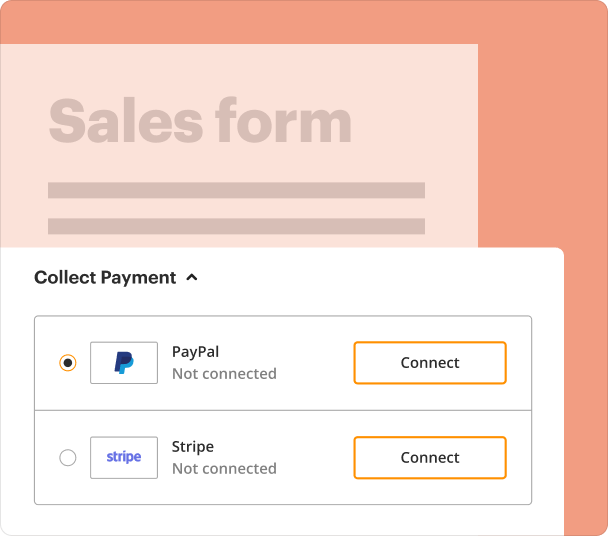

Build PDF forms with pdfFiller’s Credit Card Payment Form Builder

How to build a credit card payment form using pdfFiller

To create a credit card payment form, utilize pdfFiller's intuitive form builder. This process allows you to quickly add fields, set rules, and manage templates seamlessly, ensuring your form is ready for submission in no time.

-

Access the form builder on pdfFiller.

-

Add necessary fields for payment details.

-

Set validation rules for fields.

-

Publish and share your form.

What is a credit card payment form builder?

A credit card payment form builder is a specialized tool for creating forms that facilitate credit card transactions. This includes capturing user details, payment amounts, and ensuring secure transactions in compliance with industry standards.

How does a credit card payment form builder change document preparation?

Using a credit card payment form builder like pdfFiller simplifies document preparation by automating the creation of interactive forms. Users can input predefined fields, which reduces errors and saves time, ultimately improving the efficiency of payment collection.

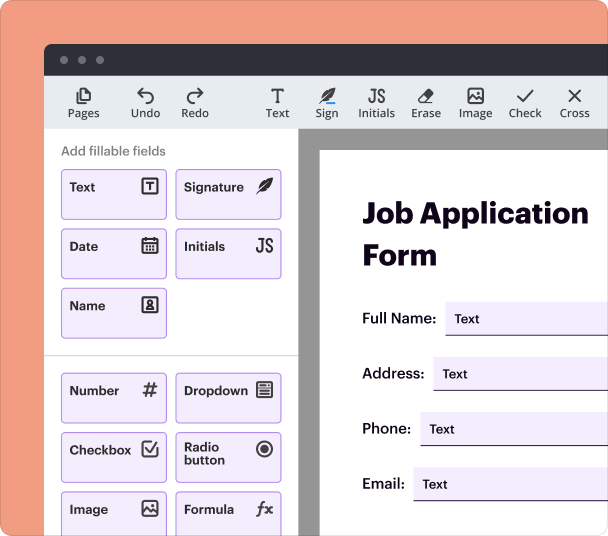

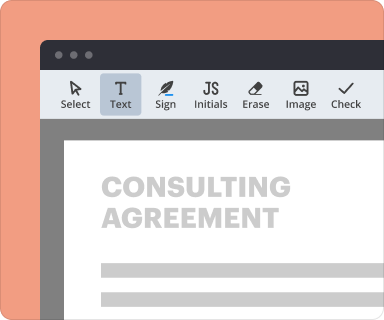

How to add interactive fields in a credit card payment form?

Adding interactive fields is straightforward with pdfFiller. Open the form editor, select the field type (e.g., text box, dropdown), and drag it onto the form. Customize field settings to ensure it meets your requirements.

-

Select 'Add Fields' in the editor.

-

Choose the type of field (e.g., text box for card holder name).

-

Drag the field to the desired location on the form.

-

Adjust the properties, such as required status and formatting.

What validation and data rules can be applied in a credit card payment form?

Validation rules ensure that users input correct data formats, such as a 16-digit card number. By applying these rules, you enhance security and minimize errors in transaction processing.

-

Set rules for minimum and maximum character limits.

-

Require specific formats for date fields (MM/YY).

-

Add checks for proper card number formatting.

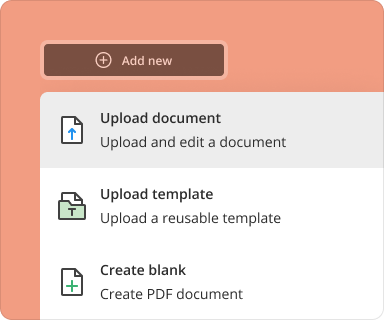

How to create a complete form from scratch using a credit card payment form builder?

To build a credit card payment form from the ground up, start with a blank template. Then gradually add fields, set rules, and incorporate design elements until the form meets your functional and aesthetic needs.

-

Select 'Create New Form' in pdfFiller.

-

Add form fields as needed.

-

Customize the aesthetics and layout.

-

Review and finalize your form for publishing.

