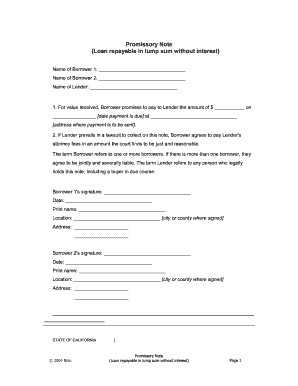

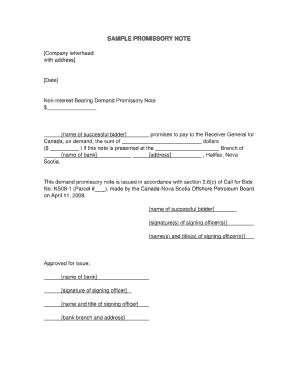

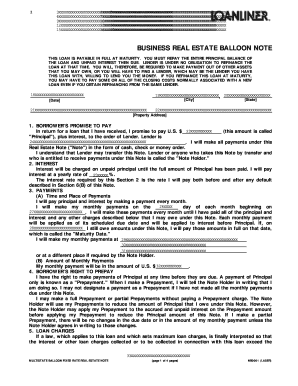

Promissory Note Format

What is Promissory note format?

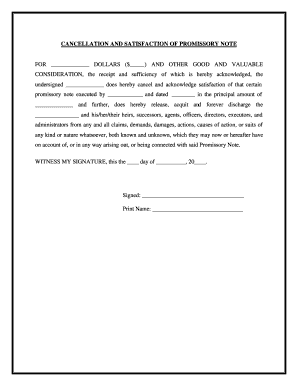

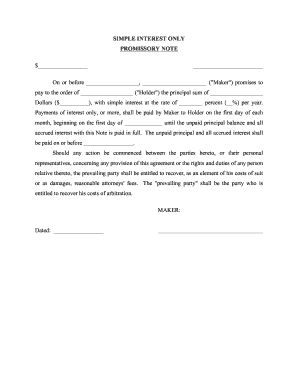

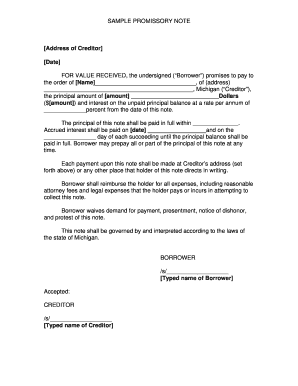

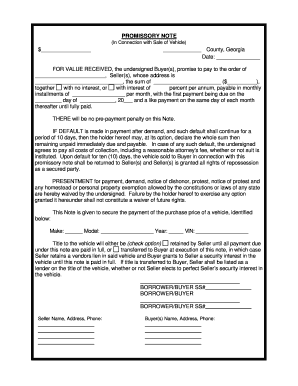

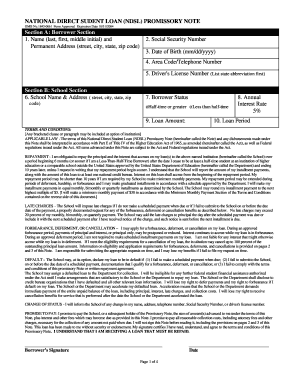

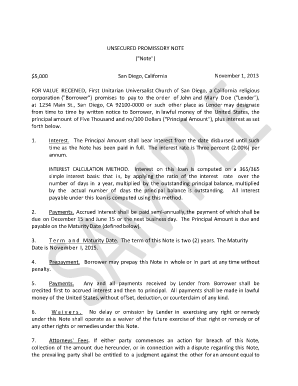

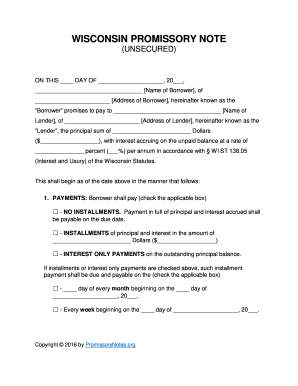

A promissory note format is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender within a specified period. It includes the terms and conditions of the loan, such as interest rate, repayment schedule, and consequences for defaulting.

What are the types of Promissory note format?

There are several types of promissory note formats, including: 1. Secured promissory notes - backed by collateral 2. Unsecured promissory notes - not backed by collateral 3. Demand promissory notes - payable on demand 4. Installment promissory notes - repaid in fixed installments over time

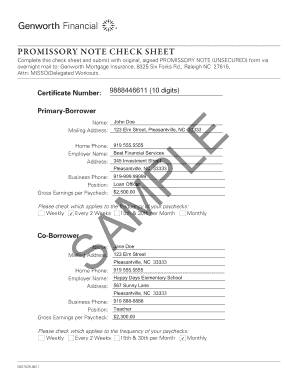

How to complete Promissory note format

Completing a promissory note format is a simple process that involves the following steps: 1. Fill in the borrower's and lender's information 2. Specify the loan amount and terms of repayment 3. Include any applicable interest rates and late fees 4. Outline any collateral that secures the loan

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.