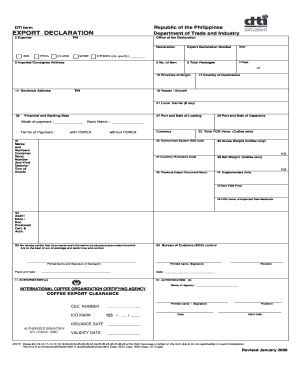

Sample Tax Declaration Form Philippines

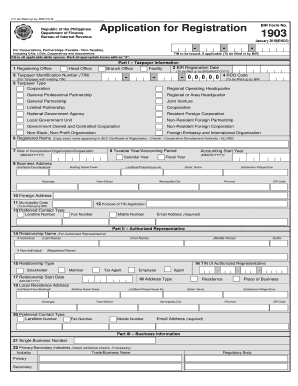

What is Sample tax declaration form philippines?

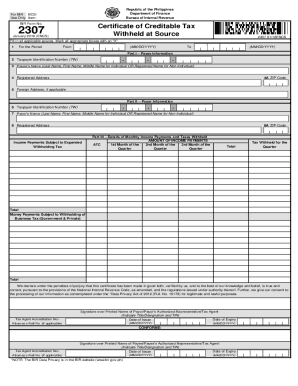

The Sample tax declaration form in the Philippines is a document that taxpayers use to declare their income, expenses, and other relevant financial information to the Bureau of Internal Revenue (BIR). By accurately completing this form, taxpayers can fulfill their legal obligation and avoid any penalties or fines.

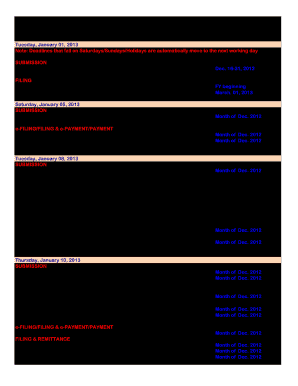

What are the types of Sample tax declaration form philippines?

There are several types of Sample tax declaration forms in the Philippines, including but not limited to: Income Tax Return (ITR) Form, Value Added Tax (VAT) Return Form, Percentage Tax Return Form, and Withholding Tax Return Form.

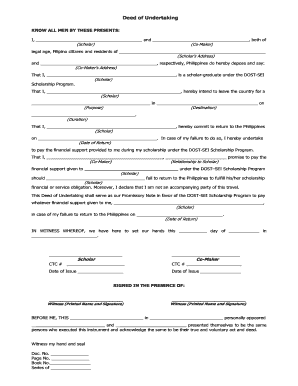

How to complete Sample tax declaration form philippines

Completing the Sample tax declaration form in the Philippines may seem daunting at first, but with the right guidance, it can be a straightforward process. Here are some steps to help you complete the form accurately:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.