Australian Credit Application Form Template Free - Page 2

What is Australian credit application form template free?

The Australian credit application form template free is a document used by individuals or businesses to apply for credit from a financial institution. It typically includes personal and financial information to assess the applicant's creditworthiness.

What are the types of Australian credit application form template free?

There are several types of Australian credit application form templates that cater to different financial needs. Some common types include:

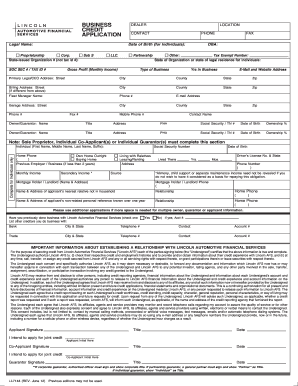

Personal credit application form template

Business credit application form template

Joint credit application form template

How to complete Australian credit application form template free

Completing the Australian credit application form template free is a straightforward process. Here are some steps to guide you through:

01

Fill in your personal or business information accurately

02

Provide details about your financial situation and credit history

03

Sign and date the form to certify the information provided is true and accurate

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Australian credit application form template free

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you draft a credit application?

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line.

How to create a business credit application form?

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

What are the three 3 main types of letter of credit?

Key Takeaways: Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

How do I get a credit letter?

How To Get a Letter of Credit. To get a letter of credit, contact your bank. You'll most likely need to work with an international trade department or commercial division. Not every institution offers letters of credit, but small banks and credit unions can often refer you to somebody who can accommodate your needs.

What is in a credit application?

A credit application is a standardized form that a customer or borrower uses to request credit. The form contains requests for such information as: The amount of credit requested. The identification of the applicant. The financial status of the applicant.

What is a credit application letter?

A credit application is a borrower's formal request to a lender for an extension of credit. Credit applications can be made either orally or in written form, as well as online.