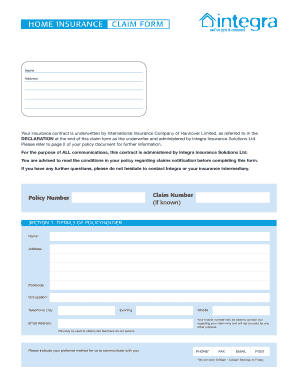

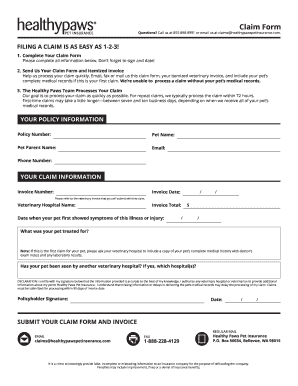

Home Insurance Claim Form Templates

What are Home Insurance Claim Form Templates?

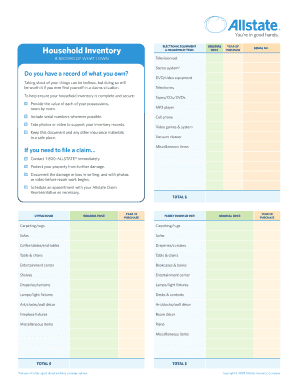

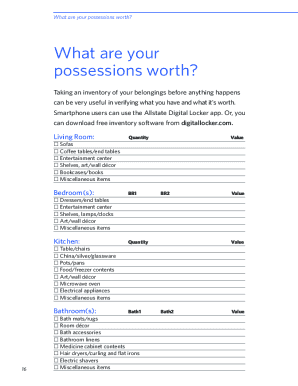

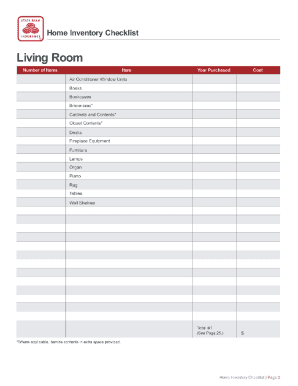

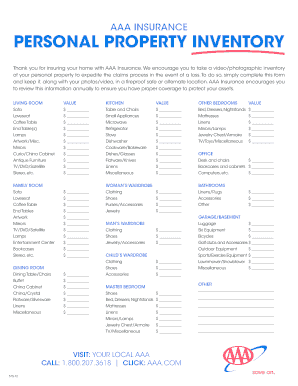

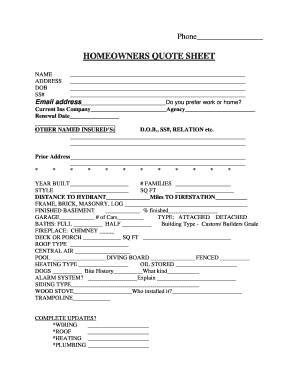

Home Insurance Claim Form Templates are standardized forms used by insurance companies to collect information from policyholders when filing a claim for damages to their home. These templates help streamline the claims process and ensure all necessary information is included for a prompt resolution.

What are the types of Home Insurance Claim Form Templates?

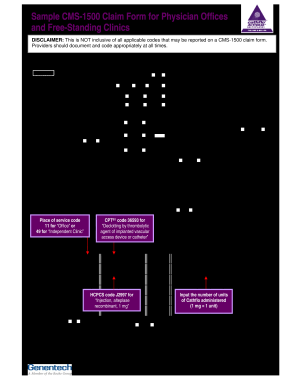

There are several types of Home Insurance Claim Form Templates that cater to different types of damages and coverage. Some common types include: Property Damage Claim Form, Theft Claim Form, Liability Claim Form, Water Damage Claim Form, and Fire Damage Claim Form.

How to complete Home Insurance Claim Form Templates

Completing Home Insurance Claim Form Templates is a straightforward process that involves providing accurate and detailed information about the incident and damages. Here are some tips to help you fill out the form correctly:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.