Safeguard Wage Notification For Free

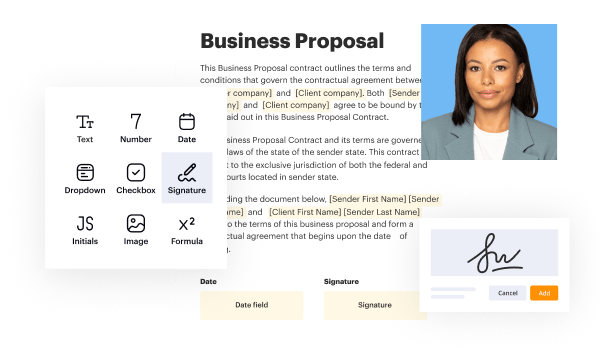

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

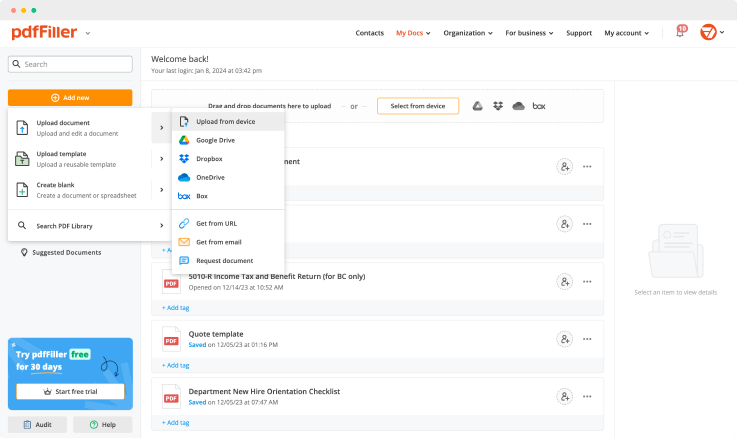

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

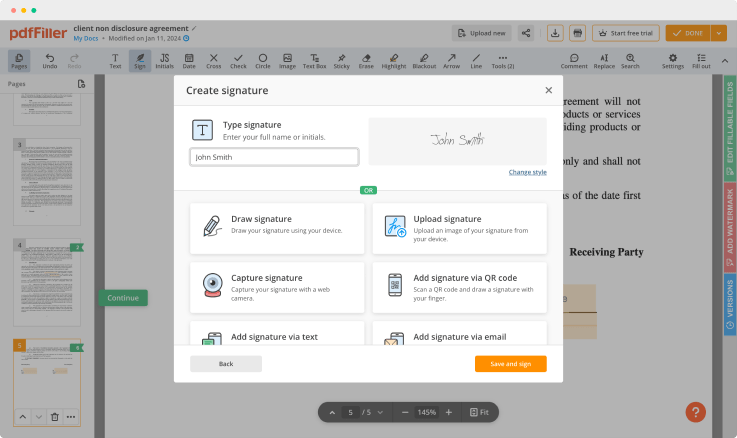

Generate your customized signature

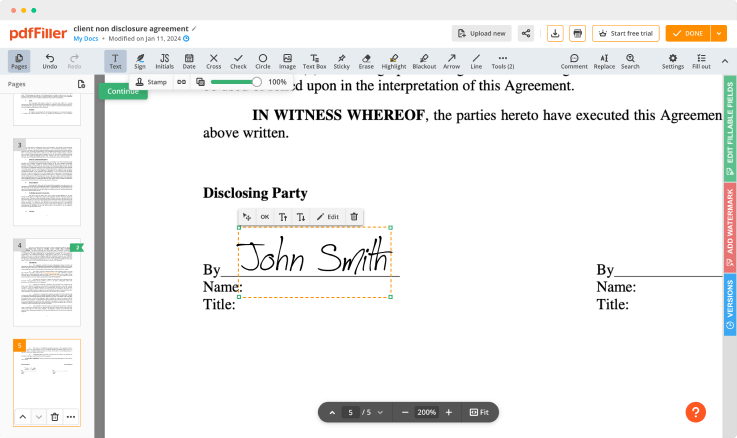

Adjust the size and placement of your signature

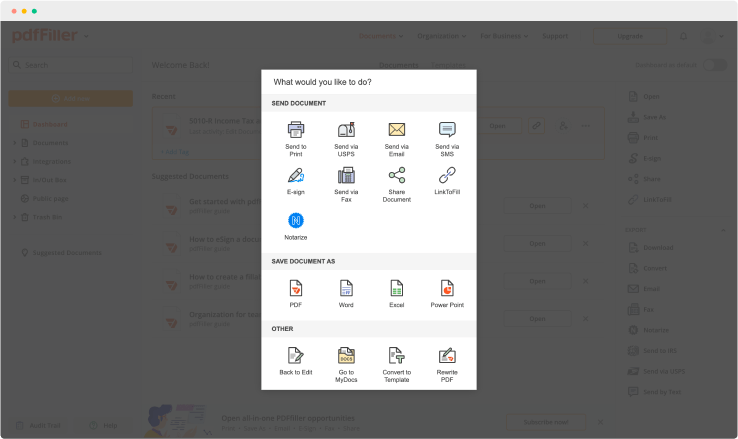

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Safeguard Wage Notification Feature

The Safeguard Wage Notification feature provides you with a reliable system for tracking wage updates. Designed for both employers and employees, this feature ensures everyone stays informed about wage changes promptly and efficiently.

Key Features

Instant notifications for wage changes

Customizable settings for frequency and type of alerts

User-friendly interface for easy access

Secure data handling to protect sensitive information

Integration with payroll systems for seamless updates

Potential Use Cases and Benefits

Employers can keep their teams informed on salary increases, bonuses, or deductions

Employees can track their wages and understand changes in real-time

HR departments can use notifications to ensure compliance with legal requirements

Teams can improve their financial planning with clear insights into wage adjustments

Organizations can enhance their communication strategies with timely wage updates

This feature resolves the common issue of delayed wage information. By using Safeguard Wage Notification, you eliminate confusion and ensure that everyone is on the same page regarding wage matters. You foster transparency, build trust within your team, and ultimately improve workplace satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a wage theft prevention notice?

What is the Wage Theft Prevention Act? California's Wage Theft Prevention Act of 2011 (WPA) went into effect on January 1, 2012, and requires that all employers provide each non-exempt employee with a written notice containing specified information regarding their pay and other benefits.

