New Employee Forms 2021 - Page 2

What is New employee forms 2021?

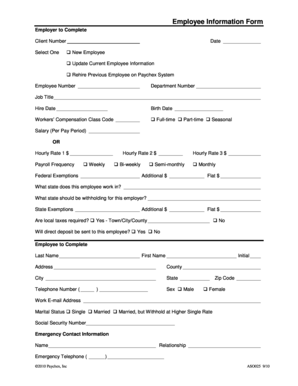

New employee forms 2021 are essential documents that new employees are required to fill out when they join a company. These forms gather important personal and employment information necessary for HR and payroll purposes.

What are the types of New employee forms 2021?

The types of New employee forms 2021 may include but are not limited to: 1. Employee Information Form 2. Tax Withholding Form (W-4) 3. Direct Deposit Authorization Form 4. Emergency Contact Form 5. Employee Handbook Acknowledgment Form

How to complete New employee forms 2021

Completing New employee forms 2021 is a simple process that can be broken down into the following steps: 1. Gather all necessary documents and information required for filling out the forms.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.