Builder Tool with pdfFiller

If you're looking to create customized Account Receiv Aging Reports, the pdfFiller Builder Tool enables you to design PDFs effortlessly, whether starting from scratch or modifying existing documents. Here's how to maximize your use of this feature-rich platform.

What is an Account Receiv Aging Report template?

An Account Receiv Aging Report template is a structured document used by businesses to monitor outstanding invoices and track the ages of receivables. Typically, it categorizes outstanding debts based on how long they remain unpaid, guiding organizations in managing cash flow and collections effectively.

Why you might need to create an Account Receiv Aging Report template?

Creating an Account Receiv Aging Report template is essential for several reasons:

-

1.It provides visibility into the financial health of a business by illustrating outstanding payments.

-

2.It aids in prioritizing collection efforts based on the age of the receivables.

-

3.It helps in maintaining accurate financial records for audit and reporting purposes.

-

4.It allows for better communication with clients regarding their payment status.

Key tools in pdfFiller that let you create an Account Receiv Aging Report template

pdfFiller offers various tools to create and customize your Account Receiv Aging Report template:

-

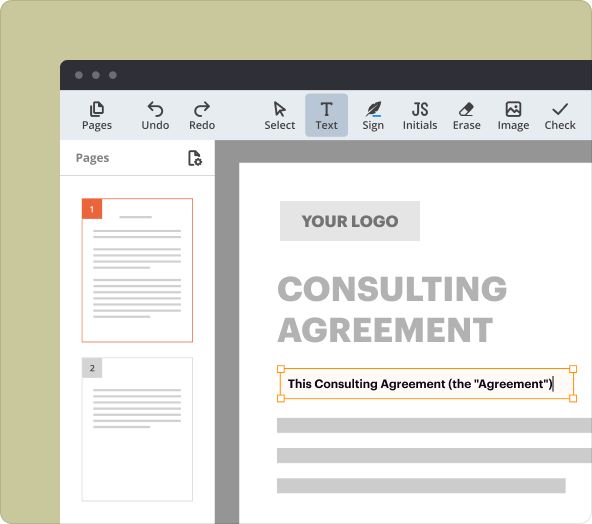

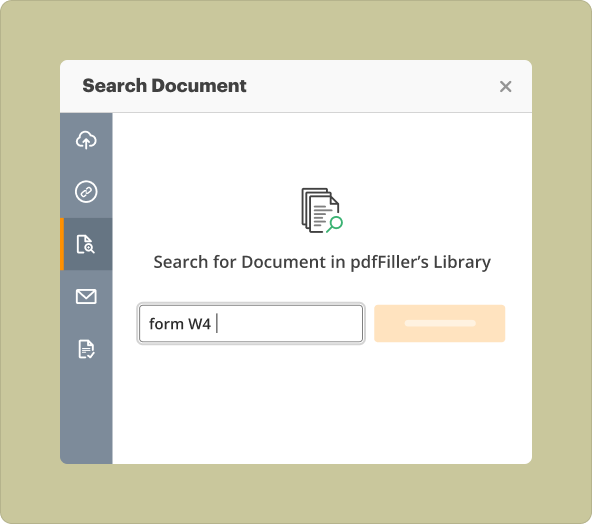

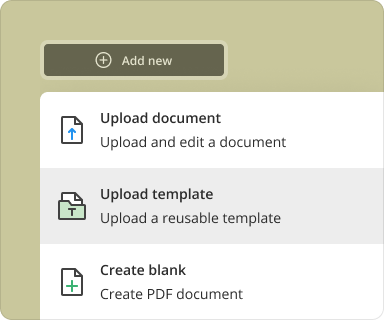

1.Document Builder: Create documents from scratch or use templates.

-

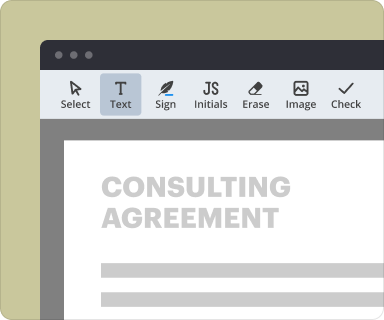

2.Text Editing: Edit text to fit your company’s branding and desired formatting.

-

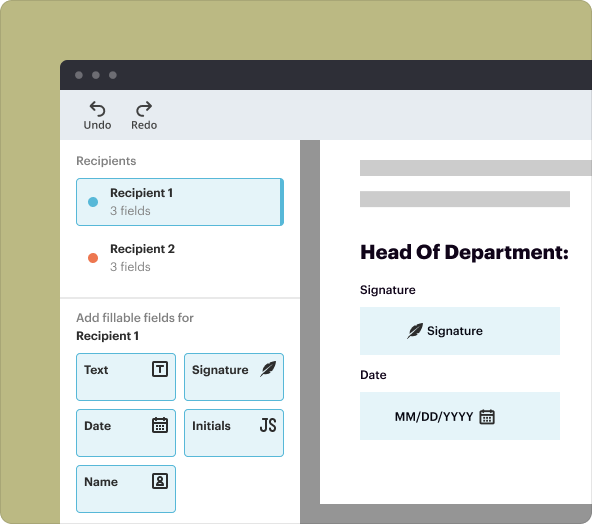

3.eSignature: Collect signatures electronically to finalize the reports.

