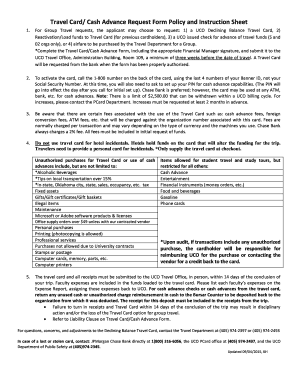

Cash Advance Request Form Pdf - Page 2

What is Cash advance request form pdf?

A Cash advance request form pdf is a standardized document used by individuals or employees to request a pre-determined amount of cash in advance of a future payment. It serves as a formal request for funds to cover expenses or urgent financial needs.

What are the types of Cash advance request form pdf?

There are several types of Cash advance request form pdf, including:

Employee Cash Advance Request Form

Business Cash Advance Request Form

Personal Cash Advance Request Form

How to complete Cash advance request form pdf

Completing a Cash advance request form pdf is easy and straightforward. Here are the steps to follow:

01

Fill in your personal or business information

02

Specify the requested amount of cash advance

03

Detail the reason for the advance request

04

Sign and date the form

05

Submit the completed form to the appropriate party for approval

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cash advance request form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is cash advance request form?

Purpose: The Request for Cash Advance form is used to request cash advances which will be issued at the discretion of the Financial Officer or Director of Finance & Business (hereafter FO). The Request for Cash Advance form is NOT to be used for travel advances.

What are 3 disadvantages of a cash advance?

Cons of Credit Card Cash Advances Cash Advance Fees. The credit card issuer will almost always charge you a fee just to take the money out. A Few Other Fees. High APR. Interest is Added Immediately. You Sacrifice Safety and Consumer Protections. It May Affect Your Credit Score. Lower Cash Advance Limits. No Rewards.

Do cash advances go on credit report?

A cash advance doesn't directly affect your credit score, and your credit history won't indicate you borrowed one. The cash advance balance will, however, be added to your credit card debt, which can hurt your credit score if it pushes your credit utilization ratio too high.

Do cash advances hurt credit?

A cash advance won't directly impact your credit scores, but it will use more of your available credit. This affects your credit utilization ratio. And depending on how much you borrow, that could lower your credit scores.

What is an example of a cash advance?

For example, if you take out $500 as a cash advance on a card with a 5% cash advance fee, you'll be charged $25 on top of the $500 loan. When you use a credit card for a purchase, most lenders give you a grace period to repay the balance before interest starts to accrue.

Are cash advances ever a good idea?

Taking out a cash advance may seem like a good idea in the moment, but it can quickly lead you to rack up debt. We recommend avoiding a cash advance altogether and opting for some alternative options that have better terms. Borrow from family or friends: You can ask family or friends for a loan.