Safeguard Period Invoice For Free

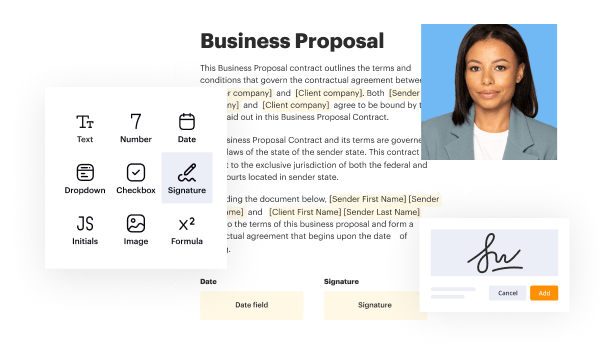

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

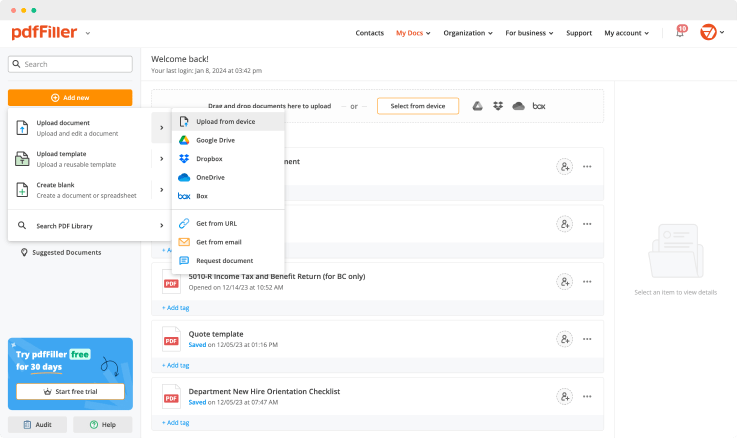

Upload a document

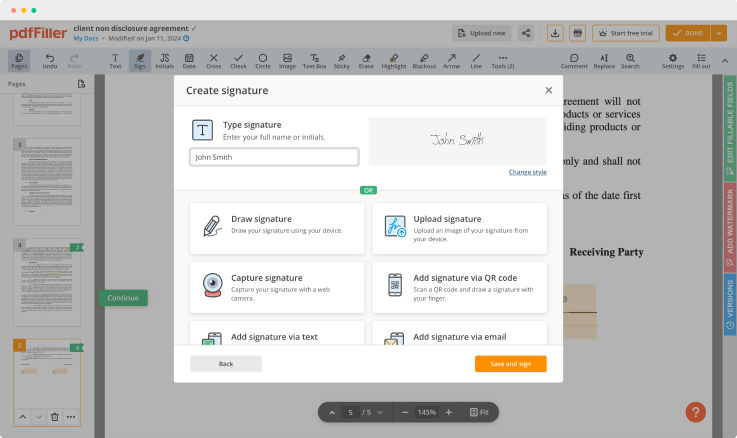

Generate your customized signature

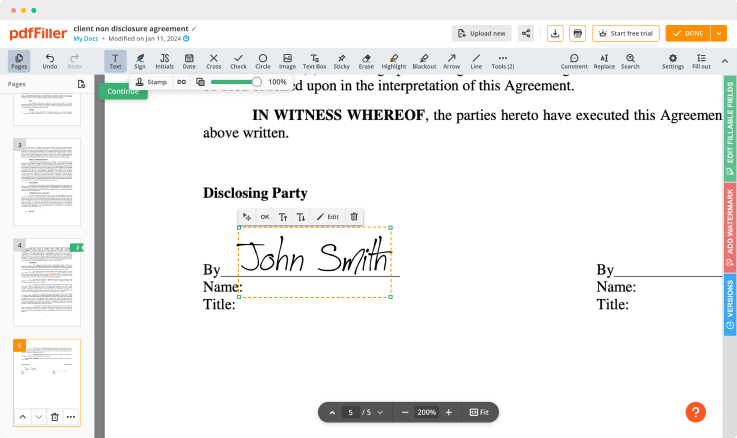

Adjust the size and placement of your signature

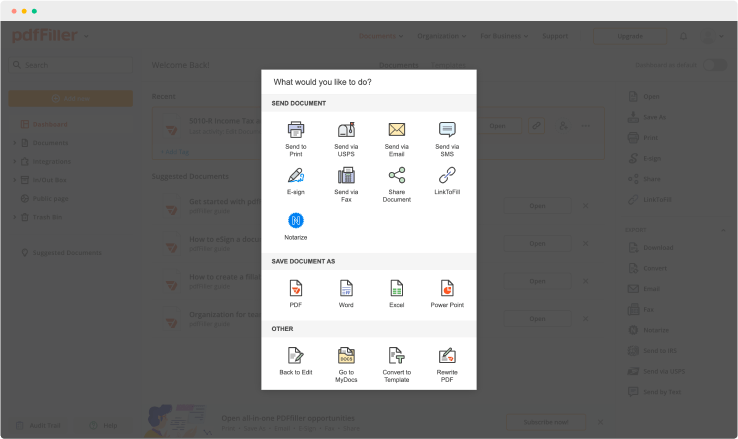

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Safeguard Period Invoice Feature

The Safeguard Period Invoice feature offers a straightforward solution for managing your invoices efficiently and on time. By incorporating this tool into your workflow, you ensure clarity and reliability in your billing process.

Key Features

Automated invoicing for recurring transactions

Customizable invoice templates tailored to your branding

Secure storage of invoices for easy retrieval and management

Integration with popular accounting software

Email reminders for upcoming invoices to prevent delays

Potential Use Cases and Benefits

Small businesses needing reliable invoice management

Freelancers looking for consistent billing options

Accountants requiring easy access to financial records

Companies aiming to improve cash flow through timely payments

Enterprises managing multiple clients and transactions efficiently

This feature resolves common problems such as late payments and misplaced invoices. By automating your invoicing process, you save time and reduce errors, allowing you to focus on growing your business. With the Safeguard Period Invoice feature, you ensure that your invoicing is professional, timely, and hassle-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you guarantee a payment?

Use a Contract. If you do nothing else: write a legally binding contract for you and the client to sign. Demand a Deposit. Always demand an up-front deposit. Contact the Right People. Find out who invoices should be addressed to. Use a Work Acceptance Document. Withhold Launch Until the Final Payment.

How do you ensure payment from clients?

