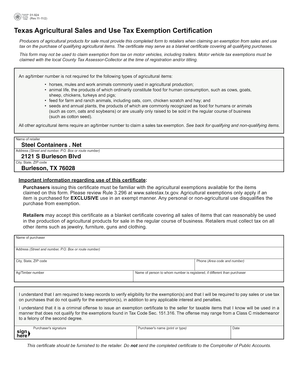

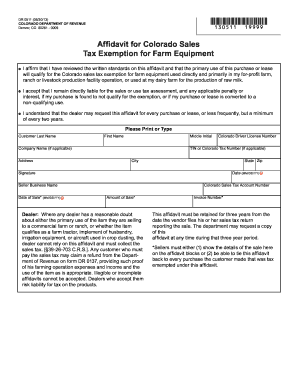

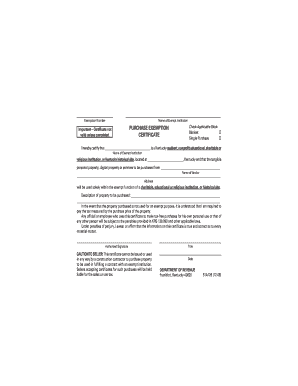

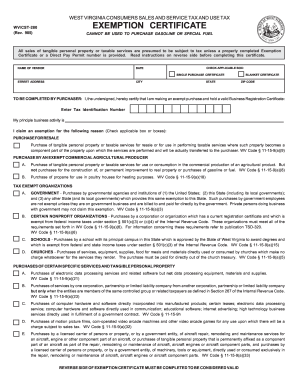

Agricultural Tax Exemption Form Templates

What are Agricultural Tax Exemption Form Templates?

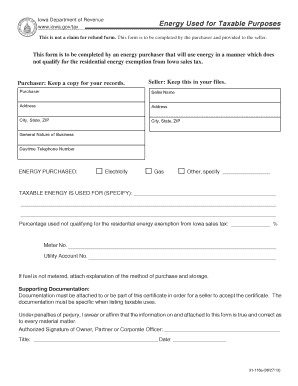

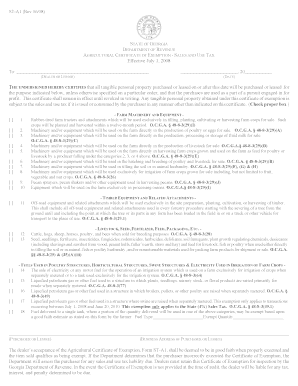

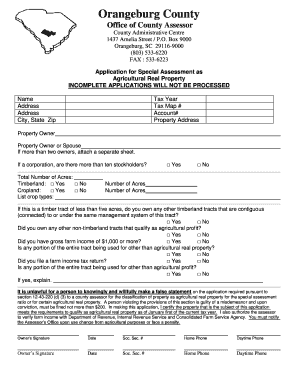

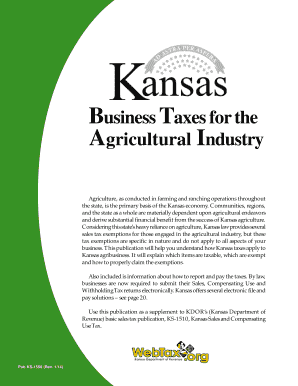

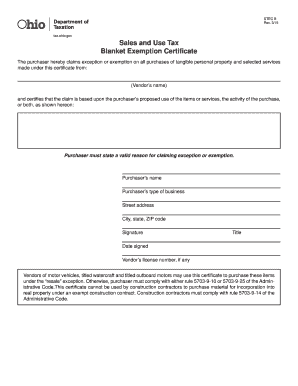

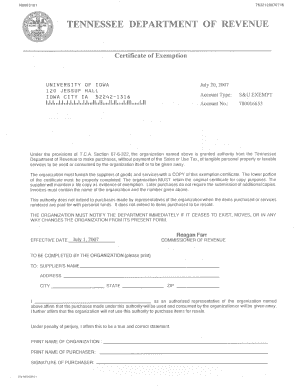

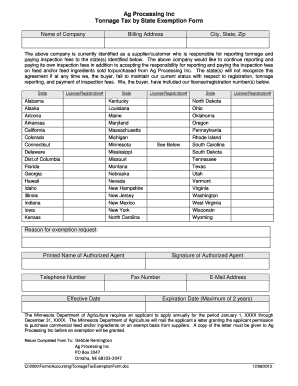

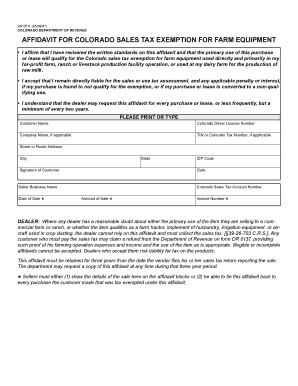

Agricultural Tax Exemption Form Templates are standardized documents used by farmers and ranchers to apply for tax exemptions on agricultural properties. These templates help simplify the process of claiming tax benefits and ensure that all necessary information is included in the application.

What are the types of Agricultural Tax Exemption Form Templates?

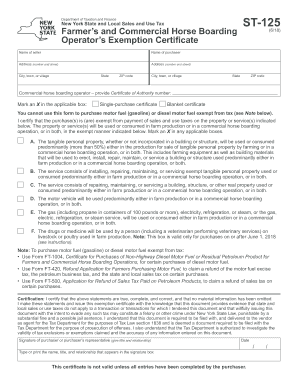

There are several types of Agricultural Tax Exemption Form Templates, including but not limited to: 1. Application for Agricultural Land Classification 2. Farm Machinery Exemption Certificate 3. Livestock Exemption Affidavit 4. Agricultural Property Tax Exemption Application

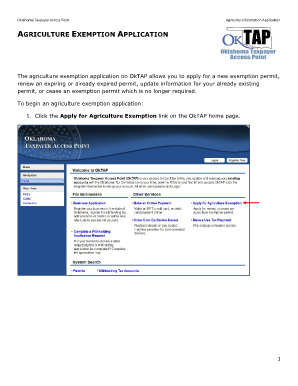

How to complete Agricultural Tax Exemption Form Templates

Completing Agricultural Tax Exemption Form Templates is a straightforward process that involves providing accurate information about your agricultural property and business. Here are the steps to fill out these forms:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.