Build PDF forms with pdfFiller’s Credit Reference Request Form Builder

What is Credit Reference Request Form Builder?

The Credit Reference Request Form Builder is a powerful tool available on pdfFiller that allows users to create, customize, and manage credit reference request forms in PDF format. This functionality transforms the way individuals and teams prepare documentation for credit assessments, ensuring a streamlined, efficient process.

-

Intuitive interface for easy form creation.

-

Customizable fields for tailored data entry.

-

Cloud-based access to forms anytime, anywhere.

-

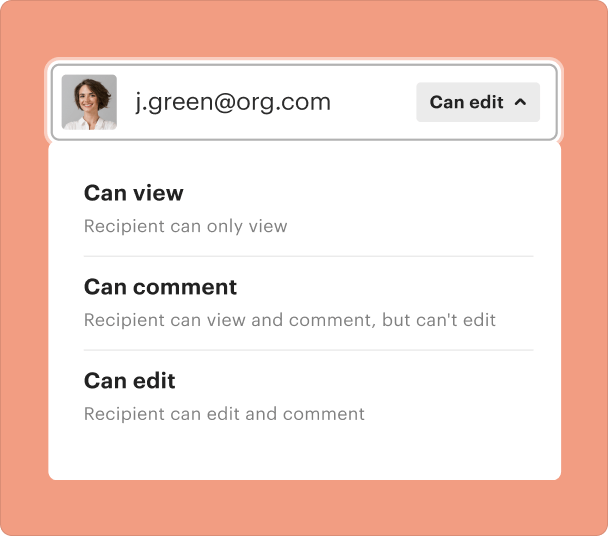

Collaboration tools for team efficiency.

How does Credit Reference Request Form Builder improve document preparation?

The Credit Reference Request Form Builder enhances document preparation by enabling users to generate standardized forms that capture essential data for credit evaluations. Leveraging cloud technology, the platform ensures that forms can be accessed, edited, and shared seamlessly among team members, significantly reducing processing time and errors.

-

Save time with pre-built templates.

-

Minimize errors through standardized formats.

-

Increase collaboration with centralized document access.

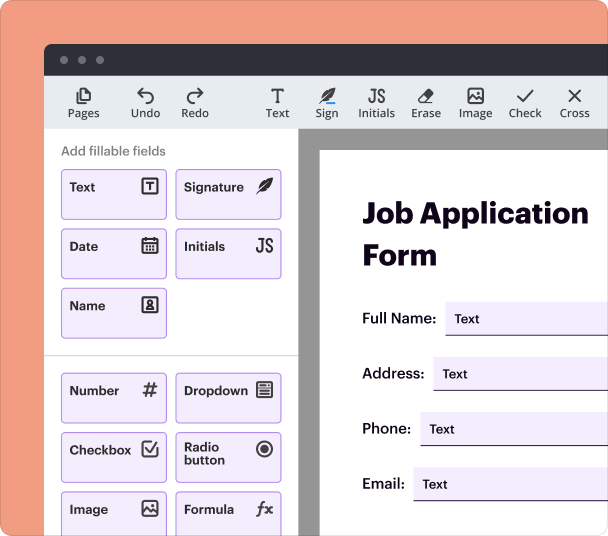

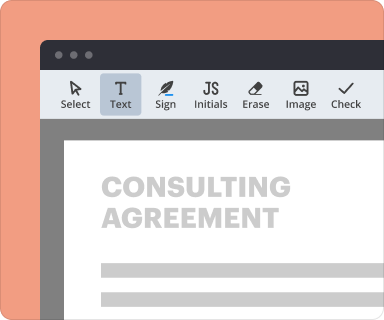

Steps to add interactive fields when using Credit Reference Request Form Builder

Adding interactive fields in the Credit Reference Request Form Builder is straightforward. Users can drag and drop various field types onto their forms, including text boxes, checkboxes, and dropdown lists, to create a user-friendly experience that guides the respondent through the necessary information required.

-

Open the form in pdfFiller.

-

Select 'Add Fields' from the toolbar.

-

Choose the type of field you want to add.

-

Position the field on the document.

-

Adjust field properties like size and name.

Setting validation and data rules as you use Credit Reference Request Form Builder

Utilizing validation rules ensures that users input the correct data format while filling out the credit reference requests. This functionality reduces the number of follow-up queries and enhances the reliability of the data collected, helping organizations maintain their integrity.

