Secure Amount Title For Free

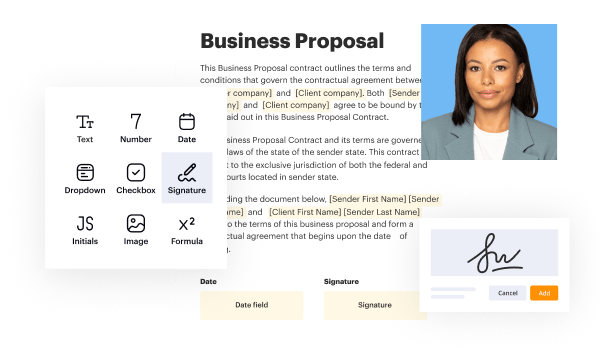

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

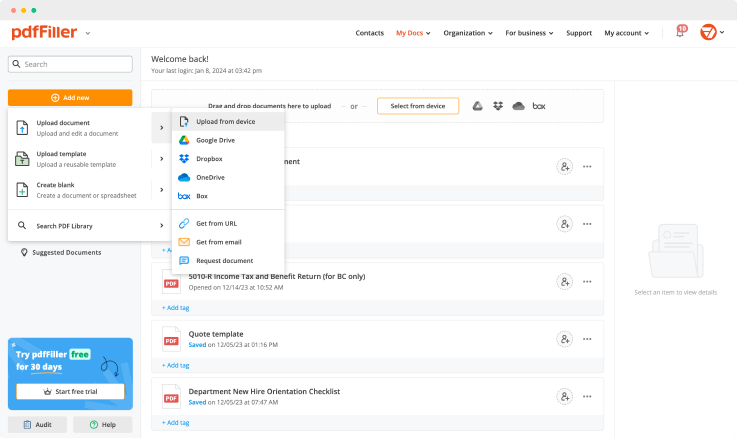

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

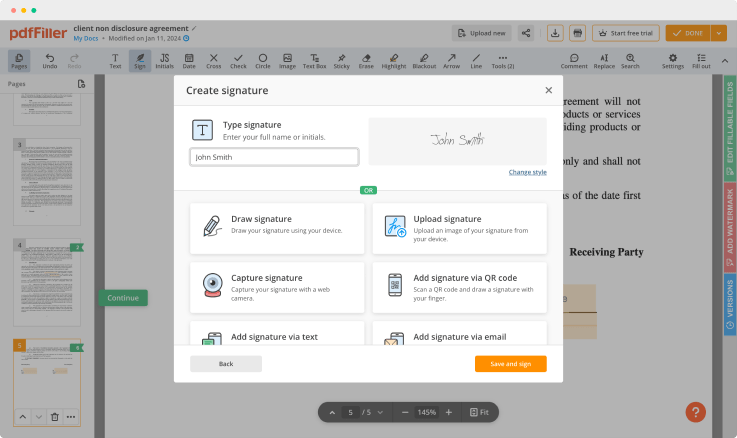

Generate your customized signature

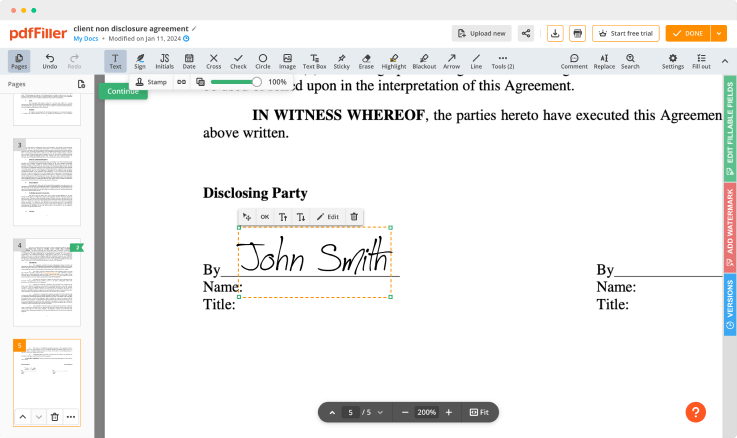

Adjust the size and placement of your signature

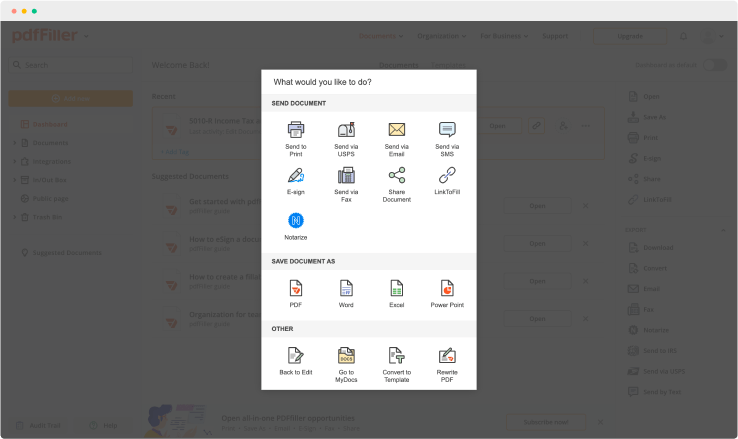

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Secure Amount Title Feature

The Secure Amount Title feature allows you to manage your financial information securely and easily. It provides assurance and peace of mind as you navigate through transactions. Whether you are a business owner, a freelancer, or someone looking to keep their financial data organized, this feature can significantly enhance your experience.

Key Features

Secure storage of financial information

User-friendly interface for easy access

Real-time updates on your financial status

Customizable settings to fit individual needs

Comprehensive data protection measures

Potential Use Cases and Benefits

Business owners can track transaction histories effortlessly

Freelancers can keep client payments organized

Individuals can manage personal savings and expenses

Financial advisors can streamline client account management

E-commerce platforms can secure customer payment data

By using the Secure Amount Title feature, you solve common problems like data breaches, disorganization, and lack of transparency in your financial dealings. With its reliable system, you can focus on what truly matters: growing your business, managing your finances, and gaining insights that lead to better decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Do you really need owner's title insurance?

That insurance just protects the bank. Don't rely on the title insurance the lender buys. You need your own. Lenders require you to purchase lender's title insurance. Owner's title insurance, on the other hand, is the only thing that may offer protection if someone files suit with a claim to the deed.

Is owner's title insurance optional?

