Home Insurance Quote Sheet Template - Page 2

What is Home insurance quote sheet template?

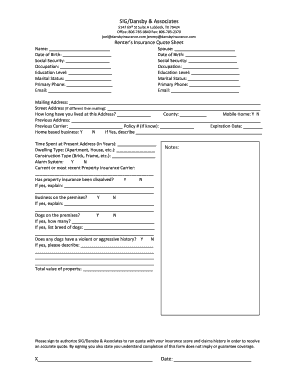

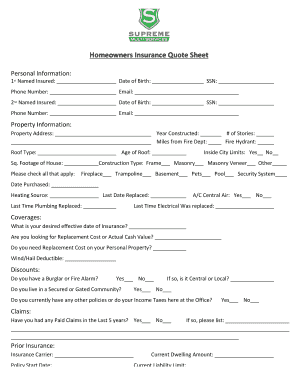

A Home insurance quote sheet template is a document used to gather information about a property and its owner in order to obtain a quote for homeowner's insurance. It includes details such as property address, value, type of coverage needed, and personal information of the homeowner.

What are the types of Home insurance quote sheet template?

There are several types of Home insurance quote sheet templates available based on the insurance company or broker. Some common types include: 1. Basic Home insurance quote sheet template 2. Comprehensive Home insurance quote sheet template 3. Specialty Home insurance quote sheet template

How to complete Home insurance quote sheet template

Completing a Home insurance quote sheet template is easy and straightforward. Follow these steps: 1. Fill in the property details including address, value, and any additional features. 2. Provide your personal information such as name, contact details, and insurance history. 3. Specify the type of coverage you are looking for and any specific requirements. 4. Review the information entered for accuracy and completeness before submitting the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.