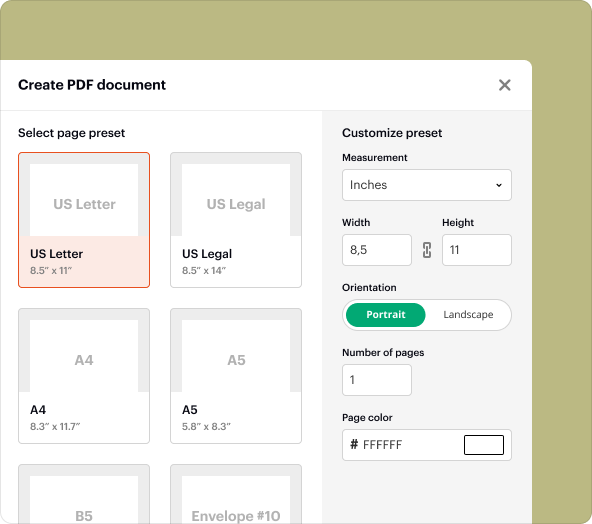

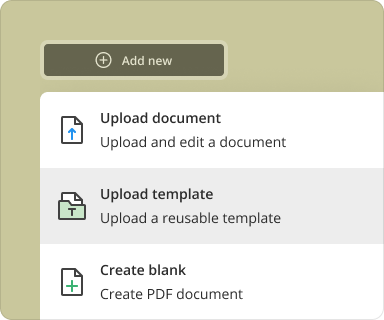

Select a page preset to create a blank PDF and start adding text, images, logos, shapes, and other elements. You'll have a polished, professional PDF in no time — no additional tools required.

Secure legal documents with Training Clawback Agreement Template creator software

Drag and drop document here to upload

Create PDF from scratch

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, or TXT

Note: Integration described on this webpage may temporarily not be available.

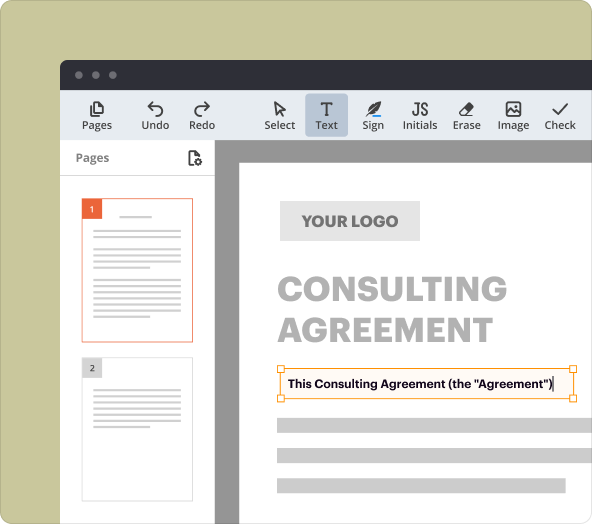

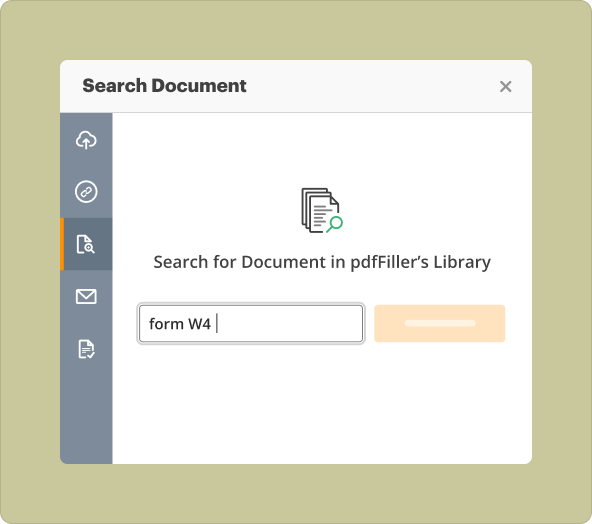

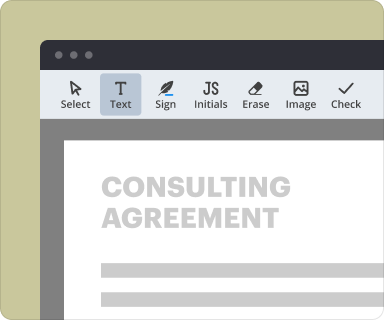

How to create a PDF with pdfFiller

Document creation is just the beginning

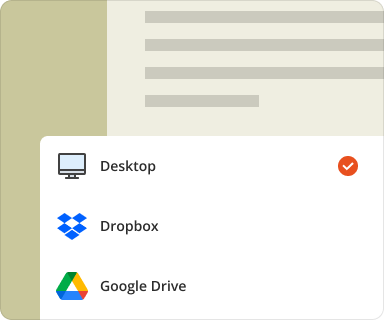

Manage documents in one place

Store all your contracts, forms, and templates in a single place with pdfFiller. Access and edit your files securely from anywhere in the cloud.