-

Access the settings menu in the form editor.

-

Select the field to apply validation rules.

-

Choose the appropriate validation type (e.g., email, phone number).

-

Save changes and test the form.

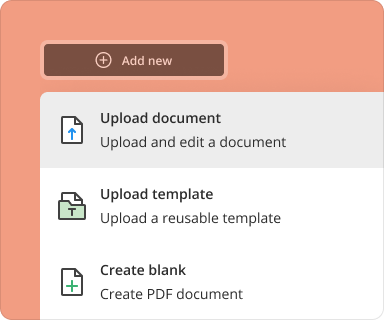

Going from blank page to finished form while using Credit Reference Request Form Builder

Creating a complete form from scratch involves a strategic approach using the Credit Reference Request Form Builder. By starting with a blank template, users can carefully design the layout, apply design elements, and place validations to ensure a polished final product, ready for distribution.

-

Start with a blank form in pdfFiller.

-

Add a header and any necessary descriptive text.

-

Insert interactive fields for data entry.

-

Review and adjust form logic.

-

Finalize the design and save as a template.

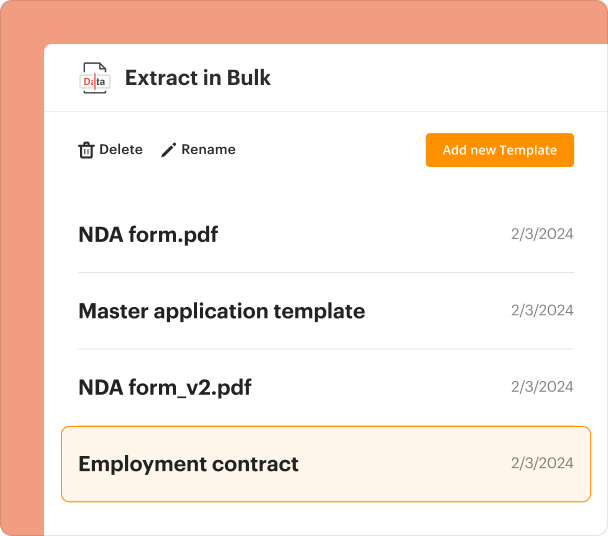

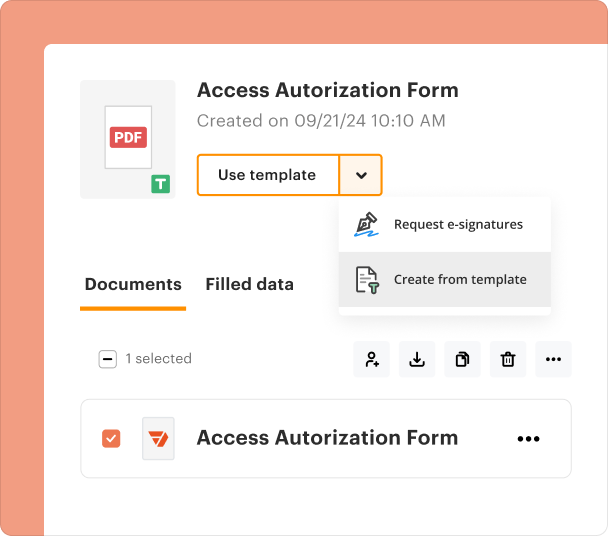

Organizing and revising templates when using Credit Reference Request Form Builder

Managing and updating PDF form templates within the Credit Reference Request Form Builder is crucial for ensuring the documents stay relevant. Users can modify existing templates to reflect new requirements or correct data capture methods without needing to start from scratch, preserving efficiency in document management.

-

Navigate to the 'My Templates' section in pdfFiller.

-

Select the template you wish to edit.

-

Make necessary changes to the fields or layout.

-

Save the updated template and optionally share with the team.

