Build PDF forms with pdfFiller’s Consumer Loan Application Form Creator

How to create a Consumer Loan Application Form using pdfFiller

Creating a Consumer Loan Application form with pdfFiller is simple and efficient. You can design a customizable PDF form equipped with interactive fields, validation rules, and easy sharing options - all from a cloud-based platform accessible anywhere.

-

Visit pdfFiller’s website and create an account if you don’t have one.

-

Select the 'Create New Form' option.

-

Use the drag-and-drop editor to add fields and customize the layout.

-

Set data rules and validation checks on your fields.

-

Publish the form and share it with applicants.

What is a Consumer Loan Application Form Creator?

A Consumer Loan Application Form Creator is a tool that allows users to design and generate customized loan application forms in PDF format. pdfFiller’s creator includes features that make it easy to edit the layout, add form fields, and apply business logic, resulting in professional documents suitable for any financial institution.

How does the Consumer Loan Application Form Creator change document preparation?

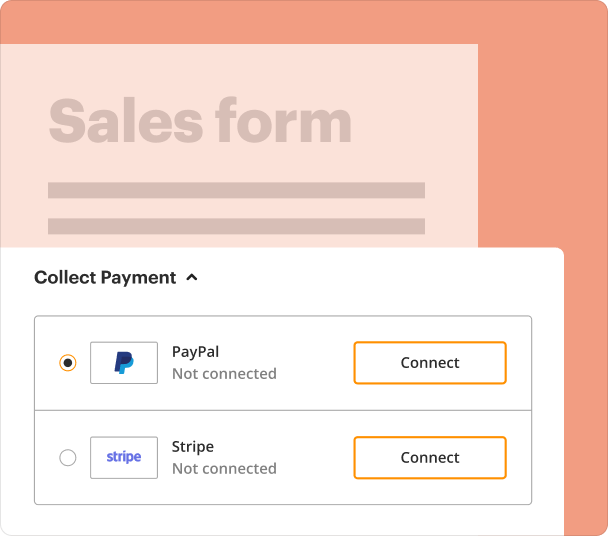

The Consumer Loan Application Form Creator modernizes the document preparation process by offering an intuitive interface for creating, editing, and managing forms. Users can eliminate the traditional paper-based methods, thus saving time and reducing errors. The integration of digital signatures and cloud storage ensures that processes are streamlined and efficient.

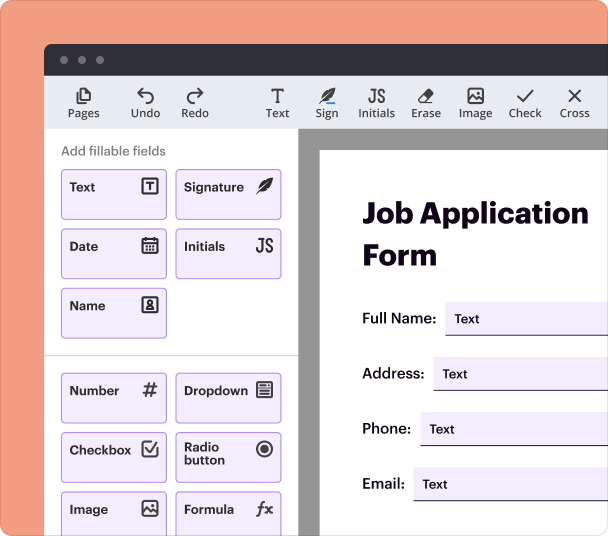

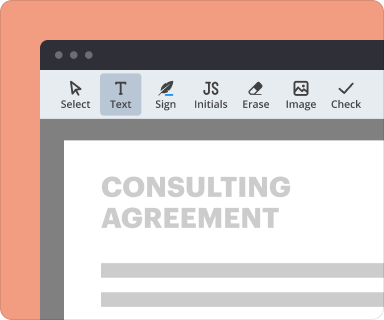

Steps to add interactive fields when using the Consumer Loan Application Form Creator

Adding interactive fields is straightforward with pdfFiller's editor. Users can choose from various field types, such as text boxes, checkboxes, and dropdowns, making forms more user-friendly and efficient.

