Secure Title Letter For Free

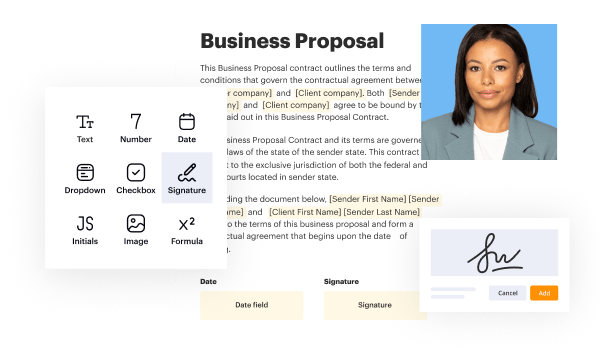

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

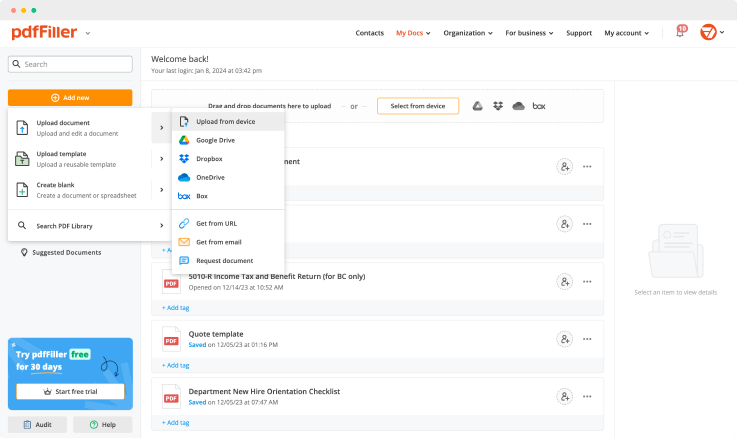

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

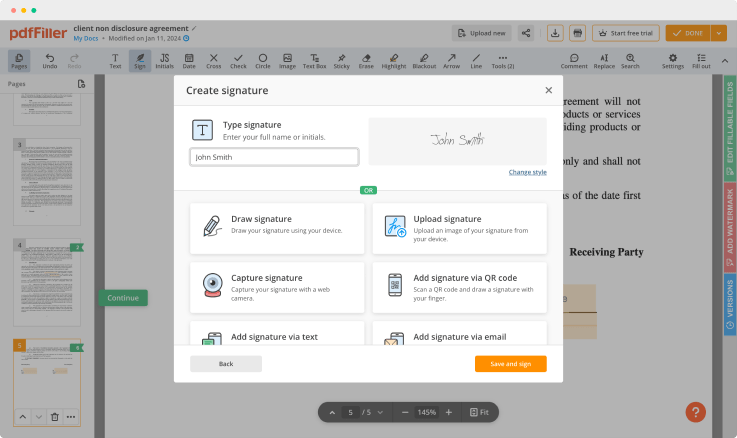

Generate your customized signature

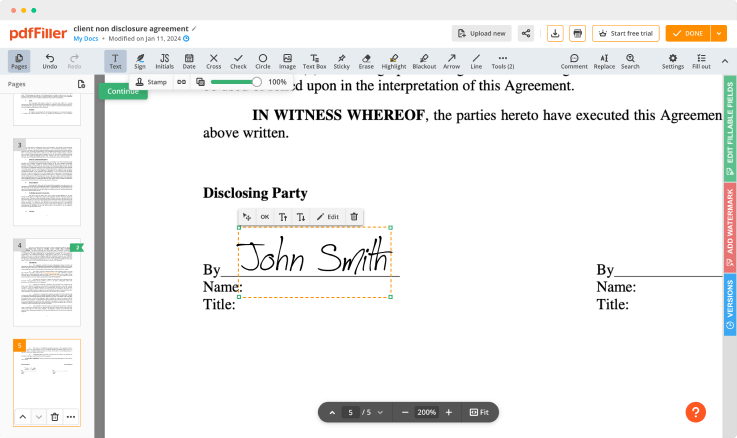

Adjust the size and placement of your signature

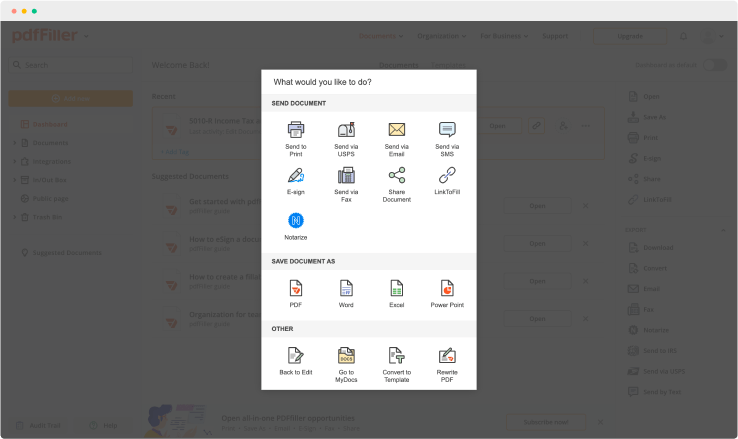

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

Video Review on How to Secure Title Letter

when you've finished editing your document click on the drop-down next to the done button and select email you will be redirected to the email settings page on the right side of the screen you can view a preview of the document or select specific document pages for sending and exclude any unnecessary ones in the add recipients section indicate recipient email addresses or choose them from your address book tick send me a copy if you want to receive a copy of the document in the documents you are sending via email section click add another document to attach more documents in the select format section choose a document format supports pdf word excel powerpoint and image formats in the personalize your message section customize a welcome message for your document or use one of the three templates casual formal and informal if needed change the subject and body of the message and attach a business card with your contact information in the next section you can set notifications for when your document is open finally protect your document with a password to prevent it from unauthorized access this option is only available for pdf files you

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Secure Title Letter Feature

The Secure Title Letter feature provides peace of mind for property transactions. It helps you verify ownership and ensures that your investment is secure. With this feature, you can confidently navigate the complexities of real estate with clarity.

Key Features

Instant verification of property ownership

Seamless access to title documents

Detailed history of property transactions

User-friendly interface for easy navigation

Secure storage for sensitive documents

Use Cases and Benefits

Ideal for homebuyers seeking to verify property details

Useful for real estate agents managing multiple transactions

Entertaining for investors to assess property value history

Essential for title companies ensuring accuracy in documentation

Critical for anyone facing property disputes

