Generator Software with pdfFiller

Creating an IRS 709 Affidavit requires precision and the right tools. With pdfFiller’s IRS 709 Affidavit Template Generator Software, you can easily create, edit, and manage this essential document with a user-friendly interface. No matter where you are, pdfFiller empowers you to handle your affidavit needs effectively.

What is an IRS 709 Affidavit?

The IRS 709 Affidavit, formally known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a crucial document filed with the Internal Revenue Service. It reports the transfer of gifts made during your lifetime, helping to assess potential tax liabilities. This form is often necessary for individuals making large gift transfers and ensures compliance with federal tax regulations.

Why you might need to create an IRS 709 Affidavit

Individuals may need to create an IRS 709 Affidavit for various reasons, including:

-

1.Transferring significant assets to family members or others without immediate tax implications.

-

2.Planning for estate distribution in a tax-efficient manner.

-

3.Documenting charitable contributions exceeding annual gift tax exclusions.

Understanding when and how to file this affidavit is essential for financial planning.

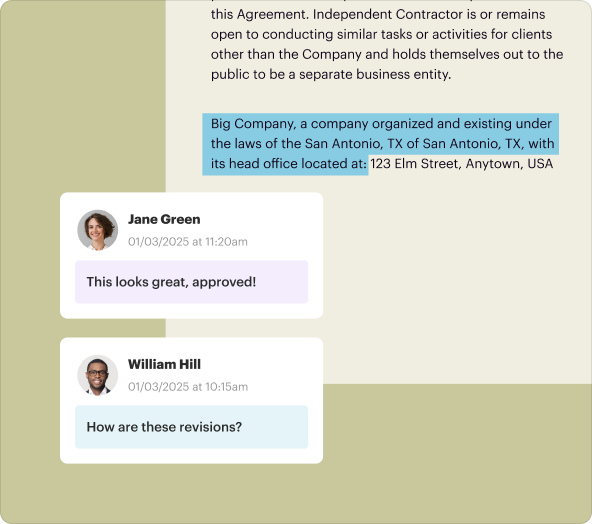

Key tools in pdfFiller that let you create an IRS 709 Affidavit

pdfFiller provides a range of features to facilitate IRS 709 Affidavit creation:

-

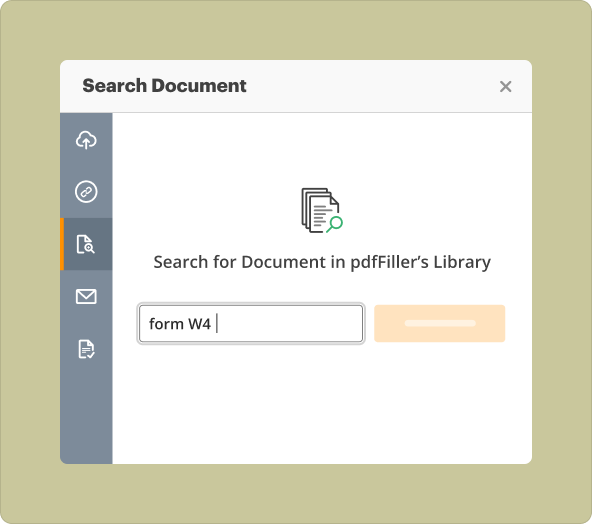

1.Document Templates: Access pre-built IRS 709 Affidavit templates to simplify the process.

-

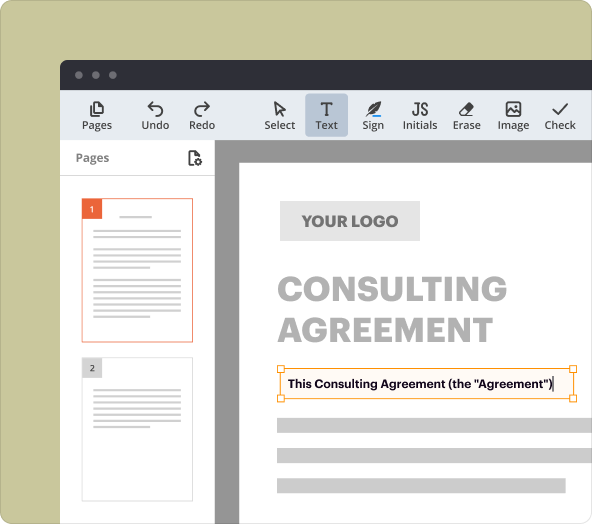

2.Form Editor: Utilize editing tools to customize each field according to your specific needs.