-

Select the type of field you wish to add from the toolbox.

-

Drag it to the desired location on the form.

-

Customize the properties of the field, like labels and validations.

-

Save your changes to reflect the new field on the PDF.

Setting validation and data rules as you create a form

Validation rules help ensure that the data submitted in the form is accurate and complete. With pdfFiller, users can easily set conditions that fields must meet before submission, thus reducing the chances of errors.

-

Choose the field and open its properties.

-

Enable validation settings, like required fields.

-

Specify formats, such as date, email, or numbers for relevant fields.

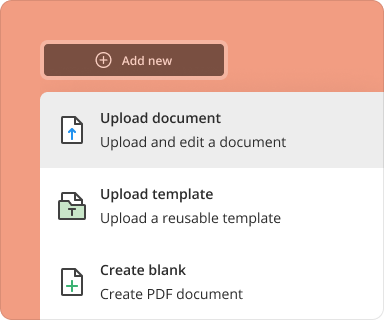

Going from a blank page to a finished form while using the Creator

Starting from scratch is easy with pdfFiller. Users can set up a stylish and professional Consumer Loan Application form in just a few steps. The platform provides templates that can be further customized to meet specific requirements.

-

Choose a blank template or select an existing template that best fits your needs.

-

Add sections such as personal information, financial details, and loan information.

-

Incorporate any company branding and logos for a professional appearance.

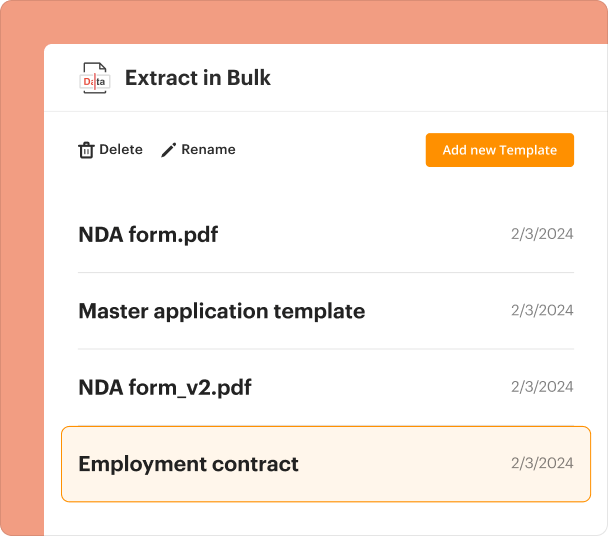

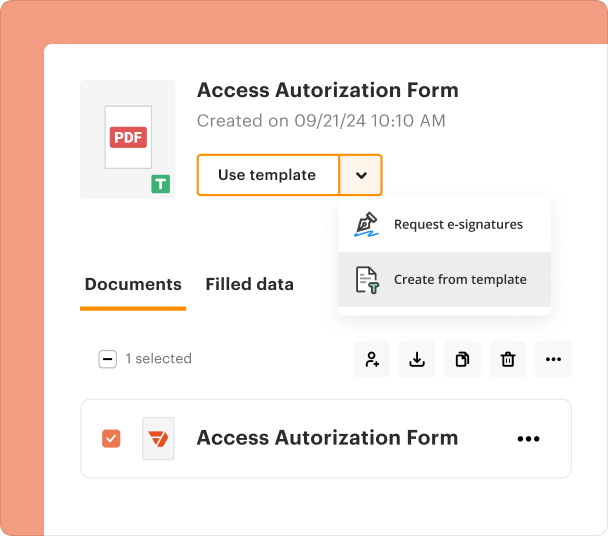

Organizing and revising templates when using the Consumer Loan Application Form Creator

Proper organization of templates is crucial for efficient document management. pdfFiller allows users to categorize and easily retrieve forms for updates and revisions as needed.

