Scetch Wage Form For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

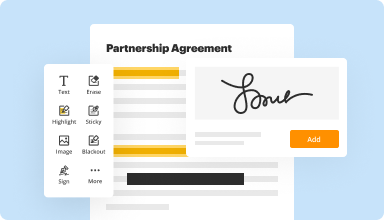

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

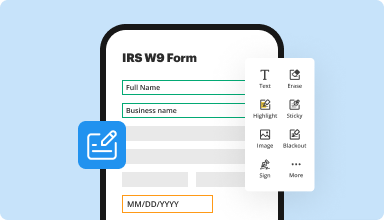

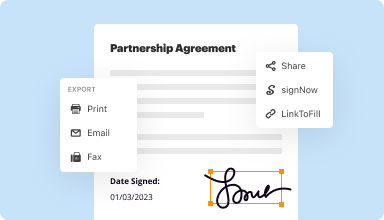

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

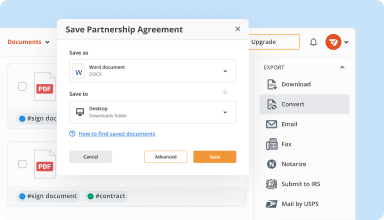

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

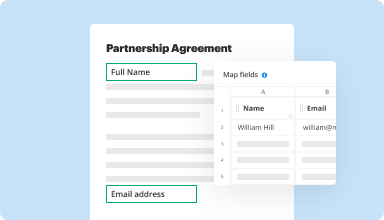

Collect data and approvals

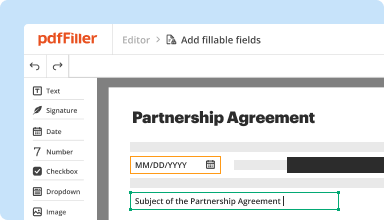

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

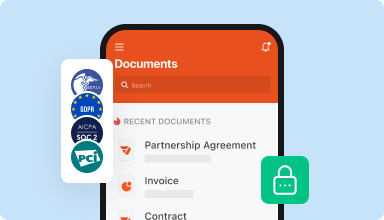

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

The forms are easier to provide typed information into rather than trying to write it in and not having enough space. It's also easier to delete and correct mistakes rather than try using white-out with ink pen entry.

2014-08-25

Works great with laptop, but Was time consuming and difficult to work on IPad. Had to switch to my laptop in order to speed up the process and complet the job.

2016-07-24

I have used the free trial twice. When I signed up for a $6 one month personal subscription I was billed $20USD. I have sent an email about this and hope to have it resolved.

2016-10-18

Great application. Only slight problem with address box, press the <enter> ket 3 or 4 times after filling sender address to keep it from printing over instructions in box immediately beneath.

2017-01-31

I cut off the bottom part of the document. I'm trying a reprint, now and will select "fit to page" on my printer preferences to see if that works.

2018-03-19

This is an excellent way to file claims. I print through the mobile app because it is so convenient. I am getting good results with claim processing. This is a good tool for my office.

2019-08-06

i have had a great experience so far

it is much easier to file medical claim forms than having to buy that specific software

i like how easy it is to import documents. I also like the ease of sharing, printing and storing documents

Really the only thing i do not particularly care for is the difficulty adding the individual box for editable fields

2017-11-14

Easy to Use

It's been fantastic to use to add whole sections into a document without having to re-do everything.

We haven't required something like this often, so I love that I can access this software for free, on an as-needed basis.

Haven't needed to use the software enough to have any issues arise that I couldn't troubleshoot on my own.

2021-06-10

This has been a great tool for me

This has been a great tool for me. Trying to apply for a new apartment has been difficult due to the quarantine but this allowed us to sign and fill out whatever we need with little interaction with others. The 30 day fee trial was great for me and I will recommend this to anyone who might need it.

2020-05-05

Scetch Wage Form Feature

The Scetch Wage Form feature simplifies wage tracking and management for businesses. With this tool, you can easily collect, organize, and analyze employee wage information, helping you work more efficiently.

Key Features

User-friendly interface for easy data entry

Customizable forms to fit your specific needs

Automatic calculations for accurate wage totals

Secure data storage for compliance and safety

Integration with popular payroll systems

Potential Use Cases and Benefits

Streamlining wage reporting for payroll departments

Enhancing accuracy and reducing errors in wage calculations

Simplifying compliance with labor laws and regulations

Facilitating transparent communication between employers and employees

Improving time management with automated processes

By implementing the Scetch Wage Form feature, you tackle wage management challenges directly. This tool helps you save time, reduce confusion, and ensure accurate records. With better organization and easy access to wage data, you can focus more on growing your business and supporting your team.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is draw salary?

Draw against commission is a salary plan based completely on an employee's earned commissions. An employee is advanced a set amount of money as a paycheck at the start of a pay period. At the end of the pay period or sales period, depending on the agreement, the draw is deducted from the employee's commission.

What does a salary draw mean?

A draw is an amount of money the employee receives for a given month before his monthly sales figures are calculated. After the employee's sales figures for the month are calculated, the employee may keep any amount of commission he earns that exceeds the draw amount.

What is a draw in terms of salary?

Draw against commission is a salary plan based completely on an employee's earned commissions. An employee is advanced a set amount of money as a paycheck at the start of a pay period. At the end of the pay period or sales period, depending on the agreement, the draw is deducted from the employee's commission.

Is a draw considered a salary?

A draw is not a salary, but rather regular payouts instead of periodic ones. For example, an employee receives a draw of $600 per week, and you give out the remaining commissions at the end of every month. When you give the employee their draw, subtract it from their total commissions.

What does draw plus commission mean?

Overview of a Commission Draw If his commission for the draw period is equal to or higher than the draw, he earns the commission. If the commission is lower than the draw, he earns the commission plus an additional amount that brings his earnings to the draw amount.

How does a forgivable draw work?

1. Salary: You receive a monthly amount and commissions are paid on top of it. Forgivable Draw: You receive a monthly amount and if you make more than that amount in commissions, it gets deducted from the commission check. Each month you start fresh, meaning there isn't a rolling balance from previous months.

What is a draw vs salary?

Salary is direct compensation, while a draw is a loan to be repaid out of future earnings. A draw is usually smaller than the commission potential, and any excess commission over the draw payback is extra income to the employee, with no limits on higher earning potential.

Is it better to pay yourself a salary or dividends?

Dividends are taxed at a lower rate than salary, which can result in paying less personal tax. Dividends can be declared at any time, allowing you to optimize your tax situation. Not having to pay into the CPP can save you money. Paying yourself with dividends is comparatively simple.

#1 usability according to G2

Try the PDF solution that respects your time.