Free Ach Authorization Form Template - Page 2

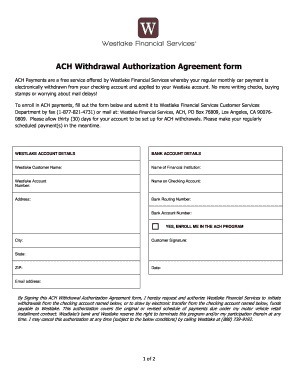

What is Free ach authorization form template?

The Free ach authorization form template is a document that allows you to authorize a payment to be deducted directly from your bank account through the Automated Clearing House (ACH) system. It serves as a convenient way to make recurring payments without the need for manual intervention each time.

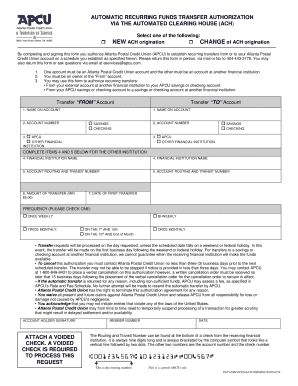

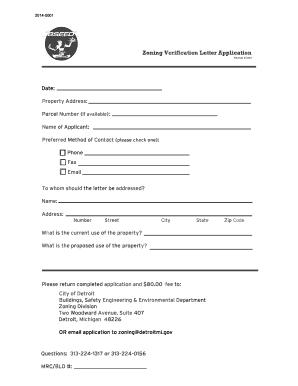

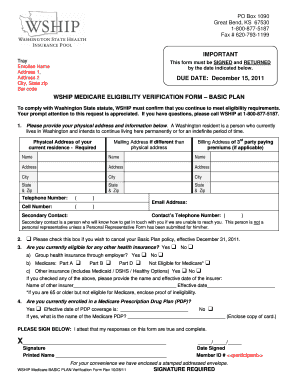

What are the types of Free ach authorization form template?

There are various types of Free ach authorization form templates available, each catering to different payment purposes. Some common types include:

How to complete Free ach authorization form template

Completing a Free ach authorization form template is a simple process that typically involves the following steps:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and securely.