What states require wage theft prevention?

In addition to California, New York, Alaska, Connecticut, Delaware, Hawaii, Illinois, Iowa, Louisiana, Maryland, New Hampshire, North Carolina, Pennsylvania, South Carolina, Utah, and West Virginia have enacted similar legislation.

Is wage theft a felony?

Wage Theft Laws. At least 10 states now allow workers to put a lien on an employer's property in connecting with a wage claim, with New York closing in on its own bill. Meanwhile, Colorado this year made wage theft a felony if the amount is more than $2,000.

Is wage theft a criminal?

The Labor Commissioner's Office inspects workplaces for wage and hour violations, adjudicates wage claims, and investigates retaliation complaints. Wage theft is a crime the Labor Commissioner's Office can partner with other law enforcement agencies to criminally prosecute employers that engage in wage theft.

What states have wage theft laws?

Only five states Arizona, California, Florida, New York, and Oregon and the District of Columbia have wage-theft-related retaliation protection laws containing the most basic elements for an effective law.

How common is wage theft?

68% Of Workers Hurt By Wage Theft, Study Finds 68% experienced at least one wage violation. 26% of workers had been paid less than minimum wage. 60% of workers had been underpaid by more than $1 per hour. 76% of workers who were eligible for overtime weren't paid the correct rate.

What is payroll theft?

Wage theft is the denial of wages or employee benefits rightfully owed to an employee.

What is a notice to employee?

The law requires that the notice contain the employer's “doing business as” names, and that it be provided at the time of hiring and within 7 days of a change if the change is not listed on the employee's pay stub for the following pay period.

Ready to try pdfFiller's? Safeguard Wage Notification

Upload a document and create your digital autograph now.