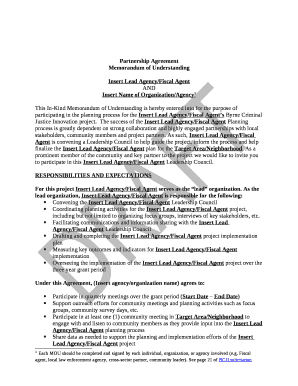

Sample Fiscal Agent Agreement

What is a Sample fiscal agent agreement?

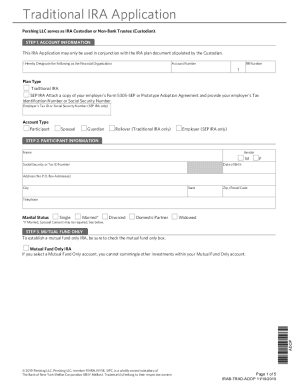

A Sample fiscal agent agreement is a legally binding contract that outlines the terms and conditions between a company and a fiscal agent, detailing the responsibilities, fees, and obligations of both parties.

What are the types of Sample fiscal agent agreement?

There are several types of Sample fiscal agent agreements, including:

Limited power of attorney agreement

General fiscal agent agreement

Special fiscal agent agreement

How to complete Sample fiscal agent agreement

Completing a Sample fiscal agent agreement is a straightforward process that involves the following steps:

01

Review the agreement thoroughly to understand the terms and conditions

02

Fill in the necessary details and information accurately

03

Sign the agreement electronically or physically, depending on the requirements

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sample fiscal agent agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a fiscal agent in government?

(Revised: 04/2021) Fiscal agents are financial institutions or other third parties receiving remittances and/or making disbursements on behalf of the state. The state's normal procedures for receipts and disbursements should be used whenever possible to minimize the use of fiscal agents.

What are the two types of fiscal sponsorship?

The most common forms of fiscal sponsorship are the Direct Model and the Grant Model. The Direct Model is the most common form of fiscal sponsorship. In the Direct Model, the project becomes an integrated part of the fiscal sponsor, with no legal identity separate from the fiscal sponsor.

What is an example of a fiscal agent?

A fiscal agent is an organization, such as a bank or trust company, that acts on behalf of another party performing various financial duties. A fiscal agent may assist in the redemption of bonds or coupons, handle tax issues, replace lost or damaged securities, and perform various other finance-related tasks.

What is the difference between a fiscal agent and a fiscal sponsor?

In a fiscal agent relationship, the non-agent entity reports activity on their own financial statements, where in a fiscal sponsorship the other entity's activity is all recorded on the sponsoring entity's nonprofit financial statements because the non-agent entity gets to share the tax-exempt status.

Is a fiscal agent a fiduciary?

In the case of fiscal agency, a fiscal agent will act as an agent with fiduciary obligations to the contracting entity and the contracting entity must have its own 501c3 status.

What does a fiscal sponsorship do?

What is fiscal sponsorship? Fiscal sponsorship, at its core, is when a nonprofit organization extends its tax-exempt status to select groups engaged in activities related to the organization's mission.