Build PDF forms with pdfFiller’s Deposit Request Form Creator

How to Deposit Request Form Creator

To efficiently create a Deposit Request Form with pdfFiller, utilize its user-friendly PDF editor to design, modify and finalize your documents. Access templates, customize fields, and collaborate - all from any device. This streamlines document management processes and enhances productivity.

What is a Deposit Request Form Creator?

A Deposit Request Form Creator is a tool that facilitates the design and generation of PDF forms for requesting deposits. With pdfFiller, users can create professional forms that simplify the process of collecting essential deposit information. This creator allows customization of fields and ensures seamless integration of eSignature functionalities for official submissions.

How does Deposit Request Form Creator improve document preparation?

Using pdfFiller’s Deposit Request Form Creator transforms how organizations approach document preparation. Instead of relying on manual methods, users enjoy a digital solution that offers template flexibility, real-time editing, and easy sharing options. This improvement not only saves time but also minimizes errors and enhances compliance.

Steps to add fields when using the Deposit Request Form Creator

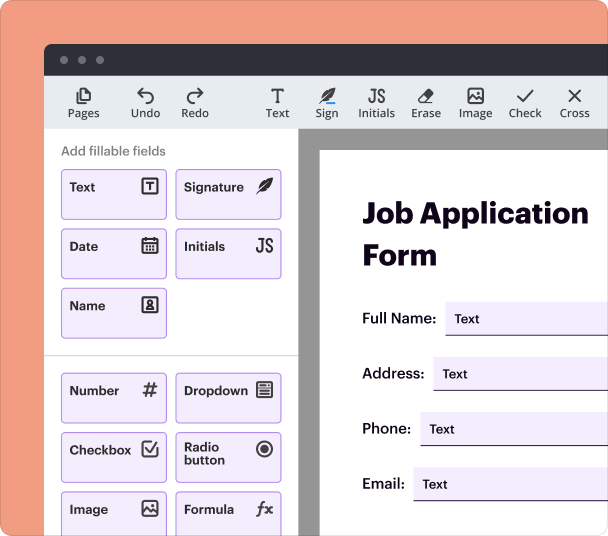

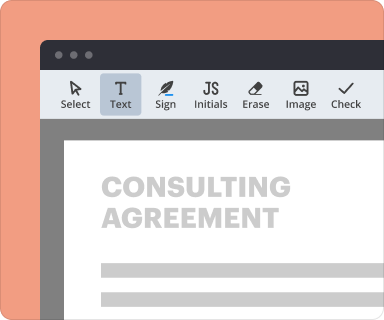

Adding interactive fields to your deposit request form is straightforward with pdfFiller. Follow these simple steps to enrich your forms:

-

Open the form in the pdfFiller editor.

-

Select the 'Add Fields' option from the toolbar.

-

Choose the type of field (text, checkbox, dropdown, etc.) you wish to include.

-

Place the field in the desired location on your form.

-

Customize field properties like size, font, and required status.

Setting validation and data rules as you create your form

Applying data validation rules to fields ensures the accuracy of information submitted through your deposit request forms. With pdfFiller, you can enforce restrictions like mandatory fields, specific data formats, and length limitations to prevent errors and ensure completeness.

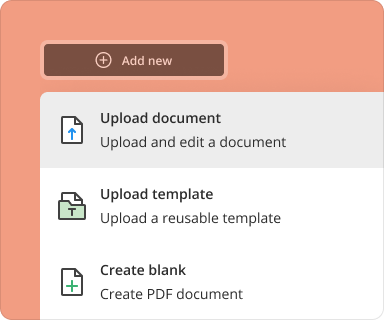

Going from blank page to finished form with the Deposit Request Form Creator

Creating a complete deposit request form from scratch is a streamlined process with pdfFiller. Start by selecting a blank template or choosing from readily available form designs. Following the steps to customize content, add fields, and apply rules will lead you to a professional PDF form ready for use.

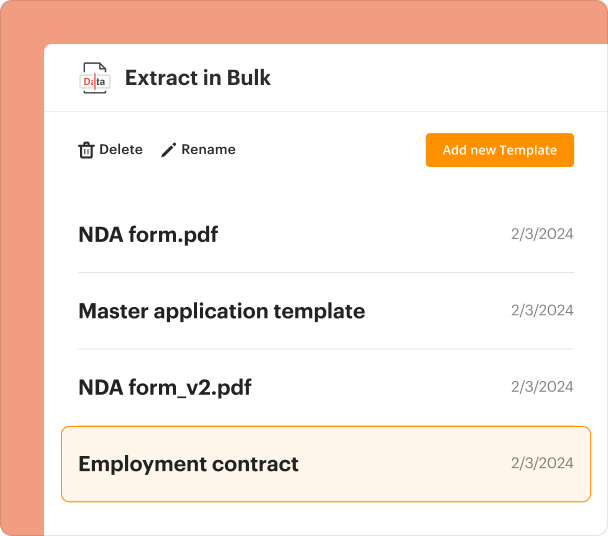

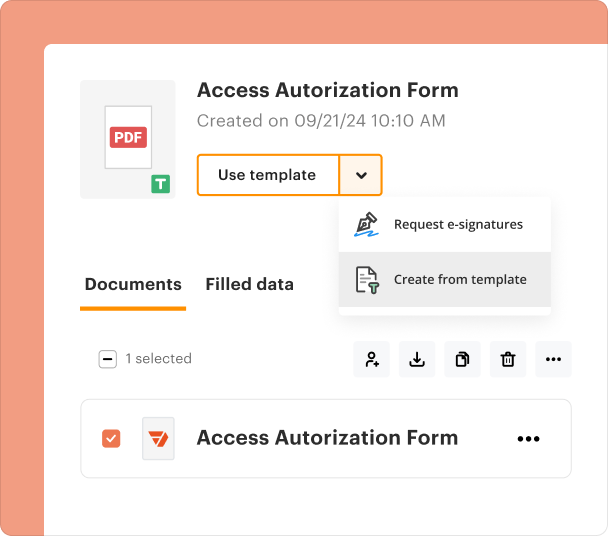

Organizing and revising templates when using the Deposit Request Form Creator

pdfFiller allows users to efficiently manage form templates with easy access to revision history and collaborative features. Users can rename, duplicate, or delete forms as needed. These organizational tools keep your repository of deposit request forms organized and updated for all collaborators.

