Simple Loan Application Form - Page 2

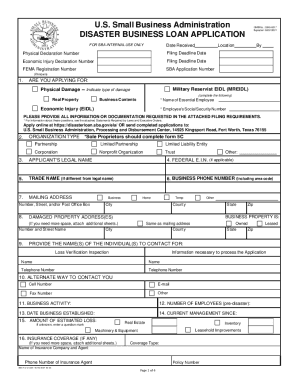

What is Simple loan application form?

A Simple loan application form is a document used by individuals to apply for a loan from a financial institution. This form typically includes personal information, employment details, income statements, and the desired loan amount.

What are the types of Simple loan application form?

There are several types of Simple loan application forms depending on the type of loan being applied for. Some common types include:

Personal loan application form

Mortgage loan application form

Business loan application form

Auto loan application form

How to complete Simple loan application form

Completing a Simple loan application form is a straightforward process that can be broken down into the following steps:

01

Gather all necessary documents such as ID, proof of income, and bank statements

02

Fill in personal information accurately and completely

03

Provide details about employment history and current income

04

Specify the desired loan amount and purpose of the loan

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Simple loan application form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a loan application form?

A loan application form is a document used by banks to collect the relevant information from a potential borrower when applying for a loan.

What do I write when applying for a loan?

The loan application letter format is generally six paragraphs long, with each major topic discussed in a separate paragraph. The content includes the loan amount requested, a description of your business, the purpose of the loan, target market and competition, and the amount you have invested in your business.

How do I write a simple loan application?

How To Write A Loan Request Letter Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. Mention the purpose of the loan. Assure the lender of repayment. Closing the business loan request letter.

How do I write a simple loan request?

What You Need To Know About Writing A Loan Request Letter Basic Business Information. Purpose Of The Loan. Provide Repayment Assurance. Closing. Heading And Greeting. Summary of Your Business Loan Request Letter. Basic Information About Your Business. Description Of The Purpose Of The Loan.

How do you write a loan approval letter?

How to write this approval letter: Inform the reader that the loan has been approved. Discuss repayment terms. Offer assistance or a friendly comment, if you wish.

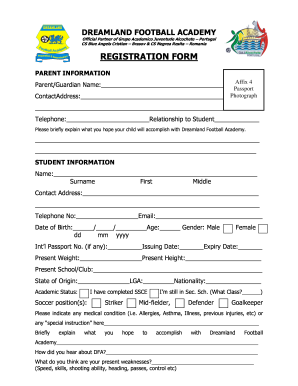

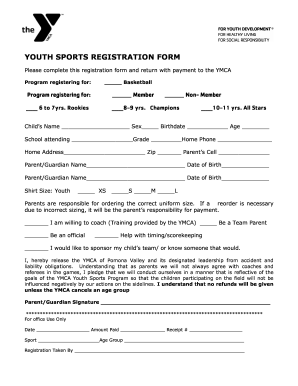

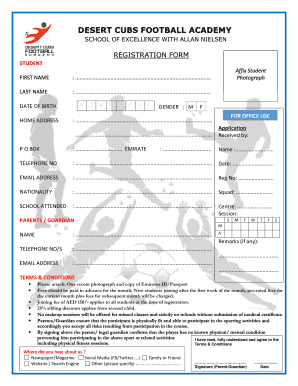

What is a personal loan application form?

Loan application forms are used to gather the following types of information: Personal details and contact information. Employment status and history. Current income and outgoings (especially related to dependents, child support, alimony, etc.)