Loan Agreement (Nonprofits) Templates

What are Loan Agreement (Nonprofits) Templates?

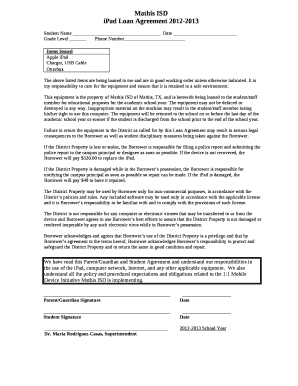

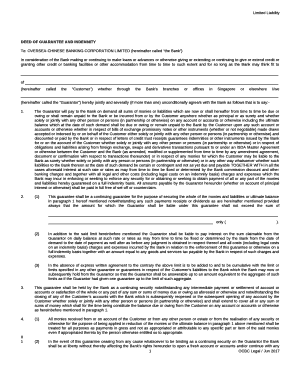

Loan Agreement (Nonprofits) Templates are pre-made documents that outline the terms and conditions of a loan between a nonprofit organization and a lender. These templates provide a structured format for documenting the agreement to ensure clarity and legality.

What are the types of Loan Agreement (Nonprofits) Templates?

There are various types of Loan Agreement (Nonprofits) Templates available to cater to different needs. Some common types include:

Term Loan Agreement Template

Revolving Loan Agreement Template

Secured Loan Agreement Template

Unsecured Loan Agreement Template

How to complete Loan Agreement (Nonprofits) Templates

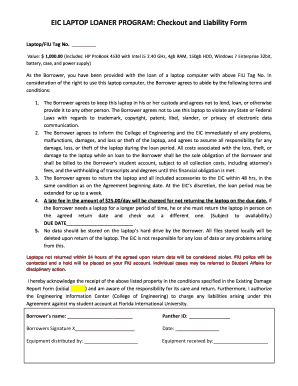

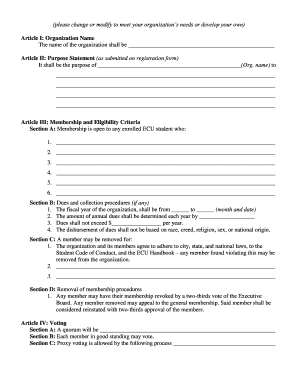

Completing a Loan Agreement (Nonprofits) Template is a straightforward process that involves the following steps:

01

Fill in the borrower and lender information

02

Specify the loan amount and repayment terms

03

Outline any collateral or security provided for the loan

04

Include any relevant clauses or conditions

05

Review and sign the agreement

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Loan Agreement (Nonprofits) Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a letter of agreement for a loan?

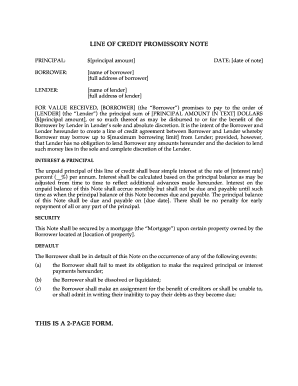

The loan agreement letter format will follow that of any legal contract. The content must explain the financial obligations of both parties: what the lender will provide and how the borrower is expected to return the sum. The time period and details of payment should be included in this letter, as well.

How do I write a loan agreement between two parties?

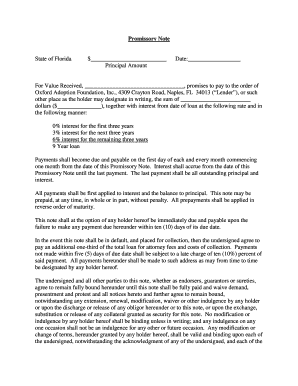

What are the Contents of a Personal Loan Agreement Form? Complete details of both the borrower and the lender, i.e. their full names and complete addresses. The total amount of the loan, both in numbers and words. The interest rate for the loan amount, if applicable. The date when the loan agreement goes into effect.

How do I write a private loan agreement?

This lending contract must include several key provisions: Loan Amount ($) Loan Date. Borrower and Lender Information. Interest Rate. Re-Payment Terms. Late Fees (if any) Default Terms (if the borrower doesn't pay) Early Payment Penalty (if any)

How do I write a simple loan agreement?

Common items in personal loan agreements. Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more.

Can I write my own loan agreement?

A loan agreement should accompany any loan of money. For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

What makes a valid loan agreement?

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.