Professional invoicing made simple with Donation Invoice generator tool

How to create professional invoices using the Donation Invoice generator tool

The Donation Invoice generator tool by pdfFiller simplifies the process of creating professional invoices. With just a few steps, users can create customized PDFs, include essential details, and manage their invoicing needs from anywhere.

What is a donation invoice?

A donation invoice is a document that acknowledges a donation made to an organization or a cause. It serves as a receipt for the donor, providing proof of the contribution, which may be required for tax deduction purposes. Additionally, these invoices often include details like the name of the donor, the amount donated, and the purpose of the donation.

Why organizations use a donation invoice generator tool

Organizations across various sectors utilize a donation invoice generator tool for several reasons, including: maintaining accurate financial records, providing receipts for tax purposes, and simplifying the donation process for donors. This tool streamlines paperwork and enhances transparency, reassuring donors of the legitimacy of their contributions.

-

Facilitates efficient record-keeping for donations.

-

Enables swift receipt generation for donors.

-

Improves transparency and trust with contributors.

-

Simplifies tax-filing processes for both donors and organizations.

Core functionality of the donation invoice generator in pdfFiller

PdfFiller's donation invoice generator comes equipped with several key functionalities, allowing users to efficiently create and manage their invoices. Features include customizable templates, secure cloud storage, eSigning capabilities, and easy sharing options, all designed to enhance the overall invoicing experience.

-

Customizable templates for different donation types.

-

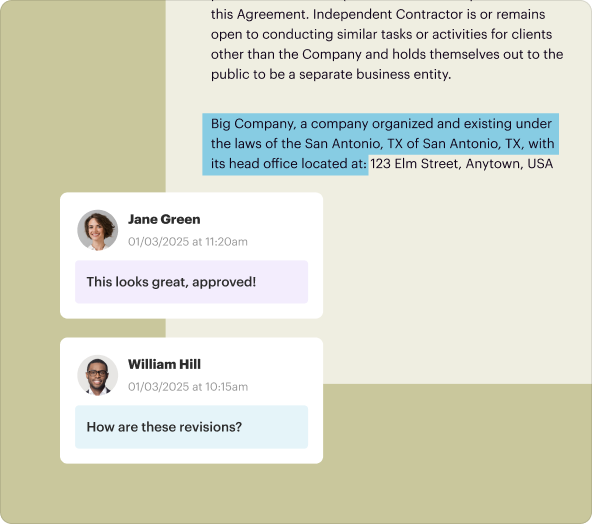

Real-time collaboration with team members on invoices.

-

Integration with popular payment gateways for seamless transactions.

-

Cloud-based access ensures documents are available anywhere.

Step-by-step guide to creating donation invoices

Creating a donation invoice using pdfFiller is a straightforward process. Follow these steps to get started:

-

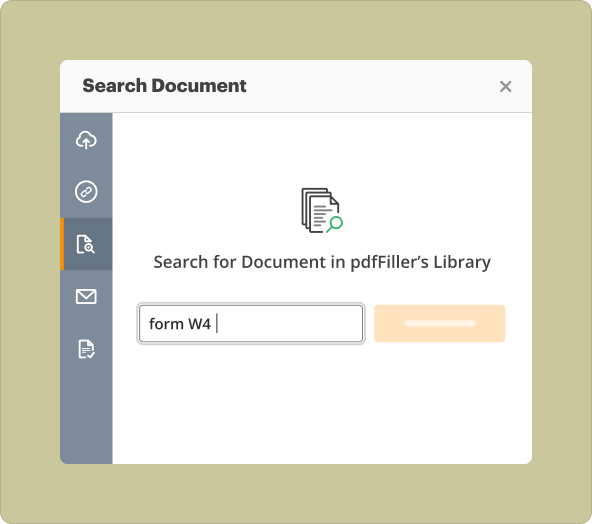

Log in to your pdfFiller account or create a new account.

-

Access the donation invoice generator tool from the dashboard.

-

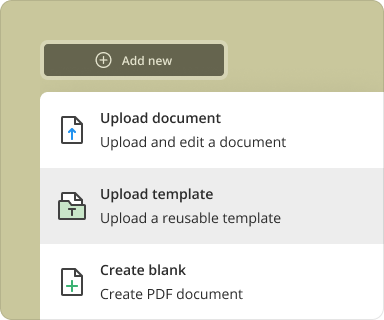

Select a template that fits your needs or start from scratch.

-

Fill in the necessary information, including donor details and donation amounts.

-

Review the invoice for accuracy and customize formatting as needed.

-

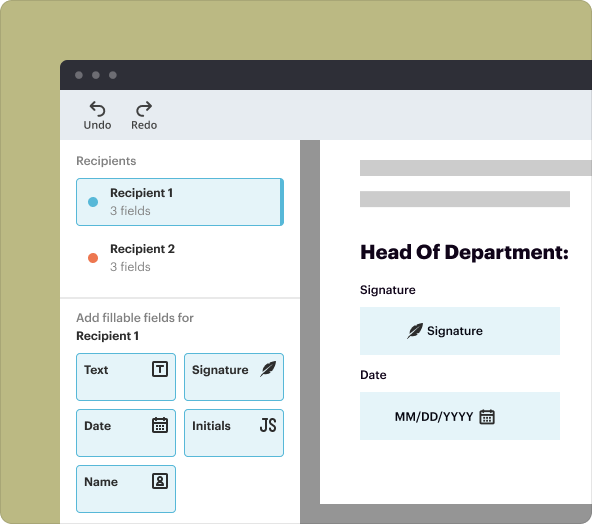

Save the invoice in PDF format and share it with the donor.