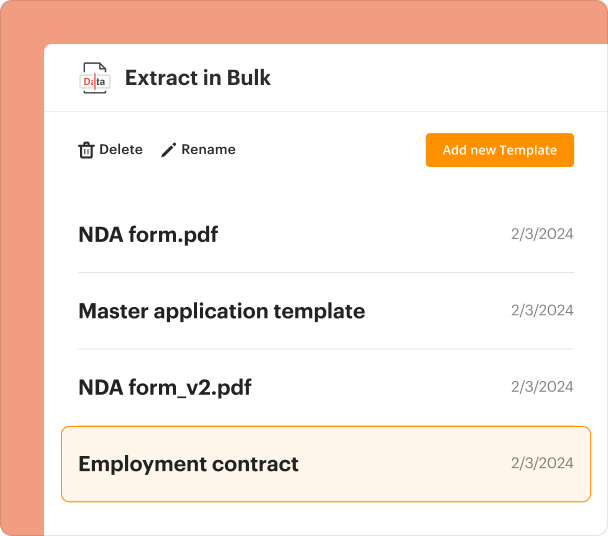

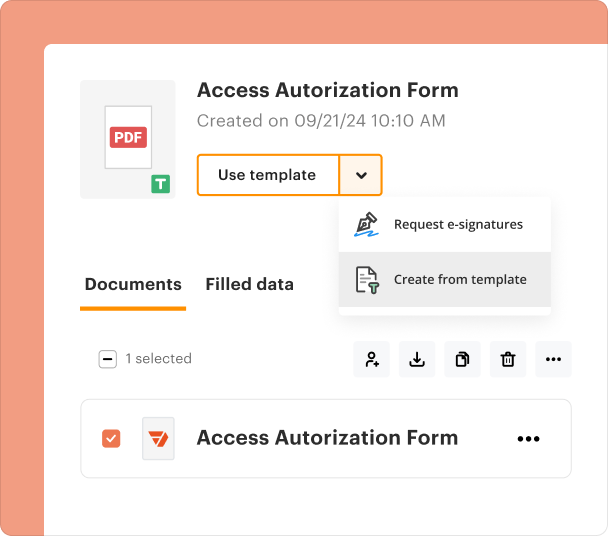

How to manage and update PDF form templates in a credit card payment form builder?

Managing and updating your templates in pdfFiller is simple. Navigate to your saved forms, make necessary edits, and re-save. This feature keeps your forms current without the need to start from scratch.

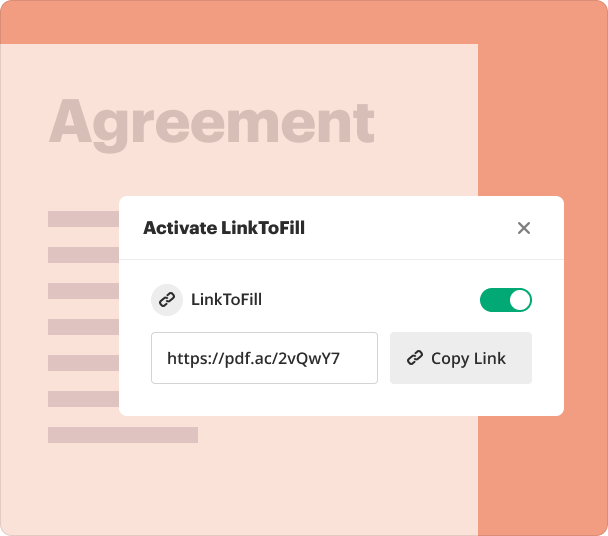

How to share forms and track activity through a credit card payment form builder?

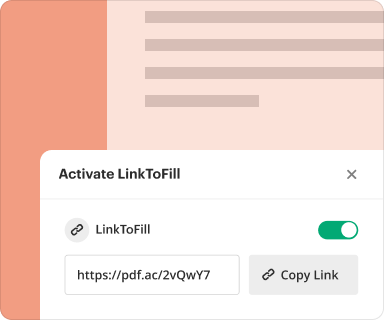

After creating your payment form, sharing it is straightforward. Utilize the sharing options to distribute the form via email or direct link, and track responses in real-time for better management.

-

Choose 'Share' after form creation.

-

Select an option: email or generate a link.

-

Monitor submissions through the dashboard.

How to export and use submitted data from a credit card payment form?

Exporting data from your credit card payment form is essential for record-keeping and analysis. Use pdfFiller’s export feature to download entries as CSV files or integrate with other applications.

-

Access the form submissions section.

-

Select 'Export' and choose your format (CSV, Excel).

-

Follow prompts to complete the export.

Where and why do businesses typically use a credit card payment form builder?

Businesses across various industries use credit card payment form builders to streamline payment processing. Common applications include e-commerce platforms, service providers, and event registrations, ensuring smooth transactions and data collection.

Conclusion

pdfFiller's credit card payment form builder equips individuals and teams with an efficient way to create, manage, and analyze payment forms. Its cloud-based functionality allows access from anywhere, ensuring convenience and responsiveness in today’s fast-paced environment.

How to create a PDF form

Who needs this?

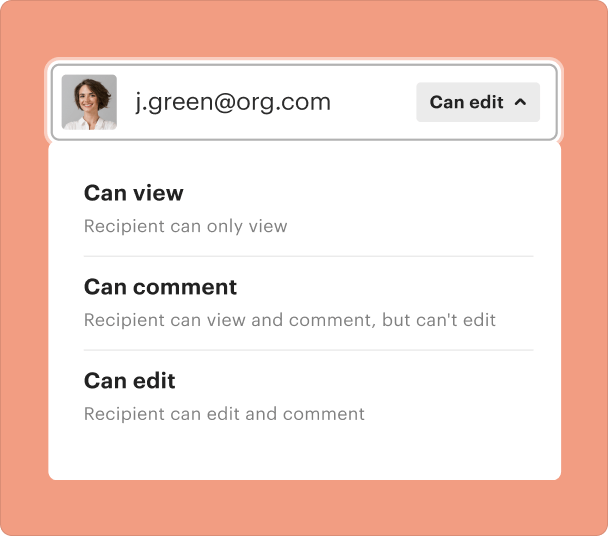

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms