Asset Sale Agreement

What is an Asset Sale Agreement?

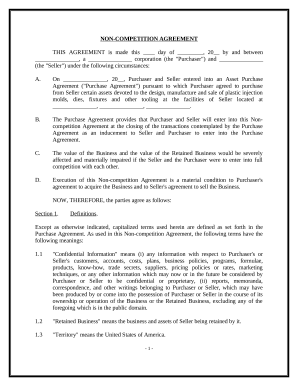

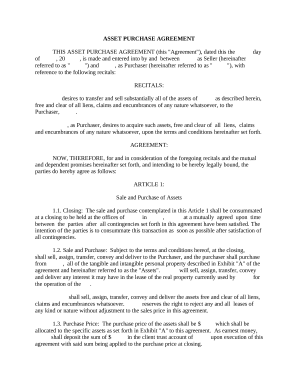

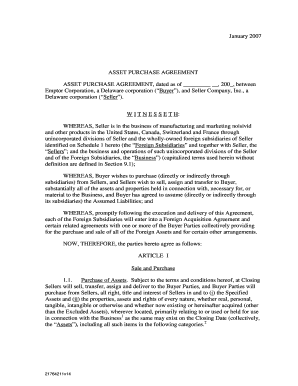

An Asset Sale Agreement is a legal contract that outlines the terms and conditions for the sale of specific assets between two parties. It is used when a company wants to sell individual assets instead of the entire business.

What are the types of Asset Sale Agreement?

There are several types of Asset Sale Agreements, including:

Business Asset Purchase Agreement

Equipment Sale Agreement

Intellectual Property Sale Agreement

Real Estate Asset Purchase Agreement

How to complete an Asset Sale Agreement

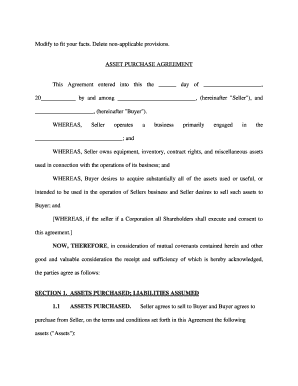

Completing an Asset Sale Agreement is a crucial step in the sale process. Follow these steps to ensure a smooth transaction:

01

Gather all necessary information about the assets being sold

02

Negotiate and agree upon the terms of the sale with the other party

03

Draft the Asset Sale Agreement, ensuring all details are accurate and legally binding

04

Review and sign the agreement together with the other party

05

Keep a copy of the signed agreement for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

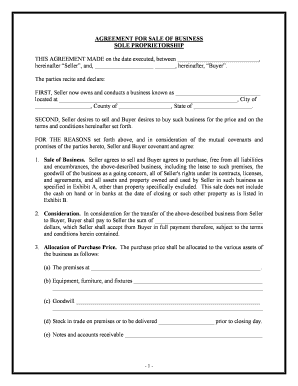

What is included in an asset sale?

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

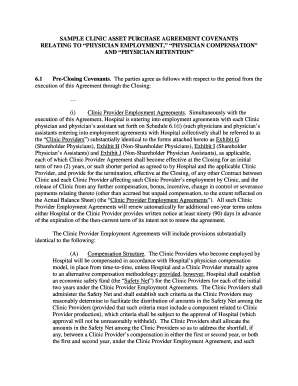

What should be included in an asset purchase agreement?

The agreement describes the assets that will be purchased, including important details like price, warranties, and breach of contract provisions. With contract management software, your company is able to manage these complex agreements effectively.

Why would a seller want an asset sale?

Asset sales are types of business transaction where buyers purchase assets from a business, and the sellers retain legal ownership of the company. They carry less risk for buyers while allowing sellers to perform fair market value due to diligence measures thoroughly.

What is an example of an asset purchase?

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Is an asset purchase agreement legally binding?

Yes, an asset purchase agreement is legally binding. The document contains enforceable obligations that require both parties to carry out the APA's terms and conditions. Pay attention to the wording of your APA to understand the penalties for reneging on those terms.

What does a asset purchase agreement include?

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.