How to sign a document online?

Why sign documents with pdfFiller?

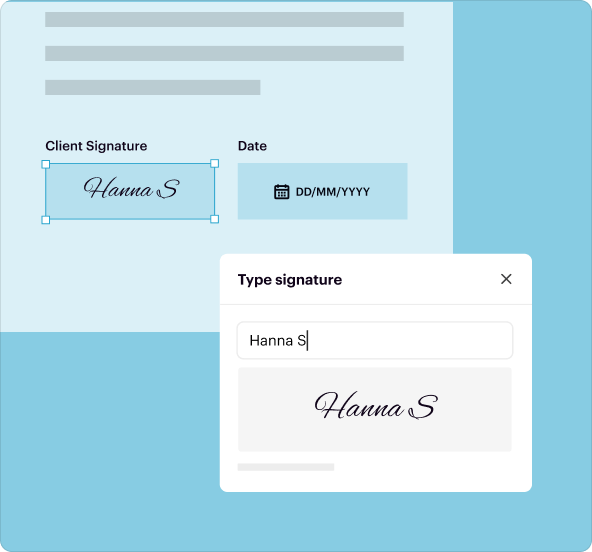

Ease of use

More than eSignature

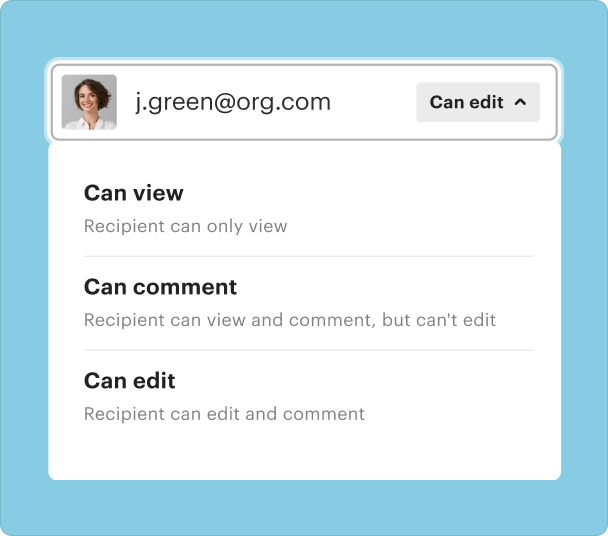

For individuals and teams

pdfFiller scores top ratings on review platforms

Watch pdfFiller eSignatures in action

Upload Email Signature 1040 Form

Using eSignature for your 1040 Form

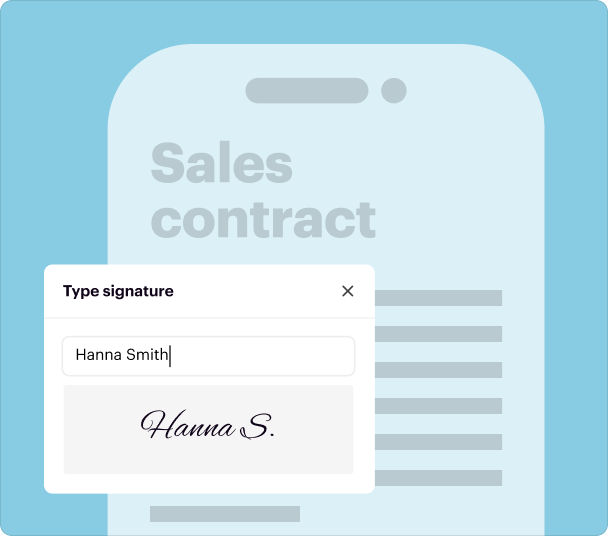

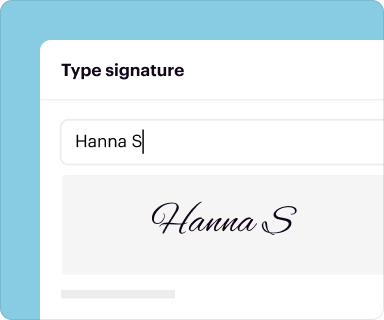

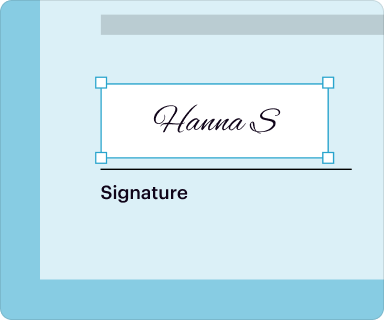

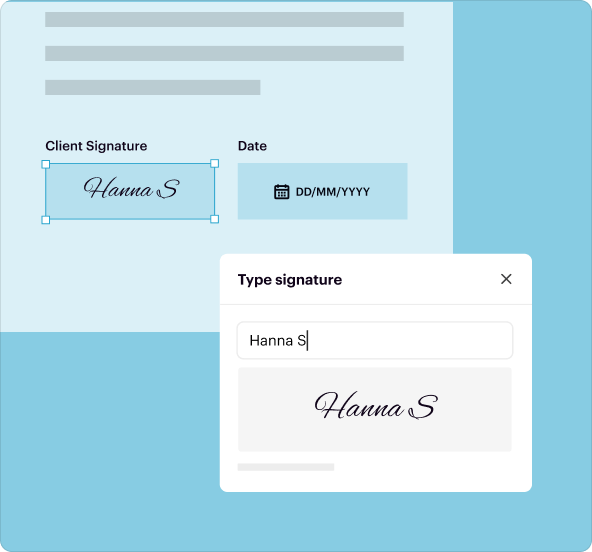

Streamline your tax filing experience by uploading your email signature directly to your 1040 Form using pdfFiller’s eSignature feature. This tool allows you to securely and efficiently sign important tax documents without the need for physical printing. With just a few clicks, you can ensure your forms are signed and submitted on time.

