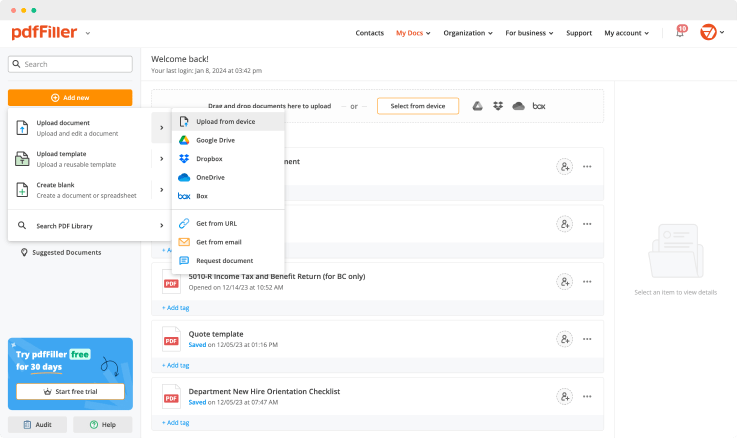

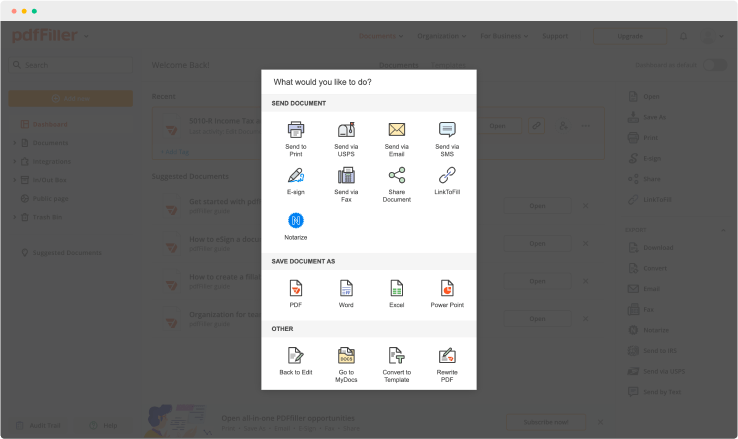

pdfFiller is an online document creating and editing tool that lets you create, edit, sign, and send PDF using one browser window. The editor integrates with major Arms, so users can edit and sign documents from other services, such as Google Docs and Office 365. Work with the finished document for personal needs or share it with others by any convenient way — you'll get notified when someone opens and fills out the form.

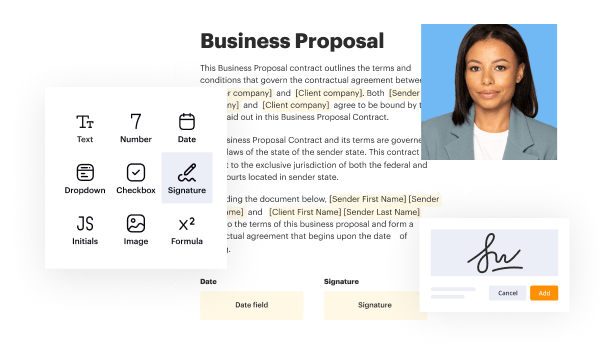

Use powerful editing tools to type in text, annotate and highlight. Change a document’s page order. Once a document is completed, download it to your device or save it to the third-party integration cloud. Collaborate with people to fill out the document. Add and edit visual content. Add fillable fields and send for signing.

Get your documents completed in four simple steps:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Report Fax Contract