This feature addresses common challenges in real estate, including uncertainty about property ownership and potential disputes. By offering clear, verified information, the Secure Title Letter feature empowers you to make informed decisions. Whether you are buying, selling, or investing in property, you can feel confident that you have the necessary tools to protect your interests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

WHO issues a closing protection letter?

A closing protection letter is essentially an agreement from a title insurance company to a lender that indemnifies the lender against any issues arising from a closing agent's errors, fraud or negligence.

Who provides closing protection letter?

A closing protection letter is essentially an agreement from a title insurance company to a lender that indemnifies the lender against any issues arising from a closing agent's errors, fraud or negligence.

Does a seller need a closing protection letter?

A law requiring a title insurer to issue Closing Protection Letters to buyer, seller and lender in a sale, or to both lender and borrower in a refinancing loan, gives protection to people who cannot get that protection today because they are not insureds. Those parties are the seller and the refinancing borrower.

What is a closing protection letter?

A closing protection letter is a contract between a title insurance underwriter and a lender. In this agreement, the underwriter agrees to indemnify the lender for actual losses caused by certain kinds of misconduct by the closing agent.

How much does a closing protection letter cost?

The Closing Protection Letter fee is $25 for each party protected. More specifically, $25 for a Lender CPL when there is a mortgage in either purchase or refinance transactions. $25 for a Buyer CPL in all purchase transactions.

What is offer of closing protection coverage?

A Closing Protection Letter or CPL is offered before closing to protect lenders against unauthorized actions by settlement agents or failure to comply with the terms of the lender's closing instructions.

Does a buyer need a closing protection letter?

A law requiring a title insurer to issue Closing Protection Letters to buyer, seller and lender in a sale, or to both lender and borrower in a refinancing loan, gives protection to people who cannot get that protection today because they are not insureds. Those parties are the seller and the refinancing borrower.

Ready to try pdfFiller's? Secure Title Letter

Upload a document and create your digital autograph now.