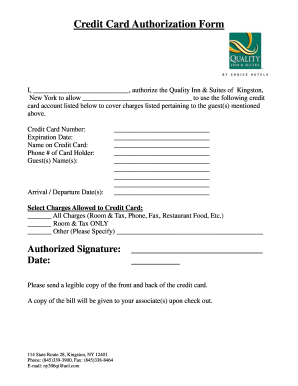

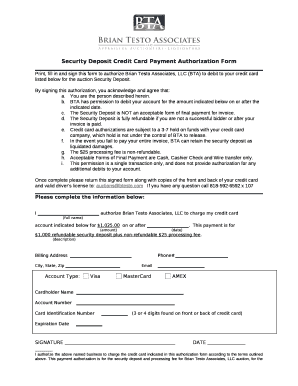

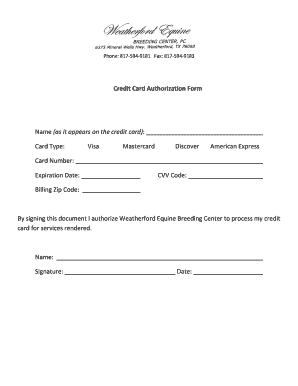

Credit Card Authorization Form Templates

What are Credit Card Authorization Form Templates?

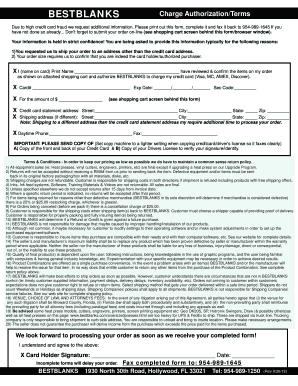

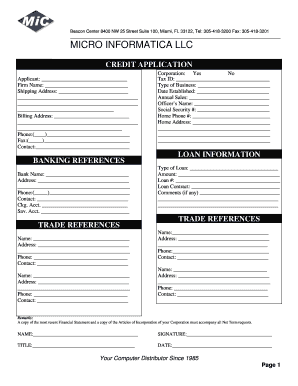

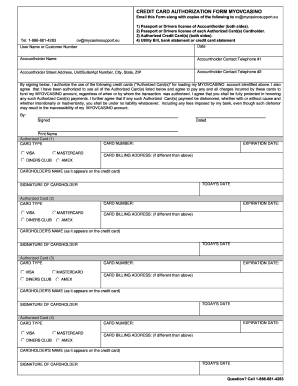

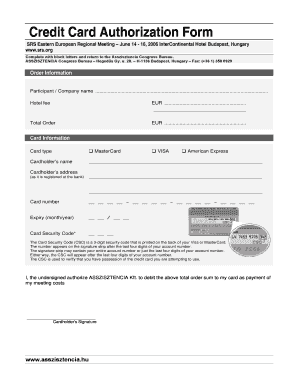

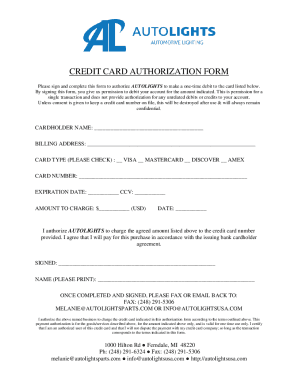

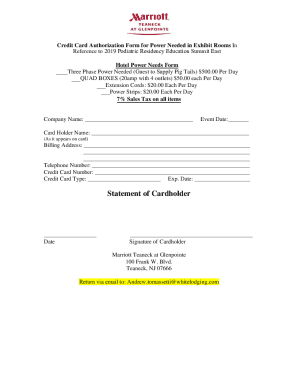

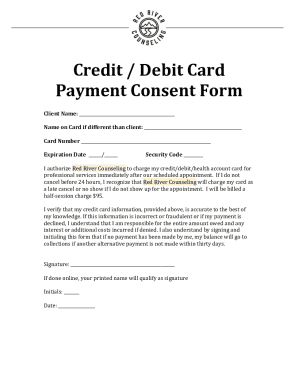

Credit Card Authorization Form Templates are pre-designed documents that individuals or businesses use to authorize the use of their credit card for specific transactions. These templates help streamline the process and provide a standardized format for capturing necessary information.

What are the types of Credit Card Authorization Form Templates?

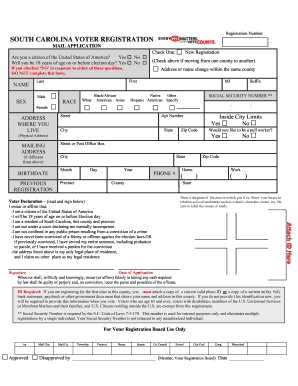

There are several types of Credit Card Authorization Form Templates, each tailored to different industries and purposes. Some common types include:

How to complete Credit Card Authorization Form Templates

Completing Credit Card Authorization Form Templates is a simple process that involves providing the necessary information accurately. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.