Report Stamp Paper For Free

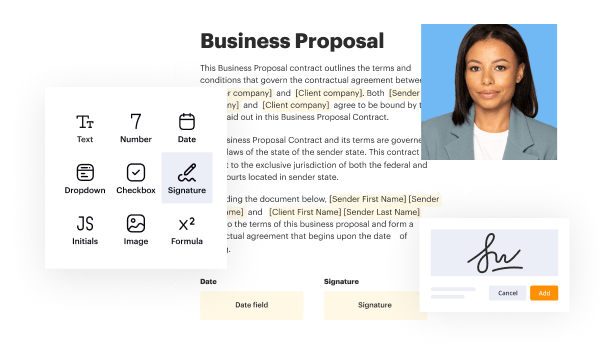

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

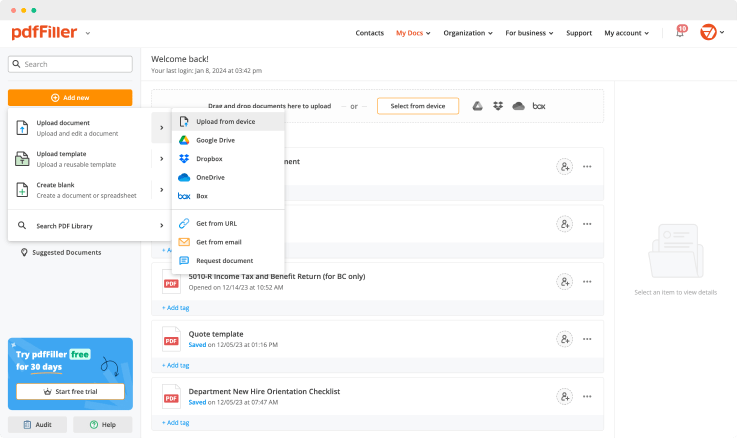

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

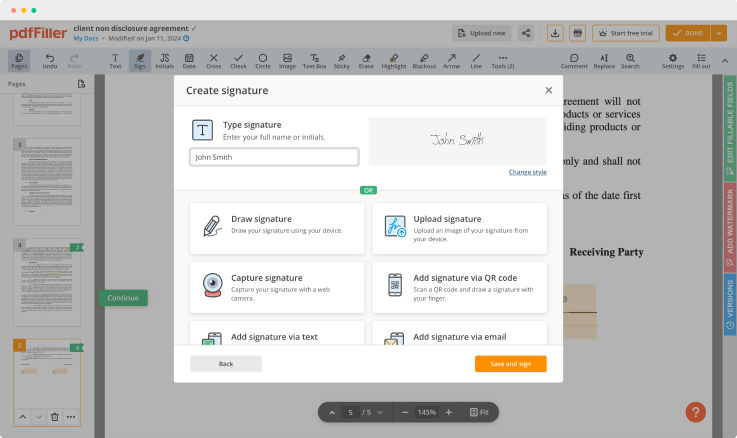

Generate your customized signature

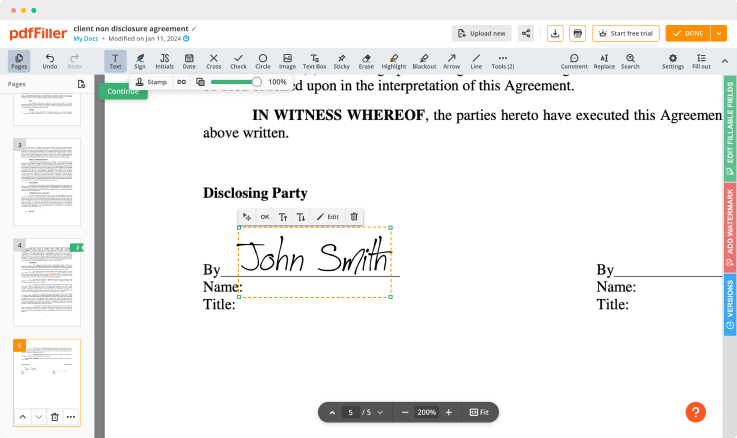

Adjust the size and placement of your signature

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

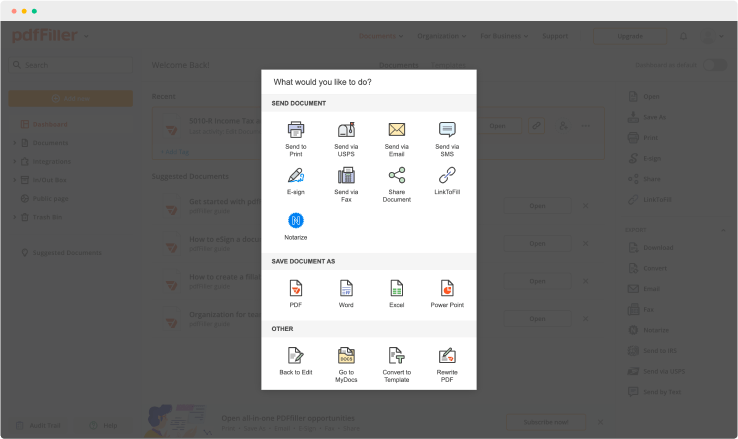

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Report Stamp Paper: Your Essential Documentation Tool

Introducing Report Stamp Paper, a reliable solution for your documentation needs. Designed for clarity and professionalism, this product helps you create official reports with ease.

Key Features

High-quality, durable paper

Pre-printed fields for easy filling

Multiple sizes to fit different reports

Environmentally friendly materials

Professional appearance to enhance your documents

Use Cases and Benefits

Ideal for legal documents, contracts, and agreements

Suitable for educational institutions for submitting assignments

Perfect for business reports and presentations

Facilitates record-keeping for various industries

Helps maintain professionalism and authenticity in documentation

With Report Stamp Paper, you can solve the common problem of disorganized or unprofessional documentation. This product ensures that your reports stand out, are easily readable, and convey the right message to your audience. Say goodbye to confusion and hello to clarity with Report Stamp Paper.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Will sellers have to pay stamp duty?

It is always the home buyer who pays stamp duty, not the seller. Usually, your solicitor will pay it on your behalf as part of the purchase process. You don't have to pay if you are purchasing a property worth less than £125,000, unless it is a second home.

Can sellers pay stamp duty?

It is always the home buyer who pays stamp duty, not the seller. Usually, your solicitor will pay it on your behalf as part of the purchase process. You don't have to pay if you are purchasing a property worth less than £125,000, unless it is a second home.

Is stamp duty going to be abolished?

Chancellor Sajid David has said he has no plans to make house sellers rather than buyers pay stamp duty tax. Stamp duty — a purchase tax paid in England and Northern Ireland on properties worth more than £125,000 — was abolished in 2017 for first-time buyers spending up to £300,000 on a house.

What will Boris do with stamp duty?

Sellers pay stamp duty instead of buyers Such a move, which was not announced when he was on the campaign trail, would ease the burden on people trading up the property ladder, while those selling would be able to tap into their equity to pay the stamp duty they owed.

Why do you have to pay stamp duty?

Stamp Duty tax is the property transaction tax. The tax is due to be paid on any property which is purchased at more than £125,000. The tax is due to be paid on any property which is purchased at more than £125,000. Historically it was introduced in 1694 to raise funds for the war.

What is the purpose of stamp duty?

Stamp duty land tax (SALT) is paid on any property purchase of more than £125,000. Stamp duty was introduced in England in 1694 during the reign of William and Mary as a transaction tax to raise money for war against France and was raised on goods including hats, newspapers and patent medicines.

Where does the stamp duty money go?

Stamp duty is a tax, so the amount you pay will go towards the state or territory government budget. The amount will be used to fund public sectors such as Health, Education and Training, Roads Transport and Emergency Services.

How can I reduce stamp duty?

Haggle. The amount of stamp duty you pay depends on a number of factors, including how much you are buying a property for. Use tax breaks. Currently, the rules are much more generous for those who have never owned a property before. Transfer a property. Buy out your ex. Get a refund. Chattels. Build your own!

Ready to try pdfFiller's? Report Stamp Paper

Upload a document and create your digital autograph now.