The process of using pdfFiller’s eSignature feature means you can manage your documents online from anywhere. This flexibility not only saves you time but also reduces stress when it comes to handling your taxes. Plus, because it’s fully cloud-based, there's no need for downloads or additional subscriptions.

Benefits of uploading your email signature to the 1040 Form

-

1.Convenient online access to your documents.

-

2.No need for paper, printing, or scanning.

-

3.Collaborate with tax professionals easily.

-

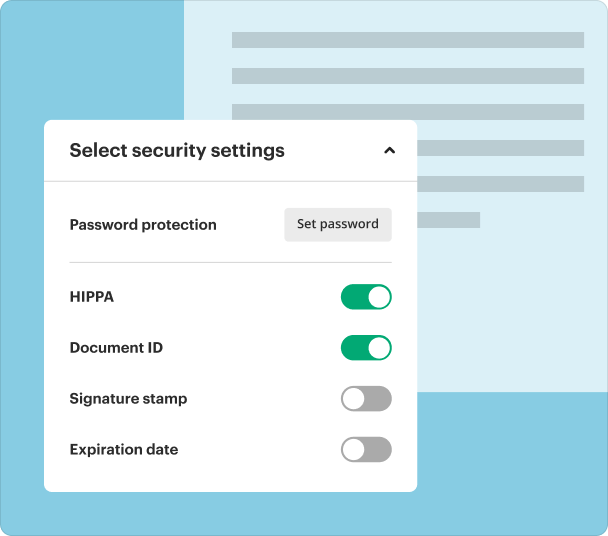

4.Sign with confidence using secure encryption.

Incorporating eSignatures into your tax documents brings significant advantages. The ability to upload your email signature for the 1040 Form enhances security and ensures compliance with IRS requirements. As you prepare your taxes, consider the added benefits of using pdfFiller’s eSignature feature for a seamless experience.

Practical examples of eSigning your 1040 Form

For individuals and businesses alike, using the eSigning feature means you can submit your forms faster. Whether you're updating information with the IRS or filing for an extension, the process remains efficient. ESigning allows for quick adjustments and communication between you and your accountant, enhancing transparency.

The ease of uploading your email signature to the 1040 Form is just one example of how pdfFiller simplifies document management. As you embrace modern solutions for your financial responsibilities, let pdfFiller enhance your eSigning experience.

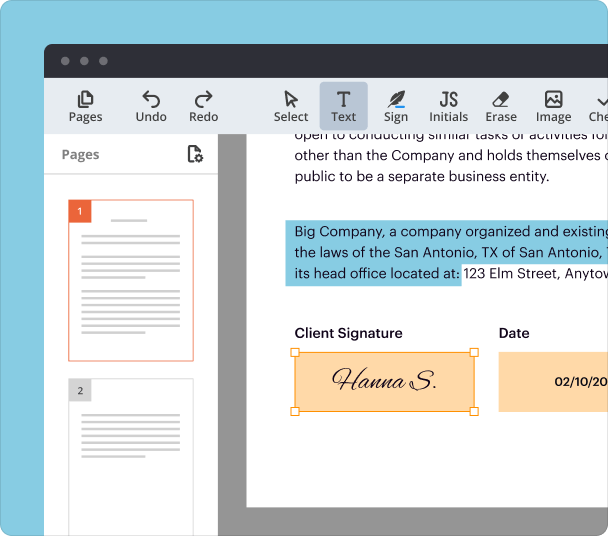

Editing a PDF with pdfFiller

Steps for editing your PDF

-

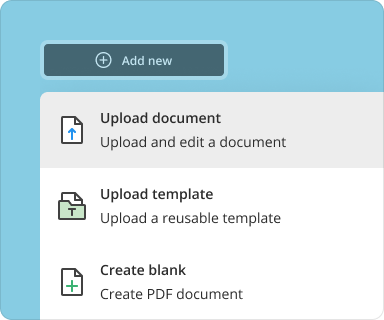

Drag and drop your document into the upload area at the top of the page

-

Select the Upload Email Signature 1040 Form option in the editor menu

-

Edit your document as needed

-

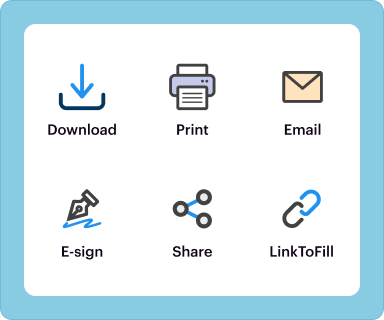

Click the orange 'Done' button located at the top right corner

-

Rename the document if you wish

-

Print, share, or save the file to your computer

Start using pdfFiller today for all your PDF editing needs.