Fill out your Irs Free Form for Phone Companies with pdfFiller

Break free from papier with pdfFiller

Thousand of positive reviews can't be wrong

The easiest way to fill out Irs Free Form for Phone Companies

Making contributions through your taxes and declaring them is the duty of every citizen. Residents and non-residents employed in the country need to provide information-dense documentation declaring their revenues to the IRS within a distinct time frame. Doing this manually is time-taking and subject to error. As a result, people prefer completing Irs Free Form for Phone Companies electronically.

There are a lot of options for completing these reports electronically. Some online editors only offer simple tools, while others provide you with more flexibility and features to work with. pdfFiller is the right solution to use not only for declaring earnings and reporting on withholdings but also for managing professional and personal documentation.

Reasons to choose pdfFiller to fill out Irs Free Form for Phone Companies

During the last decade, pdfFiller has been trusted by millions of users because of its bank-level security, intuitiveness, and powerful functionality. As to preparing and filing tax returns, it is an essential tool for the following reasons:

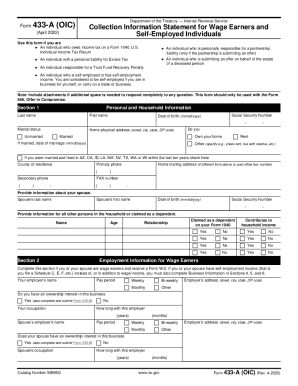

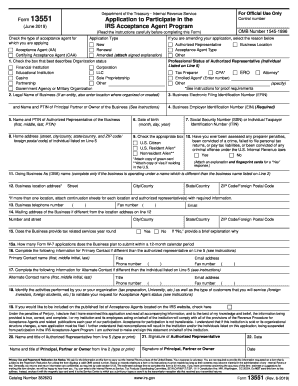

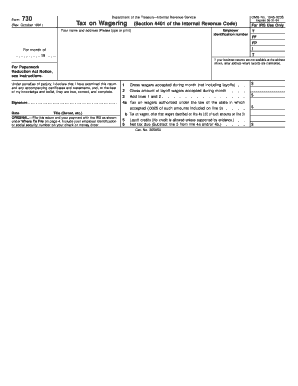

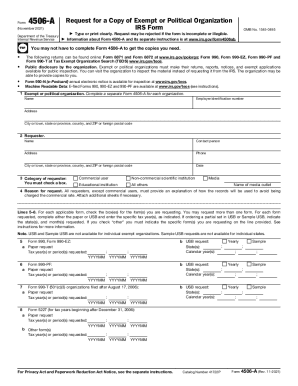

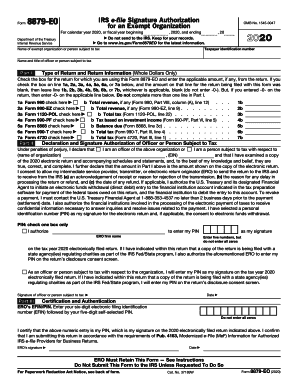

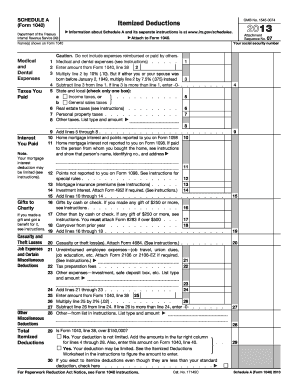

What Irs Free Form for Phone Companies can I find in pdfFiller?

Our form catalog provides users with all up-to-date formal templates for different professional areas, including Irs Free Form for Phone Companies and formal documents for previous tax years. We’ve gathered all the IRS reporting templates, such as Irs Free Form for Phone Companies, all in one place. And with one click, you can upload them to the editor to complete your documents quickly and efficiently. Try pdfFiller today!