-

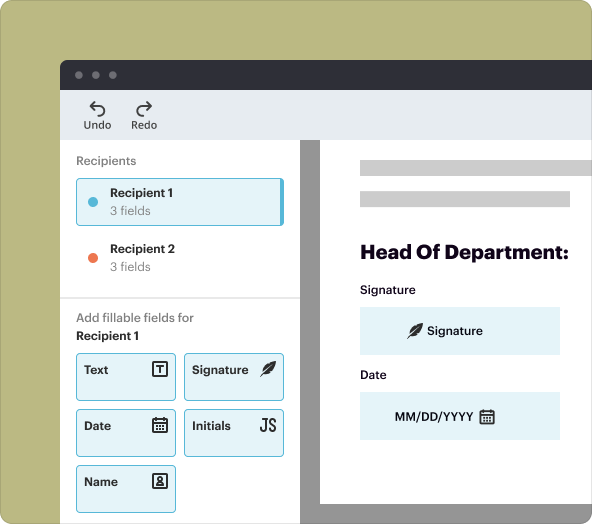

3.eSignature: Easily sign the affidavit electronically, ensuring your document is legally valid.

These capabilities allow for quick and efficient document creation and management.

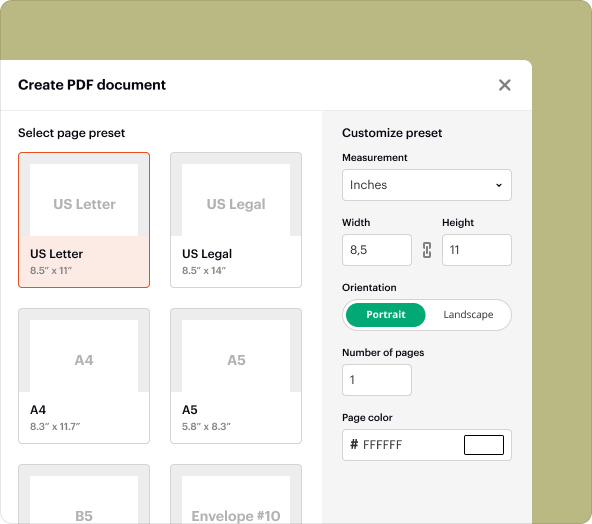

Step-by-step guide to create blank PDFs using pdfFiller

Follow these steps to generate a blank IRS 709 Affidavit using pdfFiller:

-

1.Visit the pdfFiller website and log into your account.

-

2.Navigate to the template section and search for the IRS 709 Affidavit template.

-

3.Select the template and click on 'Use this Template' to open it in the editor.

-

4.Fill in the required fields with accurate information.

-

5.Review your entries before saving or sending your document.

IRS 709 Affidavit Template from scratch vs uploading existing files to modify

With pdfFiller, you have the flexibility to either create an IRS 709 Affidavit from scratch or modify an existing document. When creating from scratch, you benefit from complete customization, while uploading existing files can save time if you already have a template. Each method has its advantages depending on your specific needs:

-

1.Creating from scratch: Ideal for unique situations requiring tailored entries.

-

2.Modifying existing files: Quick and efficient if you have a standard format and merely need to update information.

Organizing content and formatting text as you create an IRS 709 Affidavit

Proper organization and formatting of your IRS 709 Affidavit are crucial for clarity and professionalism. pdfFiller’s editing tools allow you to:

-

1.Adjust font styles and sizes for headings and body text.

-

2.Utilize bullet points or numbering for lists, making information easy to digest.

-

3.Insert images or digital signatures where required.

These features enhance the readability of your affidavit, ensuring that all necessary details are presented effectively.

Saving, exporting, and sharing once you create an IRS 709 Affidavit

After you create your IRS 709 Affidavit in pdfFiller, you have multiple options for saving and sharing your document:

-

1.Saving: Store your document securely in your pdfFiller account for future access.

-

2.Exporting: Download the affidavit in various formats, including PDF, Word, or Excel.

-

3.Sharing: Send directly via email or share a link for online viewing and collaboration.

These options ensure your affidavit is easily accessible when needed.

Typical use-cases and sectors that often create IRS 709 Affidavit

The IRS 709 Affidavit is commonly utilized in several contexts. Here are a few typical use cases:

-

1.Estate Planning: Used by individuals and families planning asset transfers.

-

2.Financial Inheritance: Beneficiaries managing inherited wealth may file the affidavit to report gifts.

-

3.Tax Professionals: Accountants and advisors often prepare these documents for clients to ensure compliance with tax laws.

Understanding various industries that utilize the IRS 709 Affidavit can guide you in formulating your own documentation approach.

Conclusion

The IRS 709 Affidavit Template Generator Software from pdfFiller provides a reliable solution for individuals and teams needing to create efficient and compliant documentation. With its accessible functionality and robust features, users can streamline their affidavit processes effortlessly. Whether you are starting from scratch or modifying an existing document, pdfFiller ensures an organized and professional approach to IRS 709 Affidavit creation. Start today and experience the comprehensive document management capabilities with pdfFiller.

How to create a PDF with pdfFiller

Who needs this?

Document creation is just the beginning

Manage documents in one place

Sign and request signatures

Maintain security and compliance

pdfFiller scores top ratings on review platforms