-

4.Cloud Storage: Access your documents from anywhere, ensuring flexibility in managing your reports.

Step-by-step guide to creating a blank Account Receiv Aging Report template

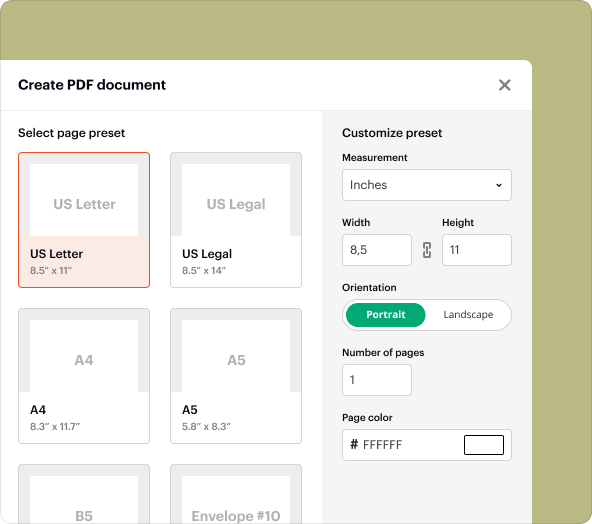

To create a blank Account Receiv Aging Report template using pdfFiller, follow these steps:

-

1.Log in to your pdfFiller account.

-

2.Select the 'Create New' option from the dashboard.

-

3.Choose 'Blank Document' from the available options.

-

4.Utilize the text editing tools to add relevant headings and sections.

-

5.Save your document regularly to prevent data loss.

Creating an Account Receiv Aging Report template from scratch vs uploading existing files to modify

When deciding whether to create a new template from scratch or modify an existing document, consider the following:

-

1.Creating from scratch: This option is beneficial if you have specific formatting or content requirements. It provides complete customization and control over the design.

-

2.Uploading existing files: This option is ideal if you have pre-existing templates that need minor updates. It saves time and effort, allowing quick modifications to align with current business needs.

Organizing content and formatting text as you create your Account Receiv Aging Report template

When structuring your report, consider these formatting tips:

-

1.Use clear headings to define sections such as “Current,” “30 Days,” “60 Days,” and “90 Days” receivables.

-

2.The use of table formats enhances readability, allowing you to present data clearly.

-

3.Incorporate company branding by using specific fonts and colors consistently throughout the document.

-

4.Utilize bullet points or numbered lists to emphasize key data points.

Saving, exporting, and sharing once you create your Account Receiv Aging Report template

Once your Account Receiv Aging Report template is complete, pdfFiller makes it easy to save and share:

-

1.Saving: Save your document in your pdfFiller account for easy access later. You can also download it to your device in formats like PDF or DOCX.

-

2.Exporting: Choose to export your report for use in presentations or further analysis. You can export it in various formats compatible with other software.

-

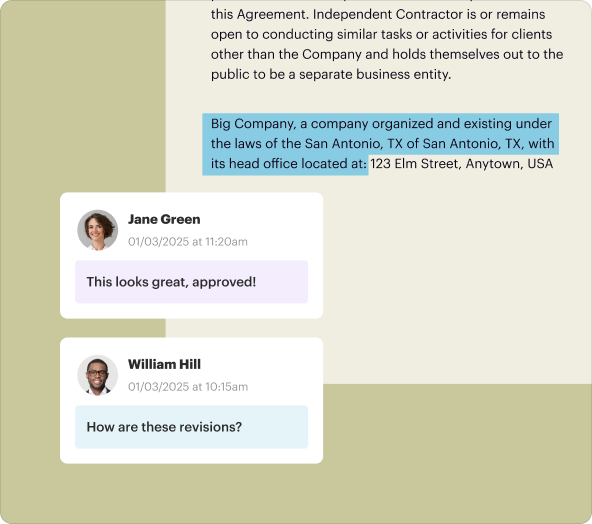

3.Sharing: Share your report directly via email or provide a link to collaborators for review and feedback.

Typical use-cases and sectors that often utilize an Account Receiv Aging Report template

Account Receiv Aging Reports are critical in several sectors including:

-

1.Finance: Financial institutions often use these reports to manage cash flow and assess risk.

-

2.Retail: Stores monitor unpaid invoices to maintain a healthy transaction relationship with suppliers.

-

3.Healthcare: Hospitals and clinics keep track of patient payments to manage revenue cycles efficiently.

-

4.Freelancing and Consulting: Independent contractors use these reports for tracking payments from clients.

Conclusion

The Account Receiv Aging Report Template Builder Tool within pdfFiller is an invaluable resource for businesses looking to maintain financial oversight. By leveraging its user-friendly functionalities, you can effortlessly create and manage your templates, ensuring that your invoicing processes remain organized and efficient. Start transforming your report creation process today with pdfFiller.

How to create a PDF with pdfFiller

Who needs this?

Document creation is just the beginning

Manage documents in one place

Sign and request signatures

Maintain security and compliance

pdfFiller scores top ratings on review platforms