How to create an Accounts Receivable Checklist Template with pdfFiller

Creating an Accounts Receivable Checklist Template is crucial for tracking incoming payments and managing financial obligations. With pdfFiller's comprehensive tools, you can easily design, edit, and share your checklist as a PDF. This article walks you through the key features of the Builder Tool, providing a step-by-step guide on how to efficiently create your template.

What is an Accounts Receivable Checklist Template?

An Accounts Receivable Checklist Template is a structured document used by businesses to monitor and manage incoming payments from clients. It typically includes key elements such as invoice numbers, amounts due, payment terms, due dates, and client information. By utilizing this template, organizations can streamline their collection processes, ensure timely payments, and maintain accurate financial records.

Why you might need an Accounts Receivable Checklist Template?

Having a well-defined Accounts Receivable Checklist Template can significantly enhance your financial management. It allows you to:

-

1.Track outstanding payments effectively.

-

2.Identify overdue invoices to follow up with clients.

-

3.Maintain compliance with accounting standards.

-

4.Improve cash flow management by anticipating incoming funds.

-

5.Reduce errors associated with manual tracking.

Key tools in pdfFiller that let you create an Accounts Receivable Checklist Template

pdfFiller offers a comprehensive suite of tools designed to simplify the creation of PDFs. Key functionalities include:

-

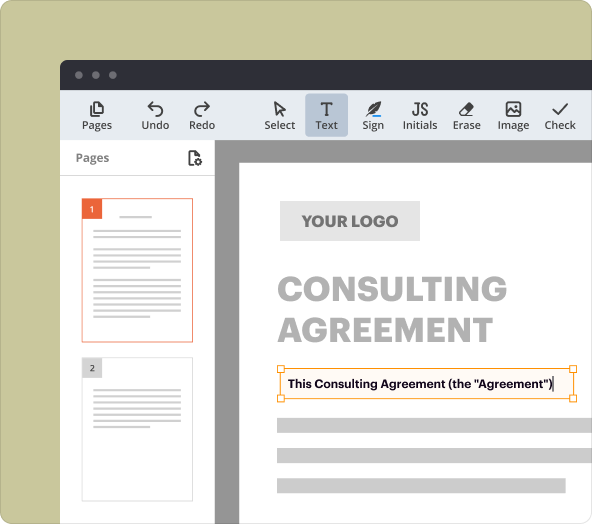

1.Document Builder: Create custom templates from scratch or modify existing documents.

-

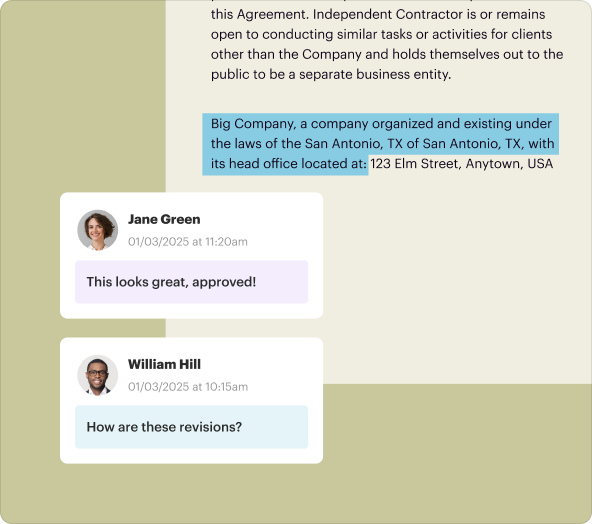

2.Editing Tools: Add text, images, checkboxes, and annotations easily.

-

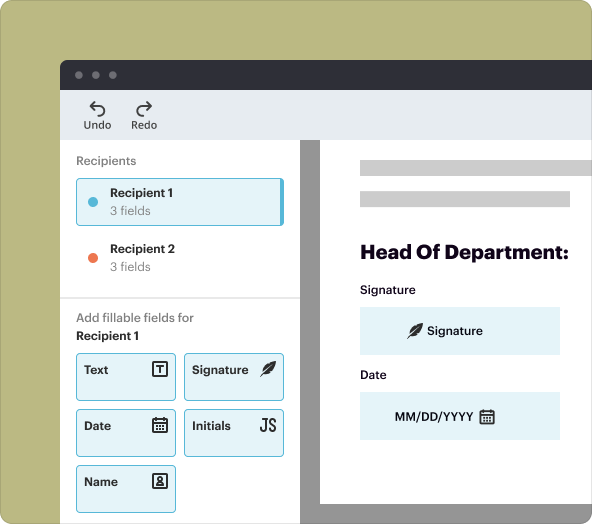

3.eSignature Integration: Allow clients to sign documents electronically for quick approvals.

-

4.Cloud Storage: Access your documents anywhere, anytime.