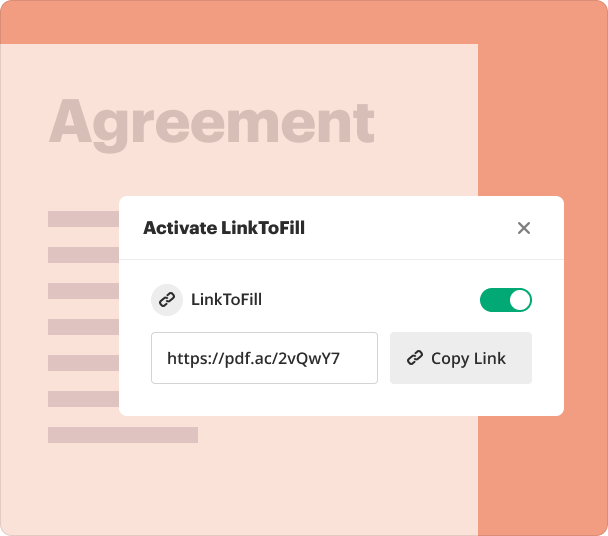

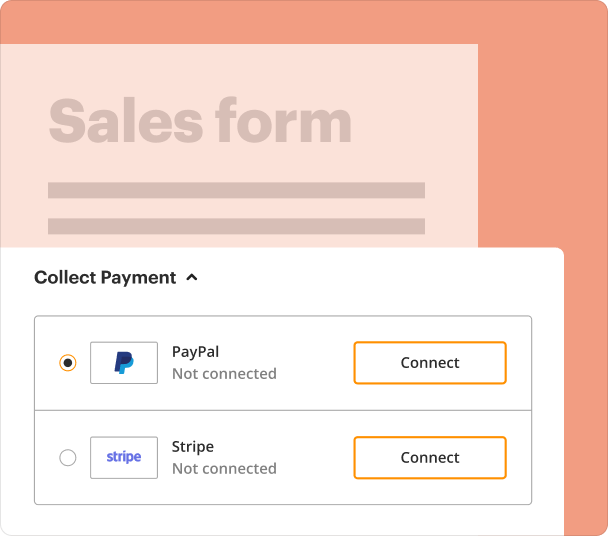

Sharing results and monitoring responses after using Credit Reference Request Form Builder

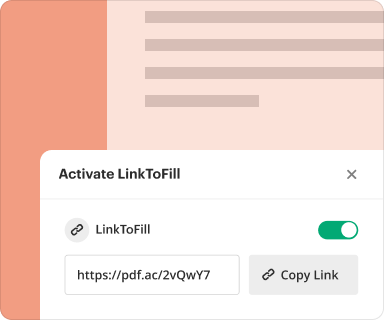

Once the forms are distributed, monitoring responses is vital for tracking engagement and data collection. The Credit Reference Request Form Builder provides features that allow users to share forms easily and view submissions in real time, facilitating better decision-making based on the collected data.

-

Use the 'Share' function to send forms via email or link.

-

Access responses in the 'Dashboard' for real-time analytics.

-

Analyze the data collected for further evaluation.

-

Follow up with respondents if needed.

Exporting collected data once using Credit Reference Request Form Builder

Exporting the data collected from credit reference requests is a key feature that facilitates further analysis and reporting. Users can convert the submitted information into various formats, such as CSV or Excel files, allowing for richer insights and integration with other systems.

-

Select submitted forms in your 'Dashboard.'

-

Click on 'Export' and choose your desired format.

-

Follow on-screen instructions to complete the export.

-

Save and utilize the exported data as needed.

Where and why businesses use Credit Reference Request Form Builder?

Various industries utilize the Credit Reference Request Form Builder to manage credit assessments effectively. From financial institutions seeking to verify borrower information to businesses needing to establish client creditworthiness, this tool provides the capability for precise information gathering and easy integration into existing processes.

-

Banks and Credit Unions for loan assessments.

-

Retailers assessing customer credit for purchases.

-

Property management companies checking potential tenants.

-

Business partners verifying credit histories for deals.

Conclusion

In conclusion, the Credit Reference Request Form Builder from pdfFiller serves as an invaluable asset for individuals and teams needing a robust document creation and management tool. By harnessing the power of PDF functionality, users can improve efficiency, reduce errors, and foster collaboration in critical document processes. Experience seamless document management today with pdfFiller.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms

I love how I can get my work done even while traveling. The ability to create and manage forms easily is great, especially with my job's remote workforce.

What do you dislike?

There isn't anything I can think of that I dislike.

What problems are you solving with the product? What benefits have you realized?

My productivity and response time is up.