Don't extend credit automatically to new customers/clients. Take partial payment in advance. Invoice promptly. State payment terms visibly and clearly. Reward customers for paying promptly. Establish a follow-up procedure for customers who miss payments.

How do you ensure clients pay on time?

Maintain great client relationships. Invoice on time. Use cloud-based services. Switch to a retainer-based model. Write the payment terms in the contract, including late fees. Ask for upfront payments.

How do you retrieve payment from a client?

Be mentally prepared. Follow up. Start by sending a reminder letter. Next, make a phone call. Don't threaten the client or get angry. Take legal action. Consider taking your customer to court or hiring a collection agency.

What is a bank guarantee and how does it work?

A bank guarantee is when a lending institution promises to cover a loss if a borrower defaults on a loan. The guarantee lets a company buy what it otherwise could not, helping business growth and promoting entrepreneurial activity. There are different kinds of bank guarantees, including direct and indirect guarantees.

What is the process of bank guarantee?

Under a bank guarantee, if the buyer is unable to make the payment to the seller or creditor, then the bank pays the fixed amount to the seller as the obligations of the contract are not met. On the other hand, under a letter of credit, the bank makes the payment to the seller once he or she delivers.

Who is the beneficiary in a bank guarantee?

The beneficiary is the one to who takes the guarantee. And the applicant is the party who seeks the bank guarantee from the bank. BGS are an important banking arrangement and play a vital role in promoting international and domestic trade. The bank issues BG on the receipt of the request from the applicant.

Why do we need bank guarantee?

The Importance of Bank Guarantees A bank guarantee is essentially a promissory provision on a loan indicating that if the borrower of the loan defaults on repayment, the bank will cover the amount of default. This is a crucial provision to convince multiple companies to work together to complete a long-term project.

Ready to try pdfFiller's? Safeguard Period Invoice

Upload a document and create your digital autograph now.