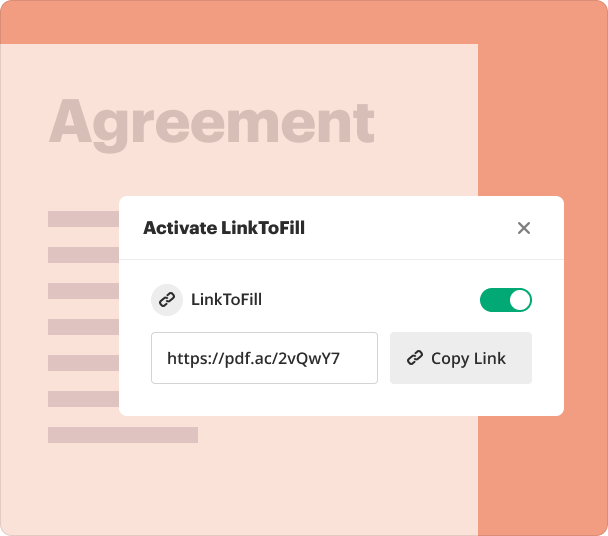

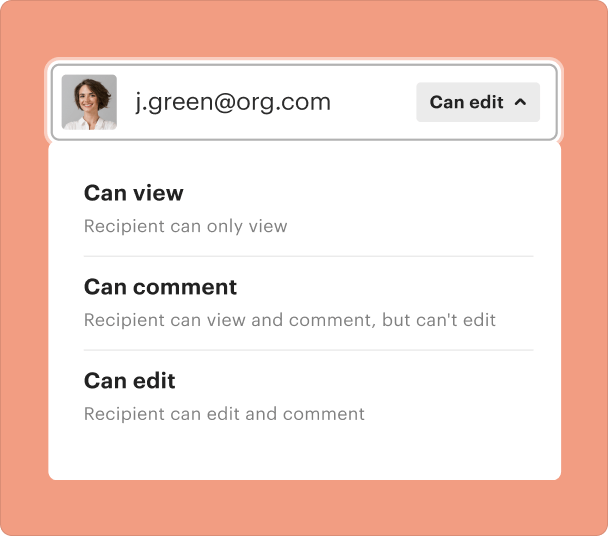

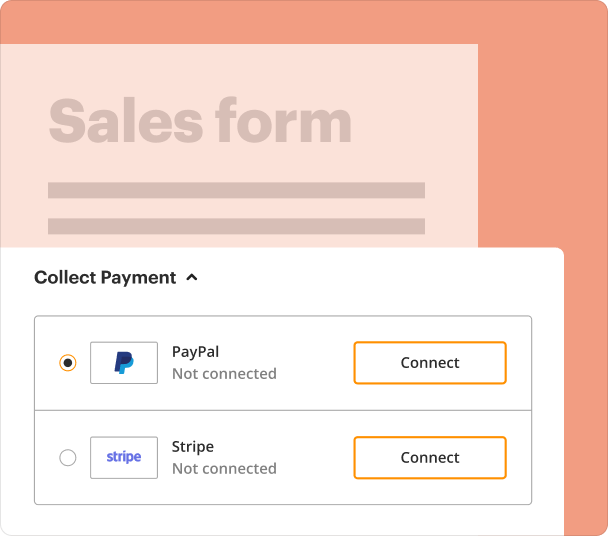

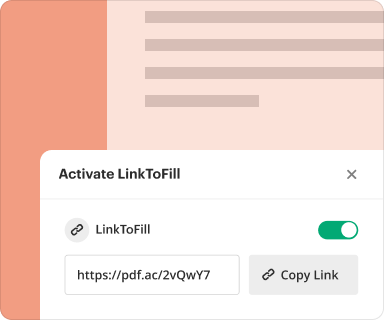

Sharing results and monitoring responses after creating your form

Once your deposit request form is completed and ready for use, pdfFiller provides easy sharing options. You can send forms directly via email, integrations with cloud services, or share links. Tracking submissions allows you to monitor who has filled out the form and view their responses in real-time.

Exporting collected data from your Deposit Request Form

After gathering responses, pdfFiller offers functionality to export submitted data in various formats like CSV or Excel. This feature aids in analyzing and reporting collected information, making it easy to compile necessary data for further processing.

Where and why businesses utilize the Deposit Request Form Creator

Businesses across multiple sectors, including real estate, finance, and eCommerce, rely on deposit request forms to streamline transactions. By leveraging pdfFiller's functionalities, teams can collaborate effectively, save time, and ensure their forms are always compliant and up-to-date.

Conclusion

The Deposit Request Form Creator from pdfFiller offers a robust solution for creating, managing, and analyzing deposit request forms. By embracing this technology, individuals and teams can enjoy significant improvements in their document workflows, enhancing efficiency and accuracy in their processes.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms