Safeguard Comment Notice For Free

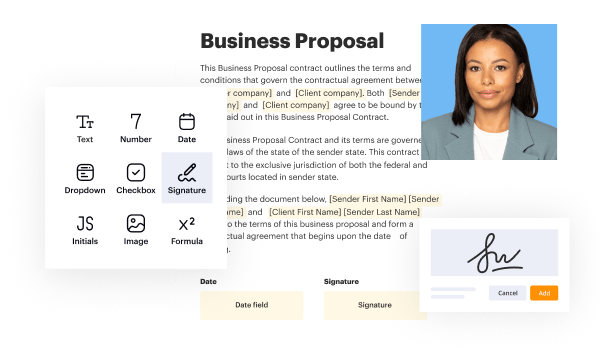

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

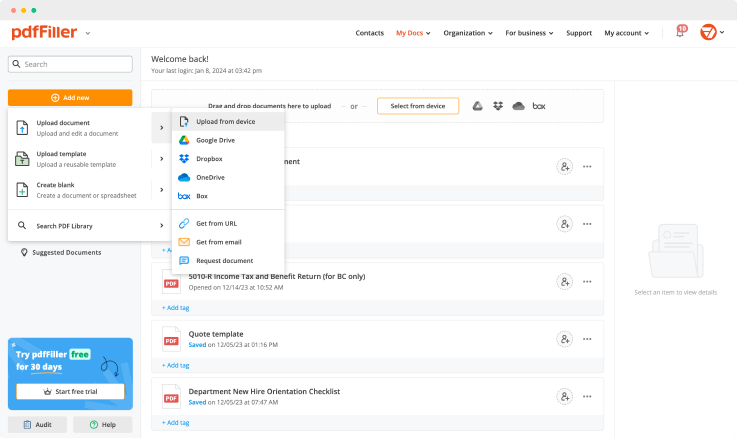

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

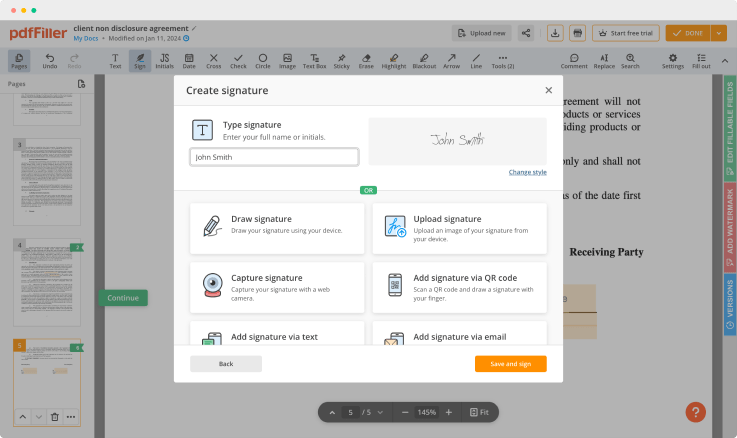

Generate your customized signature

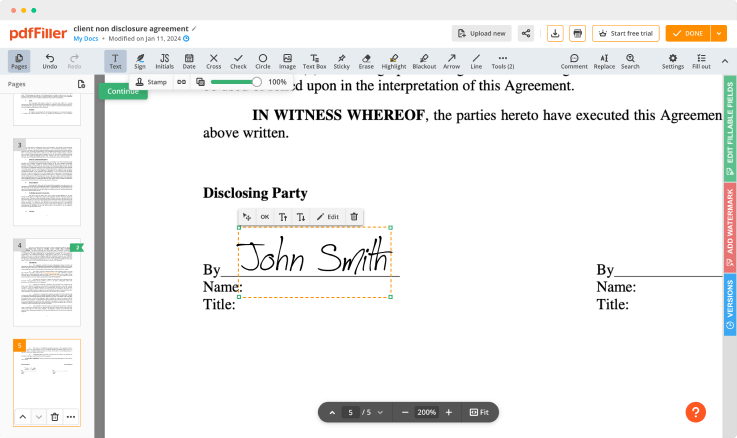

Adjust the size and placement of your signature

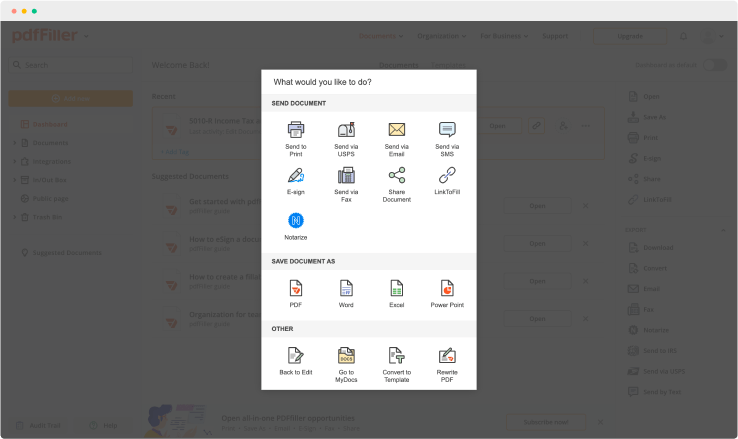

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

Video Review on How to Safeguard Comment Notice

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Safeguard Comment Notice Feature

The Safeguard Comment Notice feature provides a proactive approach to monitoring and managing user interactions. This tool helps you maintain a safe environment by alerting you to potentially harmful comments before they escalate.

Key Features

Real-time notifications for problematic comments

Customizable criteria for comment flags

User-friendly dashboard for comment management

Integration with existing platforms

Comprehensive reporting on user interactions

Potential Use Cases and Benefits

Moderating forums and online communities

Enhancing customer service interactions

Protecting brand reputation across social media

Ensuring compliance with community guidelines

Reducing the risk of misinformation spreading

With the Safeguard Comment Notice feature, you can tackle the challenge of managing user comments effectively. It reduces the risk of negative interactions, enhances user experience, and ultimately builds a trustworthy community. By staying ahead of potentially harmful comments, you safeguard your environment and foster positive conversations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the FTC Safeguards Rule?

The Safeguards Rule establishes requirements for the information security programs of all financial institutions subject to FTC jurisdiction. The Rule, which first went into effect in 2003, requires financial institutions to develop, implement, and maintain a comprehensive information security program.

What is the goal of the FTC Safeguards Rule?

The Safeguards Rule establishes requirements for the information security programs of all financial institutions subject to FTC jurisdiction. The Rule, which first went into effect in 2003, requires financial institutions to develop, implement, and maintain a comprehensive information security program.

What is required under the safeguard rule?

The Safeguards Rule, which went into effect in 2003, requires financial institutions to develop, implement, and maintain comprehensive information security programs to protect their customers' personal information.

What does the safeguards rule address?

The ALBA requires that financial institutions act to ensure the confidentiality and security of customers' nonpublic personal information, or NPI. The Safeguards Rule states that financial institutions must create a written information security plan describing the program to protect their customers' information.

What is the FTC Red Flags Rule?

The Red Flags Rule requires organizations to implement a written identity theft prevention program to help them identify any of the relevant red flags that indicate identity theft in daily operations. The Rule also offers steps to help prevent the crime and to mitigate its damage.

What is the main purpose of the ALBA Privacy Rule?

Gramm-Leach-Bliley Act. The Gramm-Leach-Bliley Act requires financial institutions companies that offer consumers financial products or services like loans, financial or investment advice, or insurance to explain their information-sharing practices to their customers and to safeguard sensitive data.

What is a federal safeguard?

Under the Safeguards Rule, financial institutions must protect the consumer information they collect. The Gramm-Leach-Bliley (LB) Act requires companies defined under the law as financial institutions to ensure the security and confidentiality of this type of information.

What information is covered by ALBA?

The financial activities in which these companies engage require them to collect personal information from their customers, including names, addresses, and phone numbers. Bank and credit card account numbers. Income and credit histories. And Social Security numbers. ALBA compliance is mandatory.

Ready to try pdfFiller's? Safeguard Comment Notice

Upload a document and create your digital autograph now.