Trace Recommended Field Warranty For Free

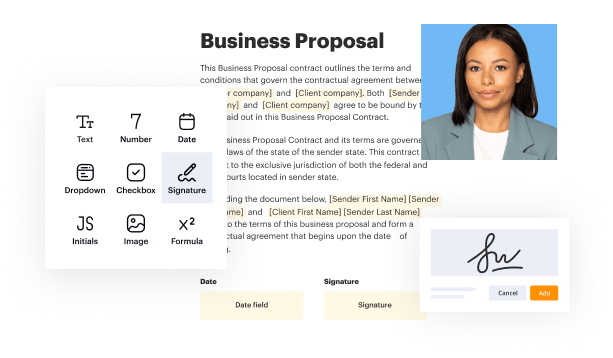

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

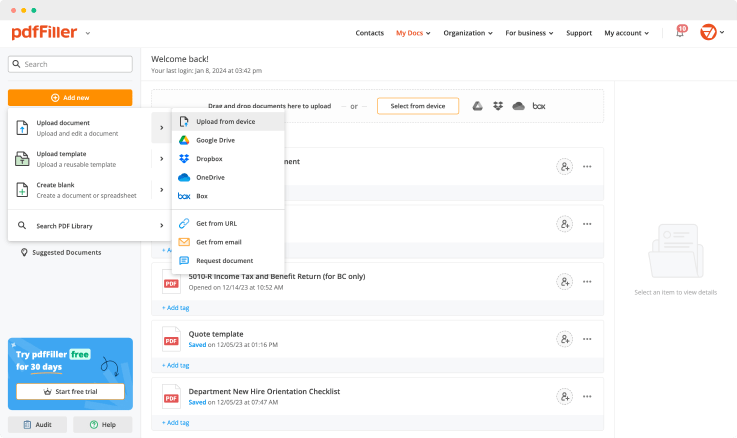

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

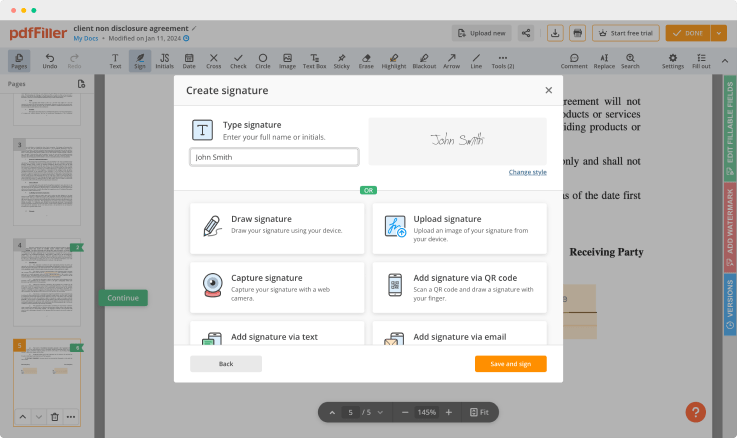

Generate your customized signature

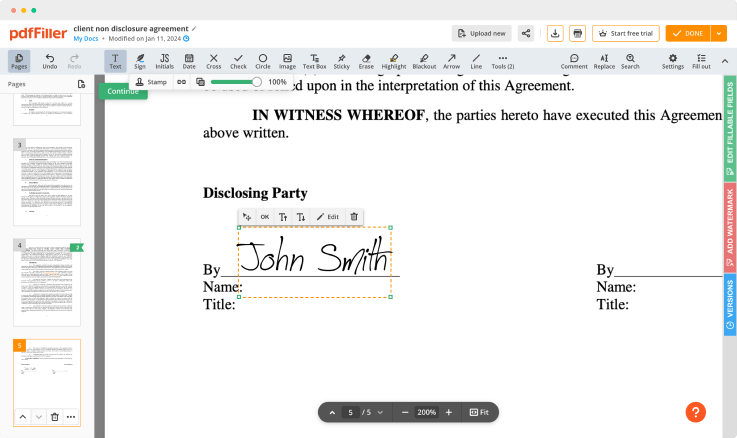

Adjust the size and placement of your signature

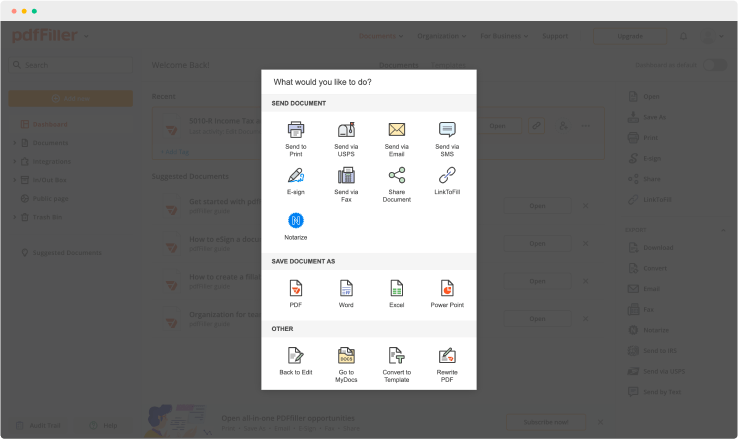

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Trace Recommended Field Warranty Feature

The Trace Recommended Field Warranty feature is designed to provide you with peace of mind and protection for your investments. This feature ensures that you receive the best support and coverage available, so you can focus on your work with confidence.

Key Features

Comprehensive coverage for hardware and software issues

Quick response times to support inquiries

Easy claim process with straightforward guidelines

Access to expert technicians for troubleshooting

Regular updates on warranty status and coverage

Potential Use Cases and Benefits

Protect your equipment from unforeseen technical failures

Reduce downtime by ensuring timely repairs

Gain valuable insights from expert support during critical moments

Enhance operational efficiency with minimal interruptions

Increase the lifespan of your equipment with consistent maintenance

With the Trace Recommended Field Warranty feature, you can confidently navigate potential problems that could disrupt your workflow. By securing the right warranty, you minimize risks and ensure that your operations run smoothly. This focus on protection allows you to undertake tasks and projects without unnecessary worry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How is warranty period calculated?

Divide the amount of your actual warranty claims in the most recent year by your total sales in the same year to calculate your warranty claims as a percentage of sales. For example, if you had $1,600 in warranty claims and $80,000 in sales, divide $1,600 by $80,000.

How is warranty expense calculated?

Warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of goods that it has sold. Accrue the warranty expense with a debit to the warranty expense account and a credit to the warranty liability account.

How is warranty cost calculated?

Total number of units sold X Percentage of units that are defective. Units needing repair or replacement X cost per unit to repair or replace. 14 water bottles x $4 per water bottle = $56 cost of inventory.

What type of expense is warranty?

Definition: Warranty expense is the cost associated with a vendor or manufacturer's commitment to repair or replace a product, should it not perform as intended during a specified period of time. In other words, it's the cost of repairing or replacing defective products after they have been sold to customers.

Is warranty an expense or cogs?

The costs associated with a manufacturer's product warranty are part of its selling expenses and therefore part of its SGA expenses. If the future costs of the warranty coverage are probable and can be estimated, they are recorded at the time of the sale.

Why should a company accrue warranty expense?

If the company can reasonably estimate the amount of warranty claims likely to arise under the policy, it should accrue an expense that reflects the cost of these anticipated claims. If the amount of warranty expense recorded is significant, expect the company's auditors to investigate it.

Where is warranty expense on the income statement?

The expense should be reported on the income statement at the time that the sale of the product is reported in order to comply with the matching principle. A related account, Warranty Payable or Warranty Liability is also established at the time of the sale.

Is warranty cost an expense?

Warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of goods that it has sold. Accrue the warranty expense with a debit to the warranty expense account and a credit to the warranty liability account.

Ready to try pdfFiller's? Trace Recommended Field Warranty

Upload a document and create your digital autograph now.