Fiscal Sponsorship Guidelines

What is Fiscal sponsorship guidelines?

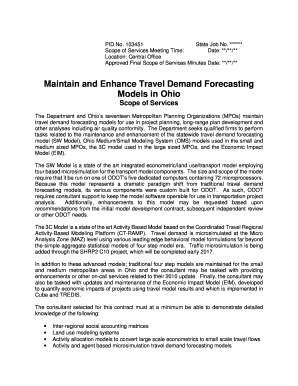

Fiscal sponsorship guidelines are a set of rules and regulations that organizations need to follow when engaging in fiscal sponsorship. These guidelines govern the financial relationship between the sponsor and the sponsored organization, ensuring transparency and accountability.

What are the types of Fiscal sponsorship guidelines?

There are several types of Fiscal sponsorship guidelines, including:

Comprehensive fiscal sponsorship

Pre-approved grants

Shared services agreements

Group exemption models

How to complete Fiscal sponsorship guidelines

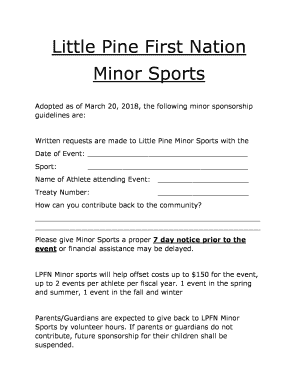

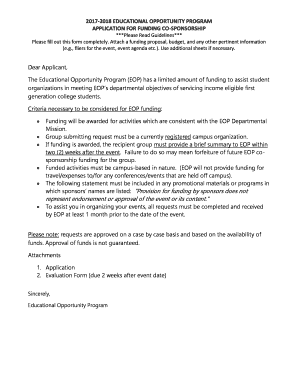

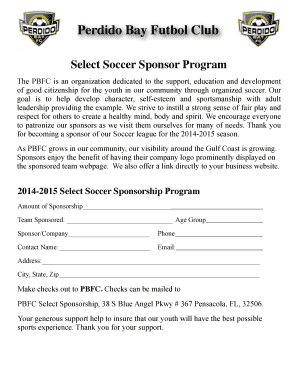

Completing Fiscal sponsorship guidelines is crucial for both sponsors and sponsored organizations to ensure compliance and smooth financial operations. Here are some steps to follow:

01

Review the specific guidelines provided by your fiscal sponsor

02

Gather all necessary financial documents and information

03

Fill out the required forms accurately

04

Seek guidance from your fiscal sponsor if you have any questions or concerns

05

Submit the completed guidelines for review and approval

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fiscal sponsorship guidelines

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Who can serve as a fiscal sponsor?

Any organization with a recognized and verified 501(c)(3) nonprofit status from the IRS is eligible to be a fiscal sponsor. Beyond applying for, achieving, and maintaining nonprofit status in the eyes of the IRS, there are no other requirements for the fiscal sponsors themselves.

What is the IRS rule on fiscal sponsorship?

Using a fiscal sponsor satisfies IRS requirements as long as the fiscal sponsor maintains the right to decide, at its own discretion, how it will use contributions. Maintaining control over the donated funds is a requirement of a legitimate fiscal sponsor arrangement.

What are the two types of fiscal sponsorship?

The most common forms of fiscal sponsorship are the Direct Model and the Grant Model. The Direct Model is the most common form of fiscal sponsorship. In the Direct Model, the project becomes an integrated part of the fiscal sponsor, with no legal identity separate from the fiscal sponsor.

What is the difference between a 501c3 and a fiscal sponsorship?

While both fiscal sponsorships and 501(c)(3)s allow for tax-deductible contributions, fiscal sponsorships are generally less expensive to start, take less time to start, and require a significantly smaller initial investment to get started.

How do you establish a fiscal sponsorship?

If you're an individual interested in a fiscal sponsor for your organization or project, there are a few different routes you can take. File for 501c3 status anyway. Search for a fiscal sponsor. Get in touch with your potential sponsor. Create a written agreement. Receive donations.

What is fiscal sponsorship?

Fiscal sponsorship refers to the practice of non-profit organizations offering their legal and tax-exempt status to groups—typically projects—engaged in activities related to the sponsoring organization's mission. It typically involves a fee-based contractual arrangement between a project and an established non-profit.