Inventory Adjustment Forms - Page 2

What is Inventory adjustment forms?

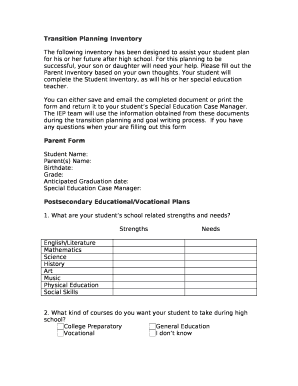

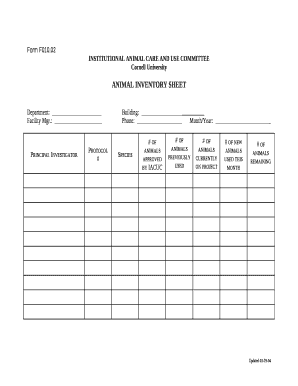

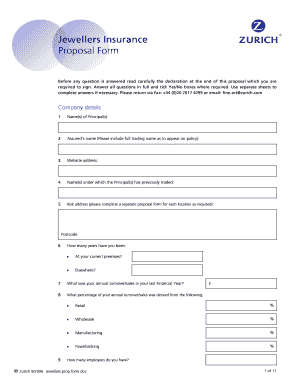

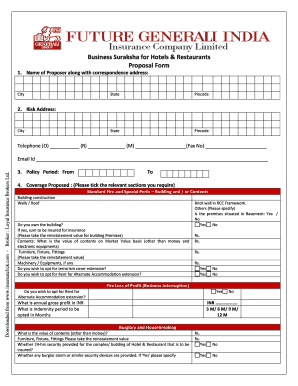

Inventory adjustment forms are documents used by businesses to make changes to their stock levels. These forms are crucial for maintaining accurate inventory records and ensuring that the right amount of stock is always available.

What are the types of Inventory adjustment forms?

There are several types of Inventory adjustment forms that businesses can use depending on their specific needs. Some common types include:

Stock Adjustment Form

Inventory Reconciliation Form

Stock Count Discrepancy Form

Shrinkage Report Form

How to complete Inventory adjustment forms

Completing Inventory adjustment forms is a straightforward process that involves following these simple steps:

01

Fill in the date and business details at the top of the form.

02

Record the item name, quantity, and reason for the adjustment.

03

Sign and date the form to approve the changes made.

04

Submit the completed form to the relevant department for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Inventory adjustment forms

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you do inventory adjustments?

The first adjusting entry clears the inventory account's beginning balance by debiting income summary and crediting inventory for an amount equal to the beginning inventory balance. The second adjusting entry debits inventory and credits income summary for the value of inventory at the end of the accounting period.

When would the year end value of inventory need to be adjusted?

At the end of the accounting year, the beginning balance in the account Inventory must be changed so that it reports the cost (or perhaps lower than the cost) of the ending inventory.

What items are the two types of inventory adjustments?

There are two types of inventory adjustments, increases in quantity and decreases in quantity. For an adjustment up, you will enter a positive quantity and can also enter a unit cost. For an adjustment down, you will enter a negative quantity, but you can't enter a unit cost.

What are the reasons for inventory adjustments?

There are three possible reasons to create inventory adjustments. The value of the item is wrong, the quantity of the item is wrong, or both the value and the quantity of the item are wrong.

What are the two kinds of inventory adjustments?

There are two types of adjustments that can be made to inventory: Stock on Hand: The quantity of stock on hand, or salable stock, is increased or decreased. Unavailable Inventory: The quantity of stock on hand does not change, but the quantity of unavailable stock, or non-salable stock, is increased or decreased.

What are some examples of when you would need to fill out an inventory adjustment form?

Inventory Adjustments: An Overview Waste: Expired or obsolete inventory (common in food and consumer goods). Breakage: Damaged inventory that cannot be legally sold as new. Shrinkage: Inventory lost to theft. Write-offs: Inventory lost to other reasons.