Bank To Bank Transfer Agreement Templates

What are Bank to Bank Transfer Agreement Templates?

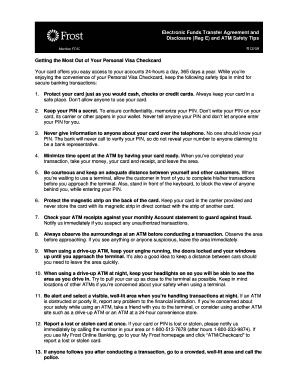

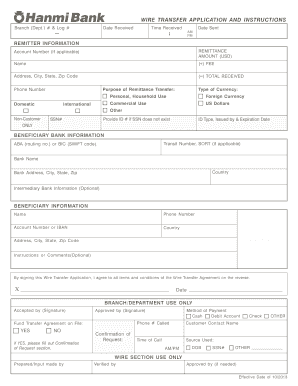

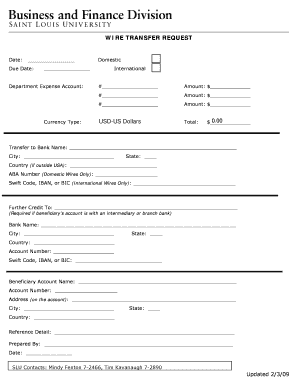

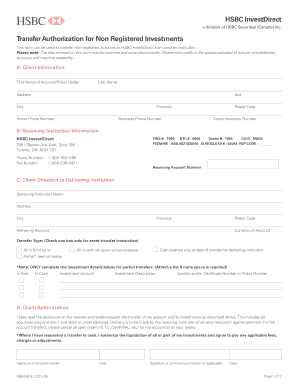

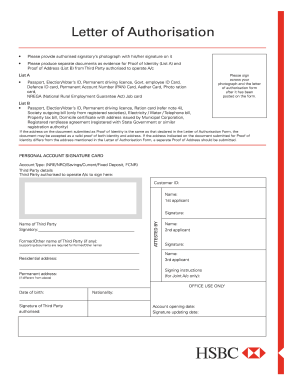

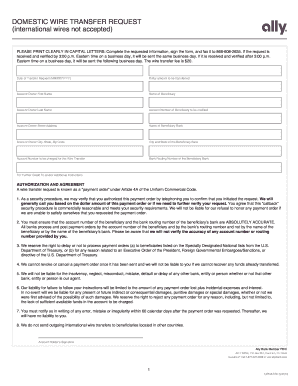

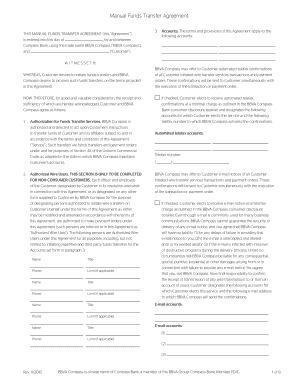

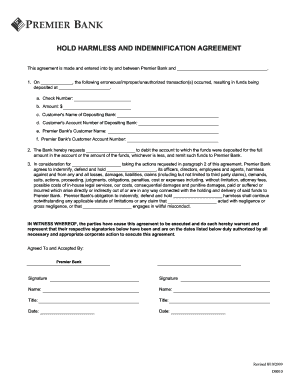

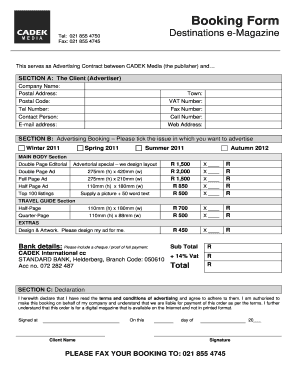

Bank to Bank Transfer Agreement Templates are standardized forms used by financial institutions to document the terms and conditions of transferring funds from one bank to another. These templates outline the agreement between the sender and receiver regarding the amount, timing, and other details of the transfer.

What are the types of Bank to Bank Transfer Agreement Templates?

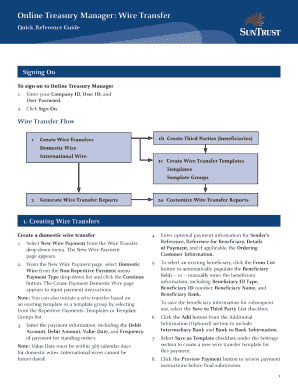

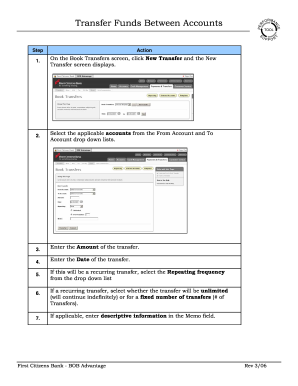

There are several types of Bank to Bank Transfer Agreement Templates available, including: 1. Domestic Transfer Agreement Template 2. International Transfer Agreement Template 3. Electronic Funds Transfer Agreement Template 4. Wire Transfer Agreement Template 5. ACH Transfer Agreement Template

How to complete Bank to Bank Transfer Agreement Templates

Completing a Bank to Bank Transfer Agreement Template is a straightforward process that involves the following steps: 1. Fill in the sender and receiver information 2. Specify the amount to be transferred 3. Include the date and time of the transfer 4. Sign and date the agreement for validation 5. Share the completed document with the receiving bank for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.