How to Budgeting Checklist Template with pdfFiller

Create a comprehensive budgeting checklist template using pdfFiller’s cloud-based PDF solutions. This guide will help you understand the functionalities and the simple steps needed to create and manage your budgeting documents efficiently.

What is a budgeting checklist template?

A budgeting checklist template is a structured document that helps individuals or teams outline and track financial goals, expenses, and income. It serves as a vital tool for managing finances effectively and ensures you keep track of your budgeting activities throughout a specified period. By using a budgeting checklist, you can simplify financial planning and monitoring.

Why you might need to budget with a checklist template?

Budgeting helps to allocate your financial resources wisely and prepares you for both expected and unexpected expenses. Here are some key reasons to consider using a budgeting checklist template:

-

1.Promotes awareness of your financial situation.

-

2.Helps in setting and achieving financial goals.

-

3.Assists in tracking income and expenses effectively.

-

4.Facilitates better financial decisions and planning.

-

5.Allows for easy adjustments and reflections on financial habits.

Key tools in pdfFiller that let you create a budgeting checklist template

pdfFiller offers several powerful features to help you create an efficient budgeting checklist template:

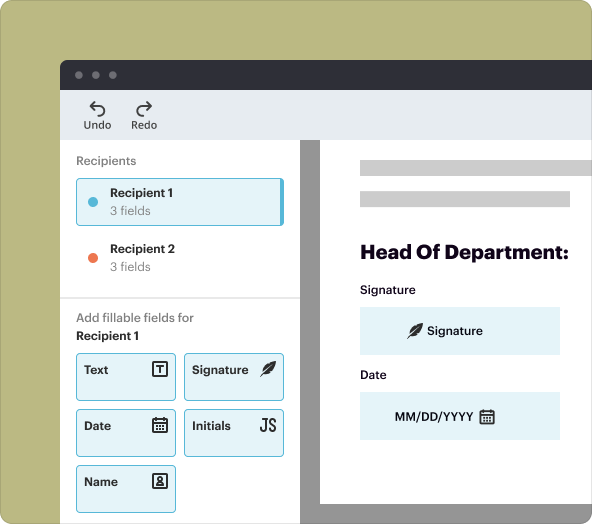

-

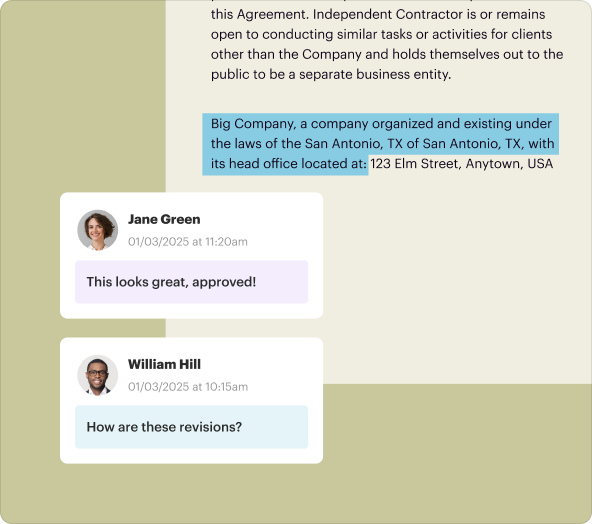

1.Drag-and-drop editor: Easily insert text boxes, checkboxes, and other elements to build your unique checklist.

-

2.eSignature capabilities: Enable others to sign your document digitally, ensuring its validity.

-

3.Cloud-based storage: Access your documents anytime from any device with internet connectivity.

-

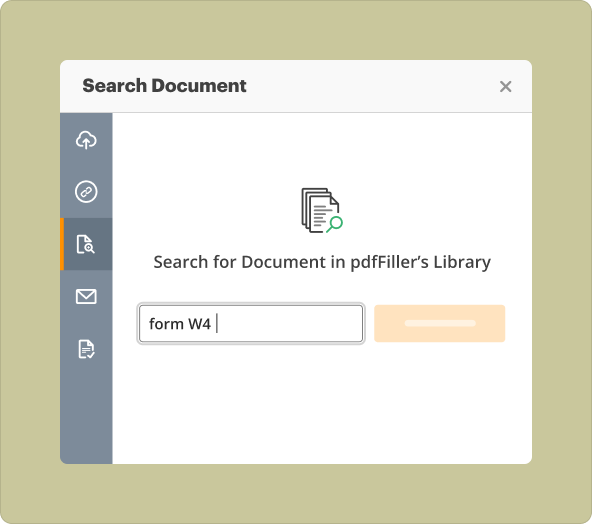

4.Template library: Leverage pre-designed templates for inspiration or start from scratch.

-

5.Version history: Track changes and revert to previous versions if necessary.

Step-by-step guide to create blank PDFs for budgeting checklists

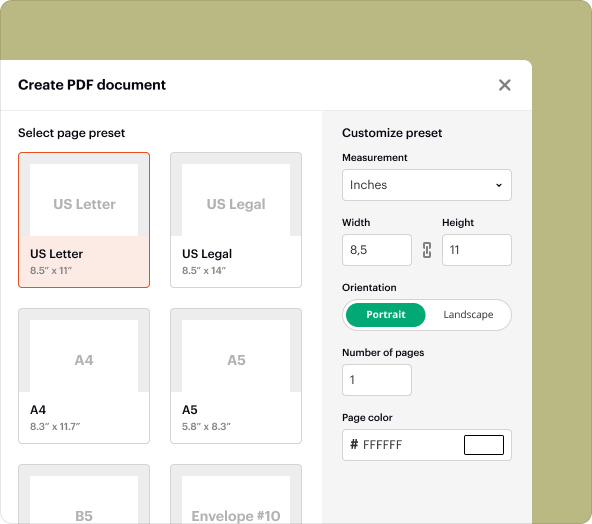

To create a budgeting checklist template from scratch using pdfFiller, follow these steps:

-

1.Log in to your pdfFiller account.

-

2.Select “Create” from the dashboard, then choose “Blank Document.”

-

3.Utilize the drag-and-drop editor to add elements like text boxes and checkboxes.

-

4.Define your budgeting categories (income, expenses, savings) using clearly labeled sections.

-

5.Personalize the layout and save your new document.

Budgeting checklist template from scratch vs uploading existing files to modify

You can either start creating a budgeting checklist template from scratch or modify an existing document. Here are the advantages of both approaches:

-

1.Creating from scratch: Tailor each element according to your specific needs, ensuring nothing is overlooked.

-

2.Uploading existing files: Save time by utilizing already formatted documents; make necessary modifications using pdfFiller tools.

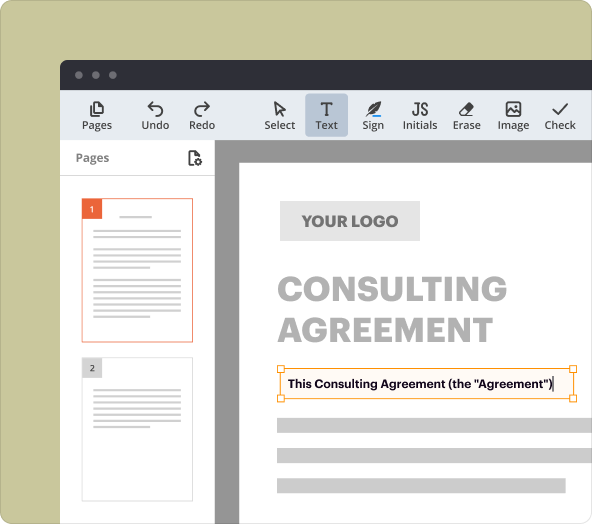

Organizing content and formatting text as you create your budgeting checklist

Once you have a basic structure, it’s important to organize and format content effectively within your budgeting checklist template. Here’s how:

-

1.Use headings and subheadings to define sections clearly.

-

2.Employ bullet points for easy readability and concise information.

-

3.Adjust font sizes and styles for emphasis on key areas.

-

4.Incorporate colors or highlights to indicate priority items.

Saving, exporting, and sharing once you finalize your budgeting checklist template

After crafting your budgeting checklist template, you can save and share it effortlessly using pdfFiller. Follow these steps:

-

1.Click the “Save” button to store your document in the cloud.

-

2.Choose the “Export” option if you need to download the document in PDF or other formats.

-

3.Use the “Share” feature to send the document directly to collaborators via email or link.

-

4.Utilize access settings to manage who can view or edit your document.

Typical use-cases and sectors that often utilize budgeting checklist templates

Many sectors and individuals benefit from budgeting checklist templates, including:

-

1.Businesses: Track expenses, manage payroll, and calculate overhead costs.

-

2.Nonprofits: Monitor donations, grants, and operational costs.

-

3.Freelancers: Manage project costs and revenues efficiently.

-

4.Students: Keep track of tuition fees, books, and other education-related expenses.

Conclusion

Utilizing a budgeting checklist template creator solution through pdfFiller empowers users to easily organize their financial plans, enhancing both personal and organizational budgeting practices. With robust tools to create, edit, and share documents, pdfFiller stands out as an ideal choice for individuals and teams looking for a comprehensive document management solution.

How to create a PDF with pdfFiller

Who needs this?

Document creation is just the beginning

Manage documents in one place

Sign and request signatures

Maintain security and compliance

pdfFiller scores top ratings on review platforms