Financial Assessment Form India - Page 2

What is Financial assessment form India?

Financial assessment form India is a document used to evaluate an individual's or company's financial status. It includes information about income, expenses, assets, and liabilities.

What are the types of Financial assessment form India?

There are various types of Financial assessment form India depending on the purpose and scope of the assessment. Some common types include:

Personal Financial Assessment Form

Business Financial Assessment Form

Tax-related Financial Assessment Form

Loan Application Financial Assessment Form

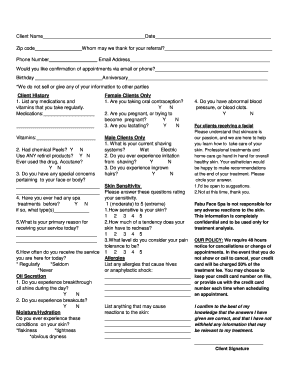

How to complete Financial assessment form India

Completing a Financial assessment form India is a straightforward process. Follow these steps to ensure accuracy and completeness:

01

Gather all necessary financial documents such as bank statements, tax returns, and pay stubs.

02

Fill in the form with accurate and up-to-date information about your finances.

03

Review the completed form to make sure all sections are filled out correctly.

04

Submit the form to the appropriate party or organization for assessment.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Financial assessment form india

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is financial assessment form?

A financial assessment form template is a form that collects financial information. This type of assessment can be used if a person wants a loan and the bank needs to find out about their current financial status. Our form is perfect for properly handling finances. Make the process easier, faster, and more reliable.

What is an example of a financial assessment?

Financial Assessment Definition: Such financial assessment is used to evaluate your contribution towards your income vs expenses. Personal financial assessment example: If a person earns $50,000, he can plan his personal budget by contributing 20% into savings and 80% into expenses.

What is the purpose of a financial assessment for a reverse mortgage?

A reverse mortgage financial assessment reviews a potential borrower's financial situation, including credit history, employment history, debts, and income, to make sure that the borrower can afford to pay the ongoing costs of maintaining their property while receiving reverse mortgage payments.

What is the financial assessment?

The financial assessment determines whether the lender must set aside a certain amount of money to pay for property taxes and other expenses over the course of the loan. The “set aside” reduces the amount of loan proceeds available to the borrower.

What information is needed for the financial assessment?

The assessment will add up all of your capital. If you own a share in an asset (for example, if you own a house as a couple or have savings in a joint account), the value of your share will be taken into account. The assessment cannot count assets that you don't own (for example, your partner's savings).