Draft personalized letters with Debt Settlement Letter generator tool with pdfFiller

How can you draft personalized letters with the Debt Settlement Letter generator tool?

To draft personalized letters using the Debt Settlement Letter generator tool from pdfFiller, simply start by choosing a letter template that fits your specific needs. Then, fill in the required details, such as your personal information and the recipient's details. The tool provides options for customization and formatting. Finally, review your document and save or print it as needed. This streamlined process allows you to create effective debt settlement letters tailored to your situation quickly.

What is a debt settlement letter?

A debt settlement letter is a formal communication sent to creditors to propose a settlement for outstanding debts. The letter outlines your financial situation and requests a reduction of the total amount owed. It serves as a negotiation tool to potentially alleviate burdensome financial obligations and can help avoid bankruptcy. Typically, such letters are structured and concise, presenting a clear request for a settlement.

Why organizations use a debt settlement letter generator?

Organizations and individuals leverage a debt settlement letter generator for several reasons. Firstly, it ensures that the letters are professionally structured and formatted, which enhances the credibility of the request. Secondly, pre-designed templates save time and effort compared to drafting letters from scratch. Additionally, the ability to customize content allows users to address their unique financial situations, improving the chances of successful negotiation with creditors.

Core functionality of the Debt Settlement Letter generator in pdfFiller

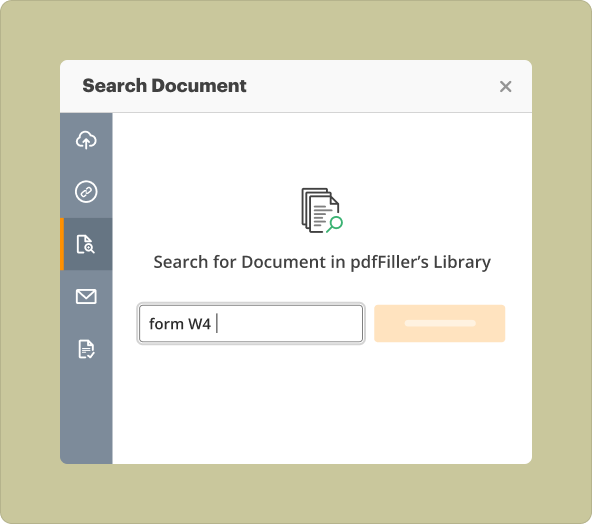

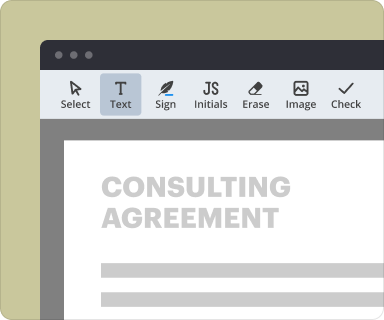

The Debt Settlement Letter generator in pdfFiller offers a range of functionalities that streamline the document creation process. Users can access customizable templates, fillable fields for quick data entry, and formatting tools for easy editing. Furthermore, cloud-based access means users can work from anywhere and collaborate with others if needed. This functionality ensures that producing a professional debt settlement letter is accessible and efficient.

Step-by-step guide to using the Debt Settlement Letter generator to create blank PDFs

Creating a debt settlement letter using pdfFiller involves several straightforward steps:

-

Access the pdfFiller platform and navigate to the Debt Settlement Letter section.

-

Select a template or choose to start from a blank document.

-

Fill in the necessary fields with personal information and details of the debt.

-

Review and customize the wording to match your situation.

-

Save, download, or directly send the document to your creditor.

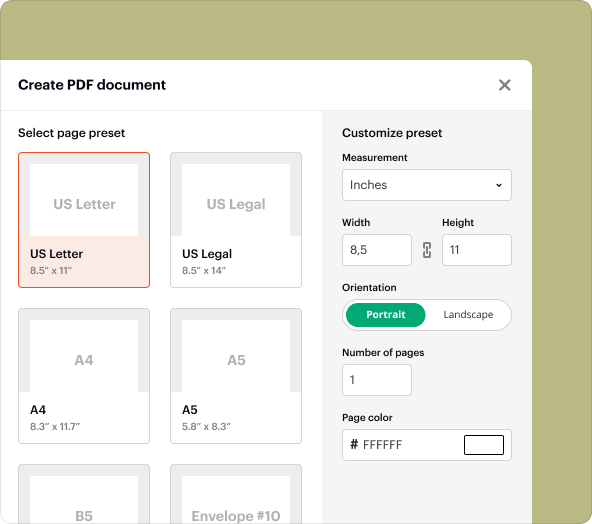

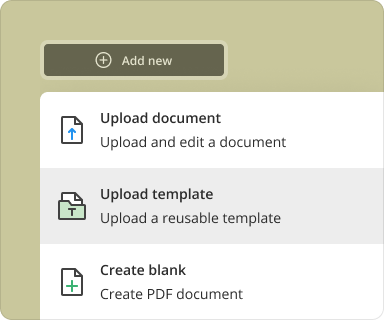

Creating new PDFs from scratch vs uploading existing files to modify

When drafting debt settlement letters, users have the option to start fresh with a new PDF or modify existing documents. Generating new PDFs allows for full creative control, while uploading existing files can save time if a template is already in use. The choice depends on individual preferences and whether previous letters need updates or if a completely original approach is more suitable.

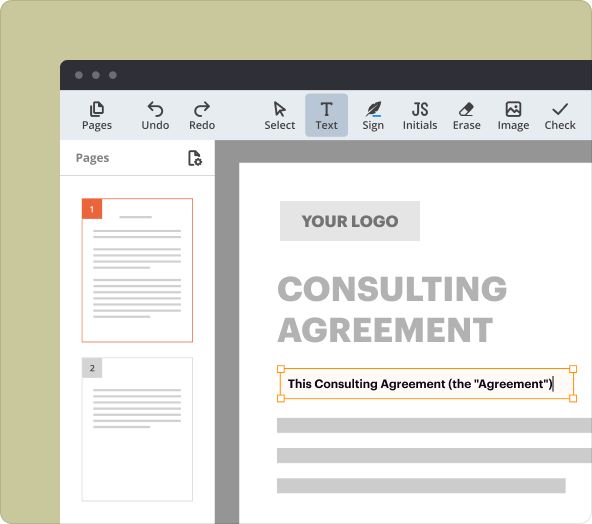

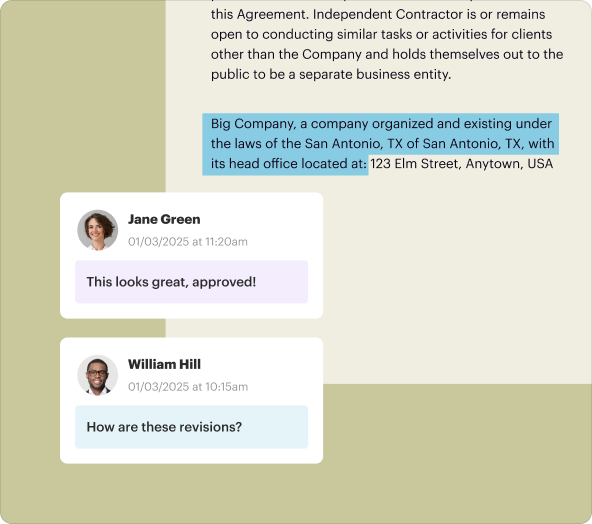

Organizing content and formatting text as you draft personalized letters

Organizing content within the Debt Settlement Letter is crucial to its effectiveness. pdfFiller allows users to use clear headings, bullet points, and a logical flow of information to make the letter readable. Flexible formatting tools help adjust text size, font styles, and spacing, ensuring that the document is not only professional but also visually appealing. This attention to detail can make a significant difference in how the letter is perceived by creditors.

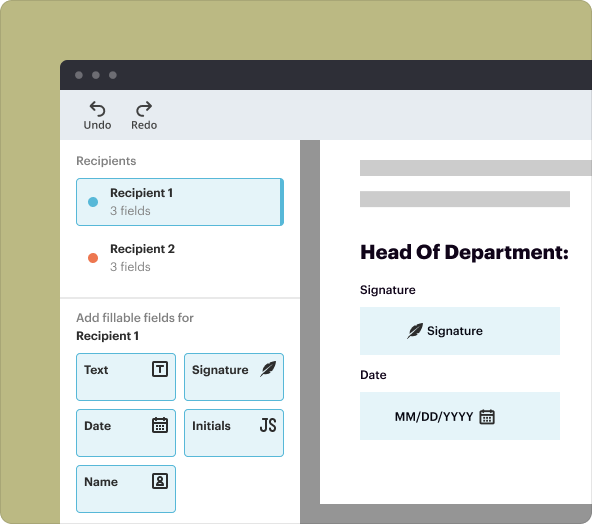

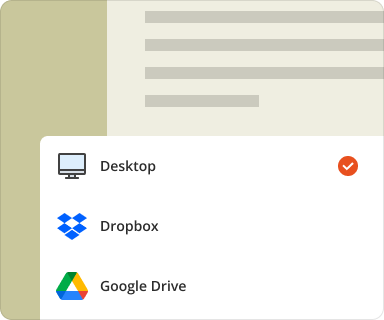

Saving, exporting, and sharing once you draft your letter

Once a debt settlement letter is complete, pdfFiller offers several options for saving and sharing. Users can save their documents in various formats, including PDF, DOCX, and more, according to their needs. Additionally, cloud storage capabilities make it easy to access documents from any device. For collaboration, pdfFiller allows users to share links directly with others or send it via email, streamlining communication during the settlement process.

Typical use-cases and sectors that often rely on debt settlement letters

Debt settlement letters are commonly used by individuals seeking to negotiate with creditors, as well as by businesses dealing with financial disputes. Industries such as finance, real estate, and even healthcare may rely on such letters to manage debts. The need for these letters often arises during financial counseling, bankruptcy negotiations, or when settling overdue accounts, making the Debt Settlement Letter generator an essential tool in various sectors.

Conclusion

Drafting personalized letters with the Debt Settlement Letter generator tool on pdfFiller simplifies the process of negotiating debts. By utilizing the platform's tools, users can create effective documents that are well-structured and tailored to their unique situations. Whether starting from scratch or editing existing letters, pdfFiller's versatile functionalities enhance the likelihood of successful debt settlements, making it an invaluable resource for individuals and organizations alike.

How to create a PDF with pdfFiller

Who needs this?

Document creation is just the beginning

Manage documents in one place

Sign and request signatures

Maintain security and compliance

pdfFiller scores top ratings on review platforms

How simple it is to use. I can sign on anywhere and make edits to pdf's. I can also convert documents. I've been using pdf filler for almost 3 years now and absolutely love it! Just renewed my subscription for year 4!

What do you dislike?

No complaints. Even on the rare occasion where the system crashes, the pdf filler team sends you an email to let you know they're working on correcting the problem. It's usually fixed within minutes.

Recommendations to others considering the product:

Don't think about it twice, use it!

What problems are you solving with the product? What benefits have you realized?

Last minute edits. Also love the signature feature that includes the dates. That comes in very handy in my field, which is real estate.