-

Use the eSigning feature to obtain the required signatures.

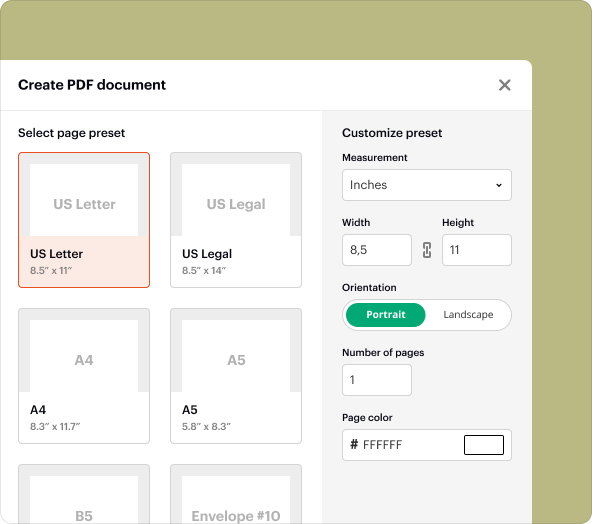

Creating PDFs from scratch vs uploading existing files

Users can create donation invoices in two ways: from scratch using pdfFiller's templates or by uploading existing documents to modify. Starting from scratch allows for more customization, while uploading existing files can save time if a similar format has been used previously.

-

Creating from scratch enables full customization.

-

Uploading existing documents can be quicker for familiar formats.

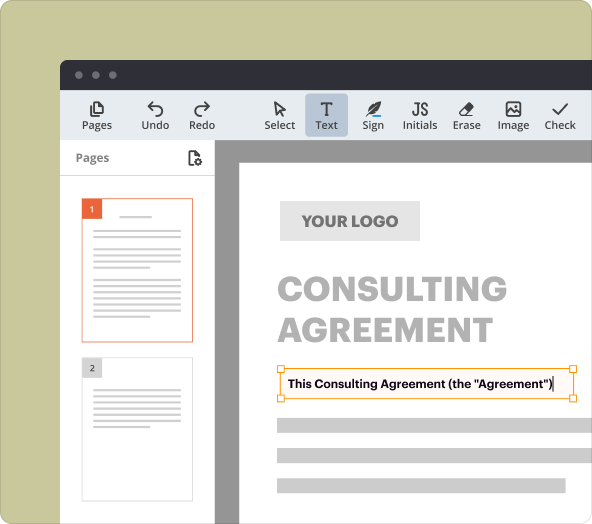

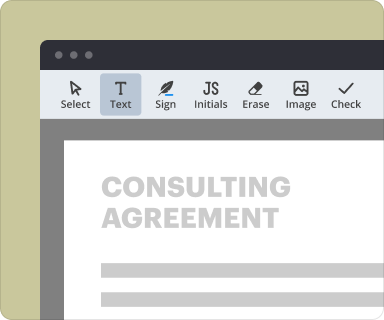

Organizing content and formatting text when creating invoices

Proper organization and formatting are crucial for creating professional-looking donation invoices. pdfFiller allows users to structure elements like headings, lists, and tables, ensuring the information is well-presented and easy to read. Users can also adjust font sizes and styles to match branding requirements.

Saving, exporting, and sharing once you create your invoice

After crafting a donation invoice, pdfFiller provides multiple options for saving and sharing your document. Users can save invoices in various formats, including PDF, and share them directly through email or a secure link. The platform ensures all documents are stored safely in the cloud, accessible anytime.

-

Save invoices as PDFs or other popular document formats.

-

Share directly via email or create a secure link.

-

Access and manage saved invoices from anywhere.

Typical use-cases and sectors that often need donation invoicing

Donation invoices are commonly used in non-profit organizations, charitable foundations, and crowdfunding platforms. Each sector has unique invoicing needs but also shares common requirements like transparency for donors and compliance with tax regulations. This makes a donation invoice generator tool invaluable.

-

Non-profit organizations managing contributions.

-

Charitable foundations providing donor receipts.

-

Crowdfunding platforms needing to issue thank you letters.

Conclusion

The donation invoice generator tool by pdfFiller streamlines the invoicing process, making it simple for organizations and donors alike. By harnessing its features, you can create professional invoices, maintain accurate records, and manage your donation documentation with ease. With pdfFiller, professional invoicing made simple is just a few clicks away.

How to create a PDF with pdfFiller

Document creation is just the beginning

Manage documents in one place

Sign and request signatures

Maintain security and compliance

pdfFiller scores top ratings on review platforms