-

Create folders for different categories of forms.

-

Regularly review and update templates to keep them current.

-

Use version control to manage changes effectively.

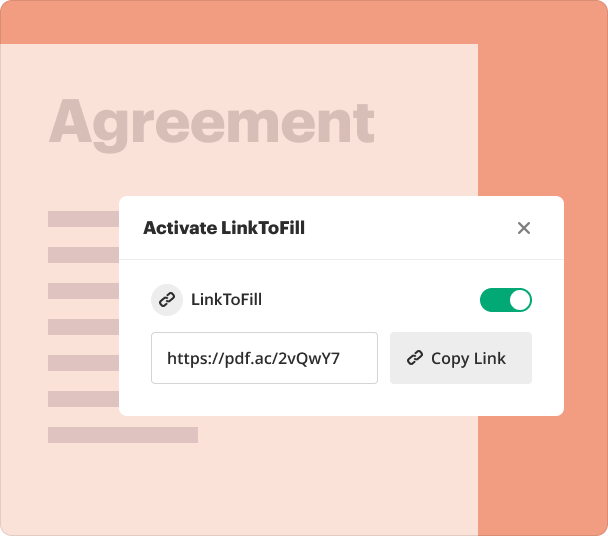

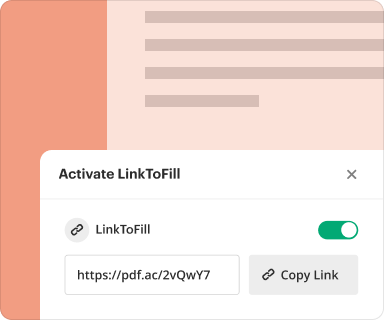

Sharing results and monitoring responses after form creation

Sharing a Consumer Loan Application form is easy with pdfFiller. You can send the document directly via email or generate a shareable link. Monitoring responses is also straightforward, with tracking capabilities that show when a form has been opened and submitted.

-

Select the 'Share' option after publishing the form.

-

Choose to send via email or create a link.

-

Access the response dashboard to view submission status.

Exporting collected data once the form is submitted

Exporting submitted data for analysis is a vital feature of the Consumer Loan Application Form Creator. Users can easily download submissions in various formats for further processing or integration into other systems.

-

Go to the responses section once submissions are received.

-

Select the export option.

-

Choose the preferred file format, such as CSV or Excel.

Where and why businesses use the Consumer Loan Application Form Creator

Many businesses, especially in financial services, use a Consumer Loan Application Form Creator for its efficiency and ease of use. Eliminating paper-based applications helps organizations improve response times and customer satisfaction.

Conclusion

The Consumer Loan Application Form Creator within pdfFiller provides an efficient solution for creating, managing, and sharing vital loan application forms. Its user-friendly design and powerful features streamline the form process, making it an indispensable tool for individuals and businesses alike.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

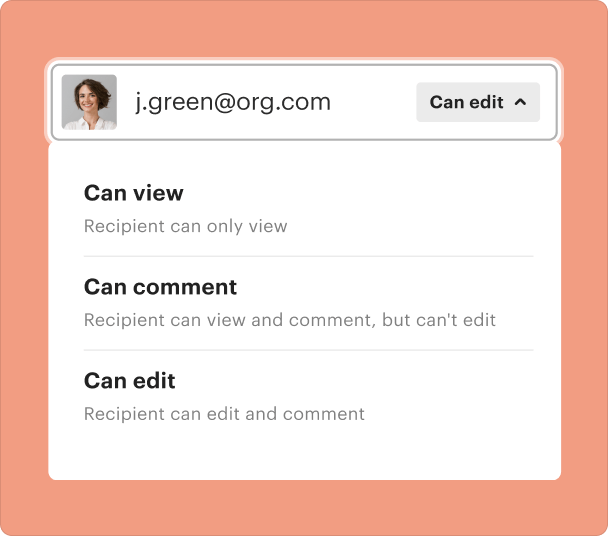

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms