What is Company vehicle policy South Africa?

Company vehicle policy in South Africa refers to the rules and regulations set by companies regarding the usage, maintenance, and responsibilities associated with company vehicles. These policies outline guidelines for the use of company vehicles by employees and are put in place to ensure safety, compliance, and cost-effectiveness.

What are the types of Company vehicle policy South Africa?

In South Africa, there are various types of company vehicle policies that companies can implement based on their specific needs and preferences. Some common types include:

General Usage Policy: This policy outlines the general rules for the use of company vehicles by employees.

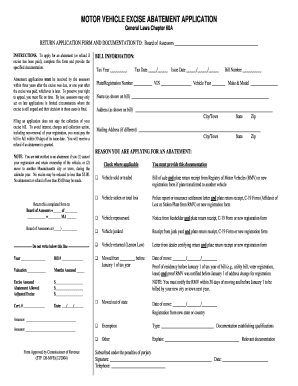

Maintenance Policy: This policy details the responsibilities of employees regarding the maintenance and upkeep of company vehicles.

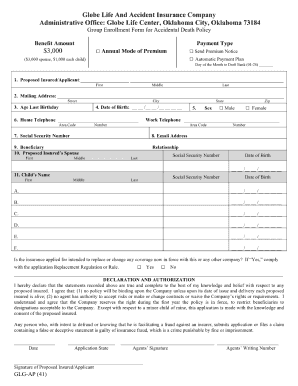

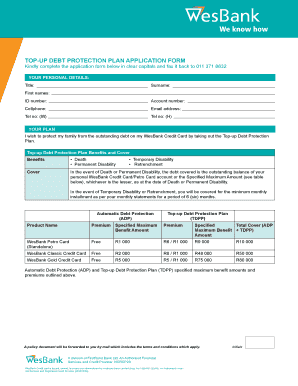

Insurance Policy: This policy specifies the insurance coverage and requirements for company vehicles.

Accident Reporting Policy: This policy outlines the procedures to follow in case of an accident involving a company vehicle.

How to complete Company vehicle policy South Africa

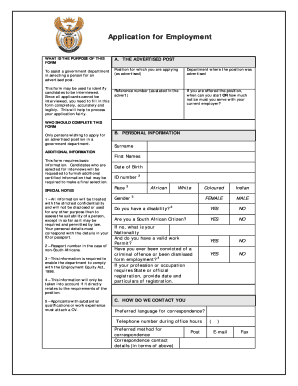

Completing a company vehicle policy in South Africa involves several steps to ensure that all necessary information is included and all parties understand and agree to the terms. Some key steps to complete a company vehicle policy are:

01

Review Existing Policies: Start by reviewing any existing company vehicle policies to ensure that the new policy aligns with the company's goals and objectives.

02

Define Policy Objectives: Clearly outline the objectives and goals of the company vehicle policy to ensure that all employees understand the purpose and importance of the policy.

03

Consult with Stakeholders: Involve relevant stakeholders in the development of the policy to gather input and ensure that all concerns are addressed.

04

Communicate and Train: Once the policy is finalized, communicate it to all employees and provide training if necessary to ensure understanding and compliance.

05

Regularly Review and Update: Regularly review and update the company vehicle policy to reflect any changes in regulations or company needs.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.