Step-by-step guide to create an Accounts Receivable Checklist Template from blank PDFs

Follow these steps to create your checklist template using pdfFiller:

-

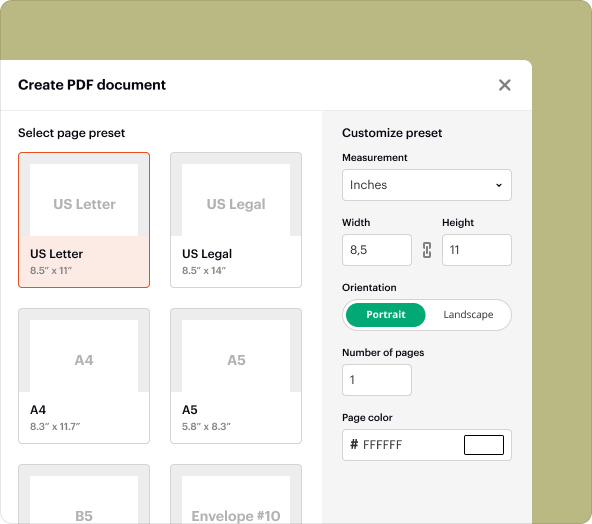

1.Step 1: Log in to your pdfFiller account.

-

2.Step 2: Click on “Create New Document” in the main dashboard.

-

3.Step 3: Select “Start from Blank Document” option.

-

4.Step 4: Use the editing tools to add required fields such as invoice numbers and payment details.

-

5.Step 5: Format the document to your liking (font size, style, colors).

-

6.Step 6: Save your document when finished.

Creating an Accounts Receivable Checklist Template from scratch vs uploading existing files to modify

You can choose between starting from scratch or modifying existing documents:

-

1.Creating from scratch: This option provides full creative control over the layout and fields you wish to include, allowing you to customize the checklist exactly to your business requirements.

-

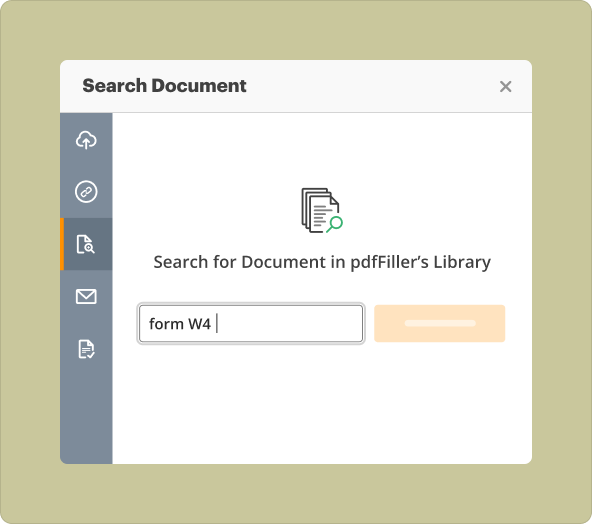

2.Uploading existing files: If you have previous versions of the checklist, you can upload them to pdfFiller. This is efficient as it allows you to retain relevant elements while making necessary updates.

Organizing content and formatting text as you create your Accounts Receivable Checklist Template

When formatting your checklist:

-

1.Use headings and bullet points for clarity.

-

2.Maintain consistent font and styling to enhance readability.

-

3.Ensure key fields are clearly labeled, such as “Due Date” and “Amount Due.”

-

4.Consider color coding or shading to differentiate between paid and unpaid invoices.

Saving, exporting, and sharing once you’ve created your Accounts Receivable Checklist Template

After completing your checklist, pdfFiller makes it easy to manage your document:

-

1.Step 1: Click “Save” to store your document in the cloud.

-

2.Step 2: Export your document as a PDF for easy distribution.

-

3.Step 3: Use the sharing options to send it directly to clients via email.

-

4.Step 4: If needed, include the eSignature feature for quick approvals.

Typical use-cases and sectors that often use an Accounts Receivable Checklist Template

Various industries can benefit from the use of an Accounts Receivable Checklist Template:

-

1.Retailers: To track customer payments and manage inventory finances.

-

2.Service Providers: Businesses like consulting firms use it to manage client invoices.

-

3.Freelancers: Independent contractors can efficiently follow up on payments owed.

-

4.Manufacturers: To ensure timely payments for products supplied to businesses.

Conclusion

Creating an Accounts Receivable Checklist Template with pdfFiller is a straightforward and efficient process. Whether you’re starting from scratch or modifying an existing document, the Builder Tool provides you with the necessary functionalities to design a comprehensive template tailored to your business needs. By utilizing this tool, you'll enhance your organization’s ability to manage incoming payments and maintain financial accuracy.

How to create a PDF with pdfFiller

Who needs this?

Document creation is just the beginning

Manage documents in one place

Sign and request signatures

Maintain security and compliance

pdfFiller scores top ratings on review platforms