The reality is that there is no law that requires you to purchase an owner's title insurance policy when you purchase real estate. If you're going to have a mortgage, your lender will require you to purchase a lender's title insurance policy to protect their interests, but the owner's policy is still optional.

Is an owner's title insurance policy necessary?

Title insurance coverage usually depends on whether you have a lender's or an owner's policy. Generally, you need to buy a lender's policy if you take out a loan from a public mortgage lender. An owner's policy is often issued for the amount you paid for the home. It covers a broad range of problems that may arise.

Why do you need an owner's title policy?

Owner's title insurance provides protection to the homeowner if someone sues and says they have a claim against the home from before the homeowner purchased it. Most lenders require you to purchase a lender's title insurance policy, which protects the amount they lend.

Who pays owner's title insurance?

Owner's title insurance is a separate policy where either the buyer or seller may pay the insurance premiums to protect the buyer's equity in the property.

Why do I need title insurance?

The actual mortgage lender needs title insurance to protect themselves against a home's defects or potential disputes between buyer and seller that could result in the lender suffering financial loss before the home sales transaction is completed.

Do you really need title insurance?

Why Do You Need Title Insurance? Purchasing lender's title insurance is a mandatory part of the mortgage process. However, it's often a good idea to buy title coverage for yourself as the homeowner. Title insurance can compensate you for damages or legal costs in a variety of situations.

Why do I need owner's title insurance?

What Is Owner's Title Insurance? Owner's title insurance is a policy you take out on the deed of your home. It protects you from someone popping up out of the blue and challenging your ownership of a property because of an event involving a previous owner. This is not like your home or auto insurance coverage.

Ready to try pdfFiller's? Secure Amount Title

Upload a document and create your digital autograph now.