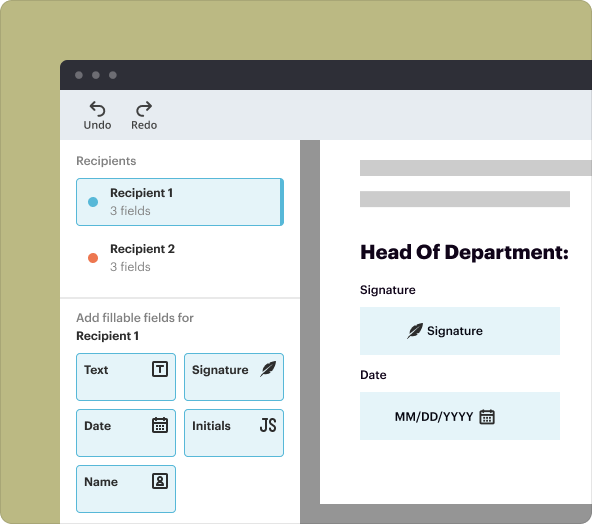

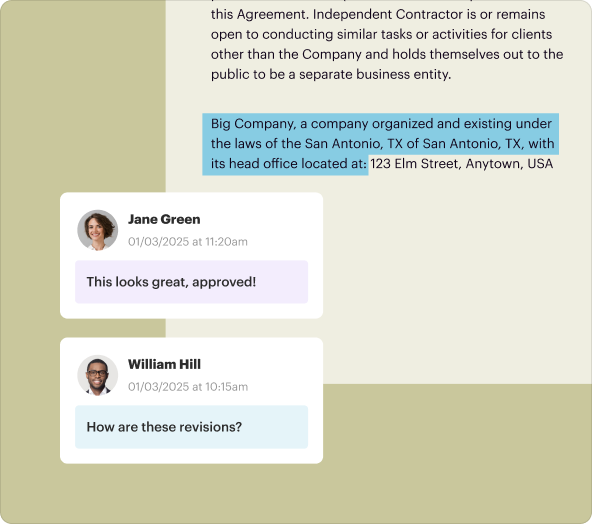

Sign and request signatures

Add your signature or send documents directly from the editor. pdfFiller makes it easy to prepare, sign, and send documents in one go—no extra steps or switching tools.

Maintain security and compliance

From data encryption to signer authentication, pdfFiller helps protect your data and comply with industry-leading security regulations, including HIPAA, SOC 2 Type II, PCI DSS, and others.

pdfFiller scores top ratings on review platforms

I have an autistic son and this PDFfiller is so amazing. There is so much paperwork between social security, IHSS, ABA therapy services, and school this gives me a few extra moments to relax

Saving me so much paper and I'm feeling really positive about my environmental impact. We are in the process submitting our B Corp assessment and this product has highlighted that with some thought you can make small differences

What do you like best?

That you allowed me to submit all that I had to the IRS.

What do you dislike?

That initially I could only submit 5 to the IRS.

What problems are you solving with the product? What benefits have you realized?

Electronic Submittals to the IRS.

That you allowed me to submit all that I had to the IRS.

What do you dislike?

That initially I could only submit 5 to the IRS.

What problems are you solving with the product? What benefits have you realized?

Electronic Submittals to the IRS.

This is a great programme

This is a great programme - but as an individual, probably not quite what I wanted as it is a bit expensive for the odd document.

100% felt Heard and understood

I started off panicking about why I requested assistance ... but the agent assigned to me was beyond patient and kind. Her calm brought me to a place of comfort and she helped me to resolve my issue in a very timely manner. Thank you, Marie!!!

I enjoy the feature that it has similar to PowerPoint. It helps you align your entries so that they look neat and comfortable for the viewer to read. The entries are convenient as I do not have to rely on drawing a text box. I would definitely recommend it to new users as well, as I am on myself. It Gives you a chance to try before you buy and has tools to help with almost all your legal questions and concerns!

Accounting

I have been very frustrated in trying to create our 1099s for 2022 in pdfFiller. I began a chat with "Kara" and she was wonderful and very patient walking me through the different steps to create a template. She also sent me a video as a tutorial. Very helpful. Very good experience and removed my frustration. Thank you.

There was a bit of a learning curve to getting the software's capabilities down, but once I understood how to use the forms feature and whatnot, I find I really enjoy using your software more than I even like Adobe. I think your program has better templates and features than the others I have tried. Bonus points for being lower priced than Adobe while you're at it.

I appreciate a free trial and I was able to get the one form that I needed. I simply cancelled so I don't forget to cancel the 30-day trial and get charged! Thank you very much for the easy to fill form.

Can a company make you pay back money for training?

Training repayment agreement provisions can be legal, but it all depends on the details of each specific case. Enforceability and repayment obligations often depend on factors like the level of employee, the type of training program attended and the actual cost of training.

What is a training repayment agreement provision?

A training repayment agreement (which sometimes goes by the descriptive acronym TRAP for training repayment agreement provision) stipulates that a firm will pay for a worker's training expenses in return for a worker agreeing to a repayment schedule if the worker leaves the firm before a designated time.

Can a company make you repay training costs?

Training repayment agreement provisions can be legal, but it all depends on the details of each specific case. Enforceability and repayment obligations often depend on factors like the level of employee, the type of training program attended and the actual cost of training.

How do you write a training agreement?

Your commitment agreement template should include: The date of the agreement. Name of employee and job title. Company name. Details about the training course or professional qualification. Declaration of who will meet the costs of the course. Statement that sets out any repayment of training costs to employer, if relevant.

What is the purpose of the training agreement?

A training agreement, or an employee repayment agreement is a legally enforceable contract that sets out the terms and conditions of any training that you provide your employees. It establishes the cost of undertaking training, and who is responsible for paying.

Can a company make you pay for training if you quit?

You do not need to repay training costs, regardless of the circumstances, if there is no agreement. But if there were an agreement that you'd repay if certain circumstances occurred, such as quitting or resigning, then you would have to repay if that agreement formed an enforceable contract.

Can a company make you pay back money after quitting?

Sometimes employers can ask for money back. This could be like if you owe them for training or have an outstanding balance on a company loan. But here's the important bit: they can't deduct this money directly from your final paycheck unless you specifically signed something allowing it.

Can an employer make you pay back money?

California offers the strongest worker protections against bosses clawing back money that they think was overpaid. First, an employer can only recoup money if the worker signs a written agreement outlining the exact terms of repayment.